WeChat will soon launch pay-to-read feature

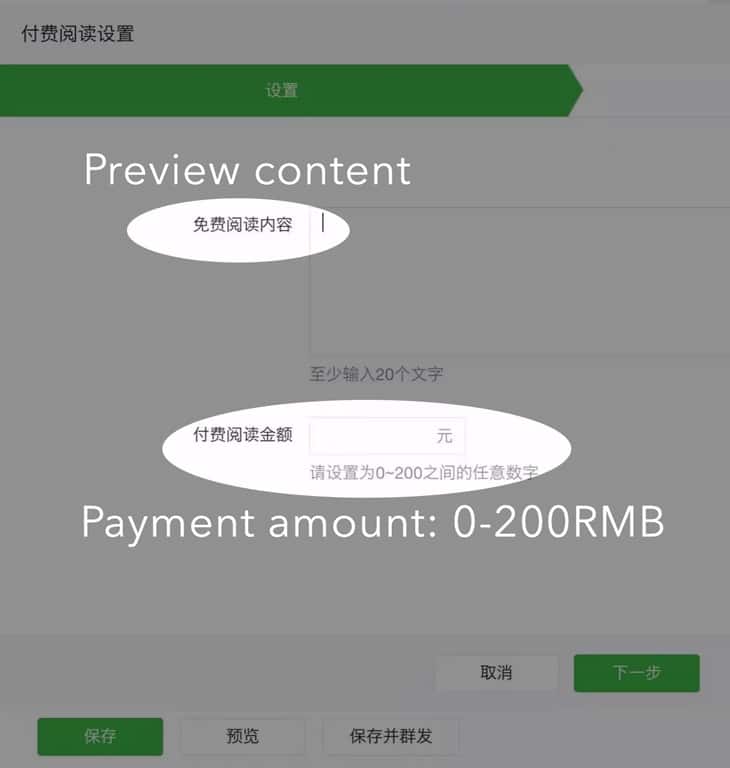

Tencent has recently been testing a new feature which allows authors to post a preview of their article, and request readers to pay in order to read the full version. This new feature enables writers to collect a fee between 0 to 200RMB for a post. The preview needs to be no less than 20 words.

It is unclear if Tencent will take a cut from this pay-to-read feature.

To millions of Official Account operators, this is a game changing feature. The income from this pay-to-read feature will push the writers to produce better quality content. Today, the majority of the income for the official accounts comes from ads.

However, for most of the official accounts, it is very questionable if the pay-to-read feature can compensate for advertising revenue.A Key Opinion Leader (KOL) account with 500k WeChat followers can make more than 1 million RMB in revenue by posting native advertising.

Encouraging signs from other APP’s are still suggesting this model might be a success. Some leading KOLs are already making decent revenue by charging reader/listeners in other channels. For example, Luojisiwei’s APP Dedao(得到) started a business blog written by Lixiang, an Economic Review reporter, and got more than 57,000 paid subscriber (199RMB yearly subscription) within the first 15 days after its launch.

Fenda raises series A+ funding round from Tencent

Fenda, an pay-to-listen audio based Q&A app just raised its series A+ founding round. The leading investor of this round is Tencent. The estimated funding raised from Fenda is over 200 million RMB.

Fenda was launched in May 2016 and instantly got viral by having internet celebrities and KOLs in many industries answer questions on the App. Within merely 42 days, it had 10 million registered users, 1 million paid listeners and 18 million RMB cash flow. But in August, the App was forced to stop operations for “obvious reason”. And when it was back online, Fenda only had three less “sensitive” categories: health, career and science.

It’s still a great sign that Tencent joined this funding round. WeChat thrives on great content, and Fenda is one foot ahead in terms of healthy revenue generation from paid content. The two have great opportunities for synergies.

Black Friday online sale hit a record-breaking $3 billion, over 1 billion from mobile

According to Adobe, Black Friday online sales hit a record breaking $3.34 billion, a 21.6% growth, year-over-year. Mobile accounted for 1.2 billion, a 33% increase from last year.

Preliminary data from retail research firm ShopperTrak showed that shopper visits to such stores fell a combined 1 percent during Thanksgiving and Black Friday when compared with the same days in 2015.

Data from an analytics firm RetailNext shows the net sales at brick-and-mortar stores fell by 5% over the two years. The number of transaction fell by 7.9%.

Total holiday season sales are expected to jump 3.6 percent to $655.8 billion this year, according to the National Retail Federation, due to a tightening job market.

There is a clear trend towards online shopping. Mobile accounts for 36% of the online sales. This is still significantly lower than the 82% mobile transaction that happened during the Chinese Single’s Day. This stresses the huge potential for the US to catch up on mobile e-commerce. It will be interesting to see the numbers for Cyber Monday.

Watch out for Weibo’s comeback

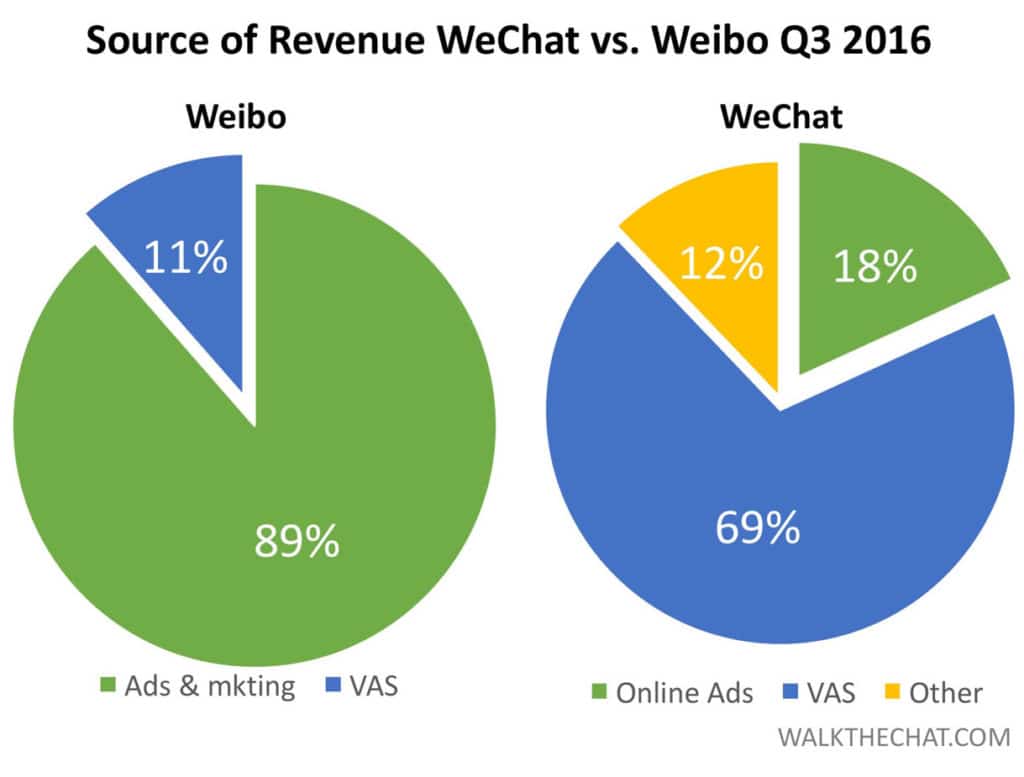

The once copy-cat of Twitter, Weibo, now seems to succeed in a slow comeback. According to Weibo’s Q3 earning report, Monthly Active User increased 34% year-over-year to 297 million. 89% of which are mobile users.

Although Weibo’s user base is not comparable with WeChat’s 848million Monthly Active Users, its advertising revenue grew to $156 million, a 48% increase year-to-year. For Weibo, advertising and marketing counts as 89% of the total revenue. While for WeChat, online ads only count as 18% of the total revenue. On the long run, you can argue that WeChat has a much more healthy revenue structure.

Weibo is definitely a force in the Chinese digital space that marketers should not forget just yet.