During its Taobao Maker Festival early July, Alibaba showcased a promising technology: cashier-free stores where customers can simply walk out from the supermarket and automatically get charged via Alipay.

How does it work and how will it change offline commerce?

The Tao Cafe

The cafe set up by Alibaba is for now a simple beta. It is however impressive: it uses face recognition to identify shoppers and bill them as they go through a “checkout hub”.

This new technology brings several benefits to customers:

- Saving time: no need to queue anymore in order to get out of the convenient store

- Saving money: the cashier-free stores will be significantly less expensive to operate, and these savings mean cheaper products. Cost of goods might go down as much as 20 to 30% in stores using this new technology

- Tao Cafe can have up to 50 people shopping in the store simultaneously (compared with 20 people for Amazon Go)

- Physical shops can finally have integrated data about who the customer is and what do they buy specifically thus providing more personalized service

At least Alibaba claimed so.

The Tao Cafe prototype still faces many challenges.

- Users have to scan a QR code before entering the Tao Cafe, and users will need to wait in the payment tunnel before exiting the shop

- It is limited to Chinese citizens

- The cost of building a store and providing the technology to operate the store is still huge compared with the human cost it saved, thus not mature yet for putting into commercial use

- It’s not clear how accurate the calculation of the cart value is yet

Does it simply mean that Alibaba wants to get into more traditional offline business, or is there more to it?

Making offline more like online

There is no doubt that Alibaba is making strong moves in the offline retail space. Just in January, it completed the purchase of the department store chain Intime with a $2.6 billion offer. Intime operates 29 department stores and 17 shopping malls in China, giving Alibaba a strong brick-and-mortar footprint.

According to the CMO of Alibaba, Chris Tung, “It’s not about Alibaba wanting to open more cafes, we are not in the restaurant business… it’s about digitalising the footprints of the visitors to an offline store,”

What does this mean? Alibaba might license this technology beyond its own stores.

The overall purpose is to make offline more like online. That is to say:

- Making the experience fast and smooth

- Customizing the experience for each user depending on their habits and needs (hence the importance of face recognition)

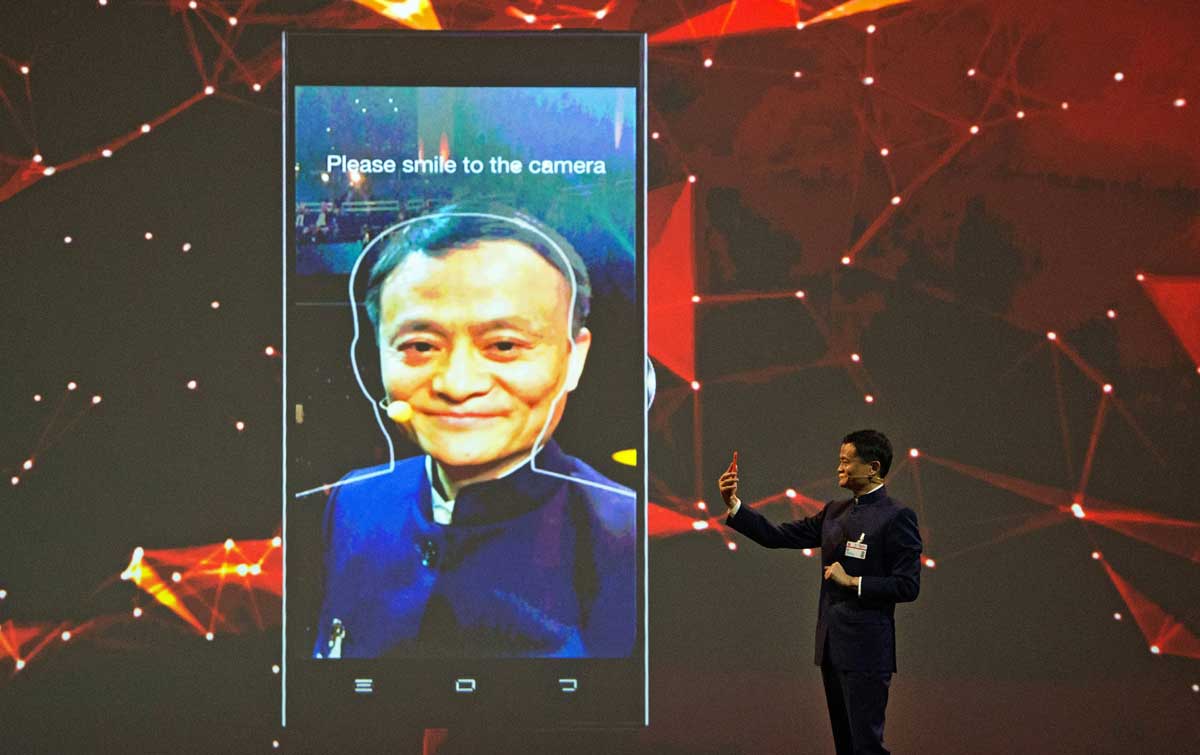

Jack Ma started showcasing Alibaba’s face recognition technology during a speech in Germany

Alibaba’s CEO Daniel Zhang added: “We don’t divide the world into real or virtual economies, only the old and the new. Those who cling on to the old ways of retailing will be disrupted, and brick-and-mortar businesses will be able to create value for consumers if they are integrated with the power of mobile reach, real-time consumer insights, and technology capability to improve operating efficiency,”

Startups joining the game

The cashier-free department store market is not limited to Tech giants. Startups like F5 Future Store are joining the revolution, opening 24/7 unmanned supermarkets.

Unmanned supermarkets tend to be of smaller size than regular supermarkets and operate with lower costs, making it possible for startups to compete in this brand new market.

Things seem to be gaining momentum for F5 Future Store who raised a 30 million RMB (4.4 million USD) round in 2017.

Another startup in this space, Bingo Box (backed by the French department store chain Auchan), raised a 100 million RMB A round of financing earlier in July.

However, everything isn’t perfect as Bingo Box recently announced that their first shop was to stop operating, highlighting the fact that the market might be more challenging than it appears.

Looking West

In order to better understand the possibilities and limitations of the cashier-free department store market, it is interesting to take a look at what Western companies are doing in this space.

Amazon Go

The highest-profile example of cashier-free stores outside China is Amazon Go. Amazon Go was announced in 2016, and is for now limited to a trial store for the company’s employees in Seatle.

The store operates on a slightly different model than Alibaba’s Tao Cafe: users identify themselves when getting into the store by swiping a QR code, and items are then automatically added to the cart as they take them off the shelves (most likely via bluetooth technology).

Customers can then simply walk out of the store when they’re done and are automatically billed.

Amazon has however temporarily put on hold the expansion of Amazon Go, mentioning technical difficulties. As of today, Amazon Go stores can only have 20 people inside the store before they start malfunctioning (Alibaba claims this number to be 50 customers allowed in the Taobao Cafe)

Walmart Scan & Go

Walmart has actually be doing attempts at automating the checkout process since 2012. It has, however not been very successful, highlighting the main issue with self check-out: a very high theft rate. Theft rates in self check-out stores shoot up to 0.7% to 3%.

Nowadays, Walmart is taking a kind of hybrid approach asking users to scan the products and then having a cashier quickly check the list. This seem to be the worse of both worlds as customers have to queue while the risk of theft remains high.

Conclusion

The market of cashier-free supermarkets is definitely booming. It holds the promise of more customization, faster and more convenient experience, and lower prices. There are however challenges to overcome in order to enable them to reach the mainstream: from dealing with theft to pure technological challenges. These problems will however almost surely be overcome, threatening the jobs of a large portion of the world’s workforce.