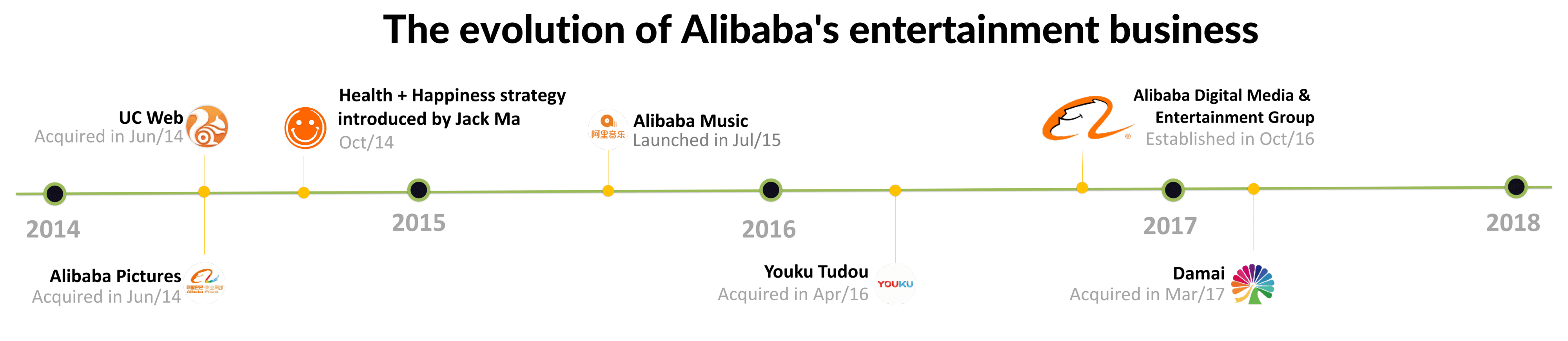

Alibaba has been growing in the entertainment business with an aggressive acquisition strategy since 2014.

The article will cover the following topics:

- Alibaba’s entertainment business’s structure

- Alibaba Picture

- Taopiaopiao

- Damai

- Youku Tudou

- UCweb

- How Alibaba links entertainment with e-commerce

- Competitors (Tencent & Baidu)

What comprises Alibaba’s entertainment empire?

Alibaba Pictures

The film company was formerly called ChinaVision Media, of which Alibaba Group bought a majority stake in late 2014

Alibaba Pictures invests in local (Once Upon a Time, etc.) and international (Star Trek Beyond, Teenage Mutant Ninja Turtles: Out of the Shadows, etc.) movies, and owns a major Chinese movie ticketing App (Tao Piao Piao, more about it later in this article). They managed successful hits such as “A Dog’s Purpose”.

“A Dog’s purpose” scored only US$ 64M in the U.S, but US$ 88M in China

“A Dog’s purpose” scored only US$ 64M in the U.S, but US$ 88M in China

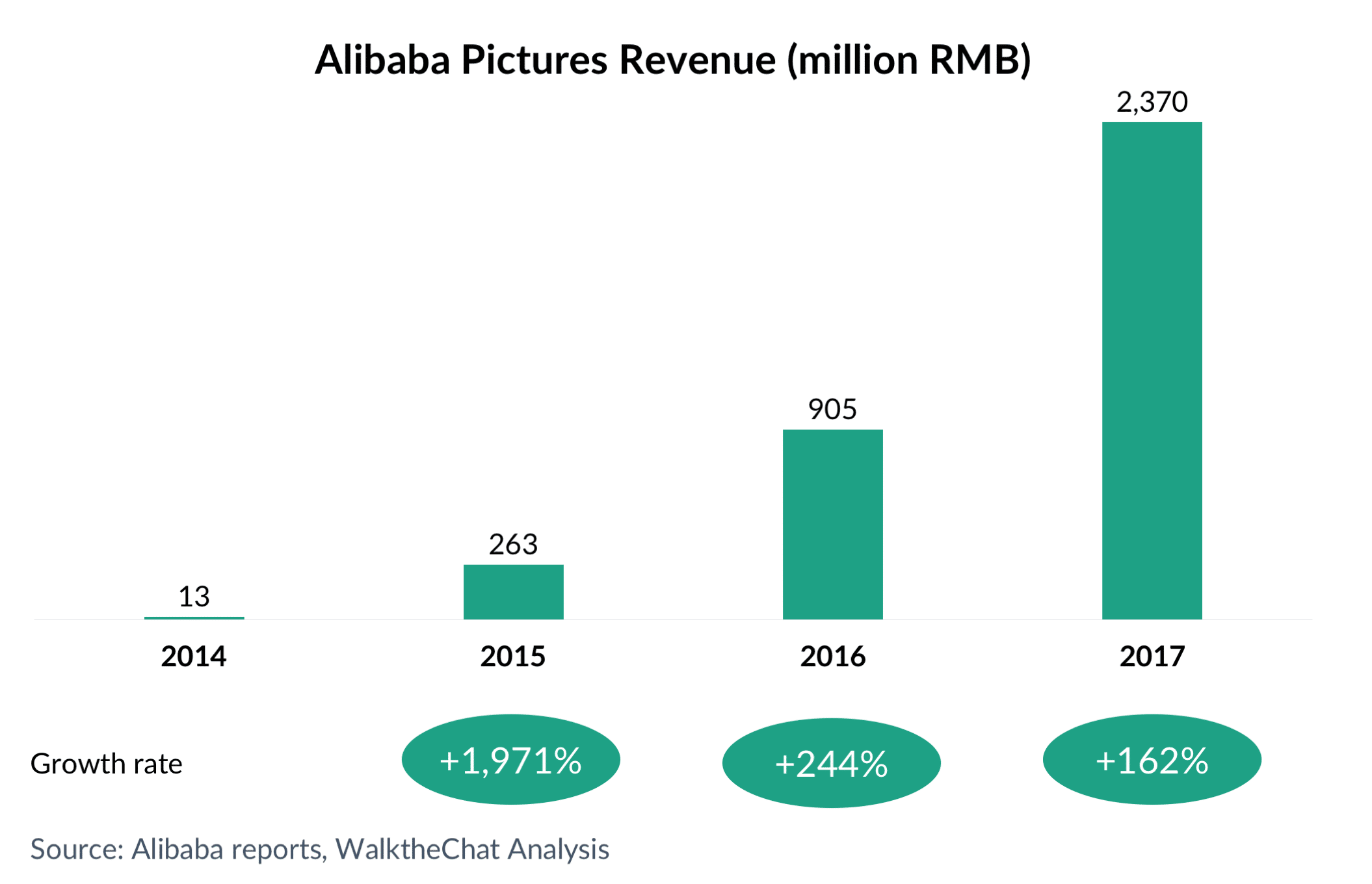

Since its acquisition by Alibaba and becoming Alibaba Pictures, ChinaVision Media saw an exponential explosion of its revenue.

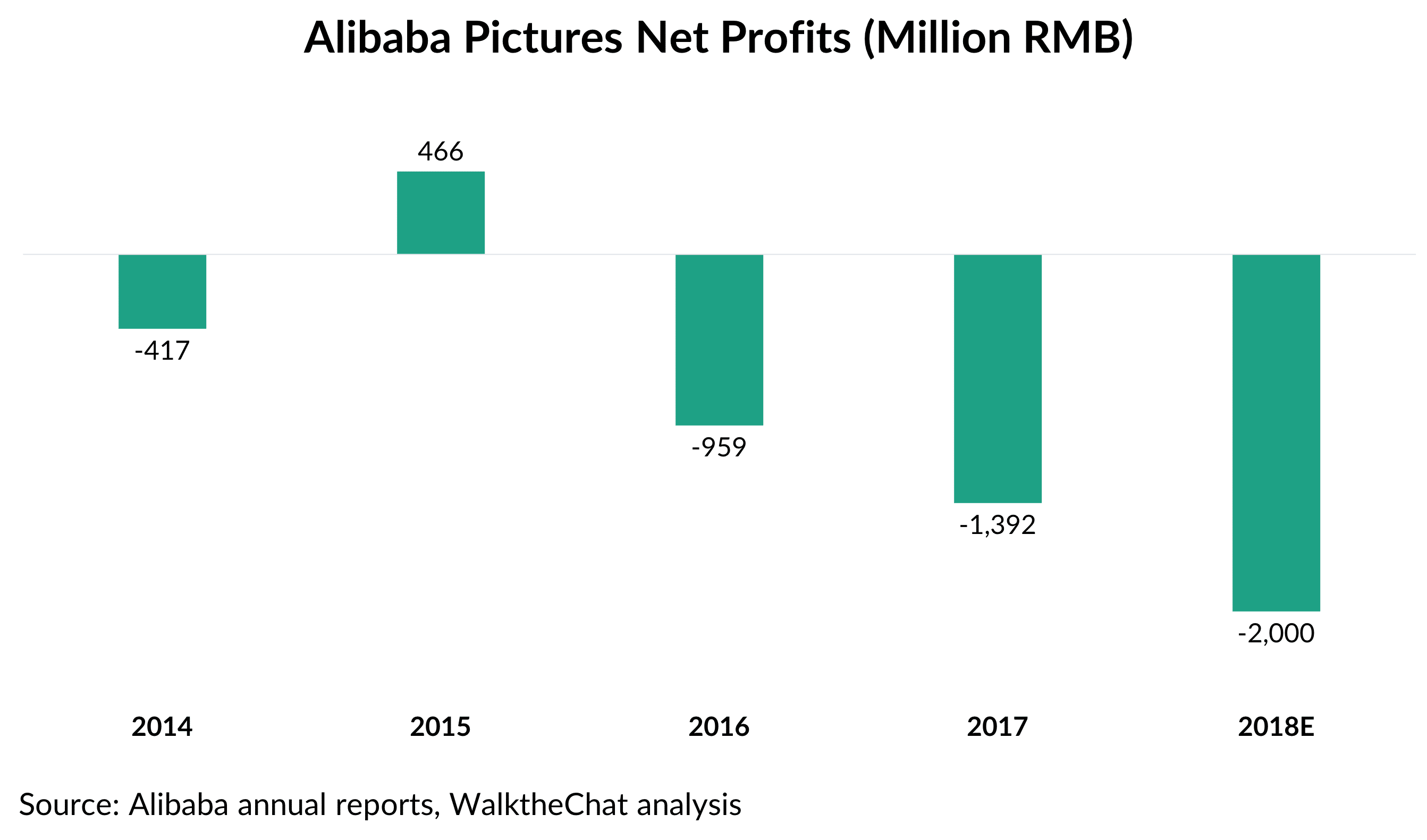

The company is, however, struggling with profitability. Alibaba Pictures as a whole recorded a net loss of RMB 1.4 billion in 2017, and the situation seems to be getting worse and worse.

Its content production segment earned a meager profit of 4.1 million yuan in 2017, which is still a significant improvement from last year’s RMB 244 million loss.

Tao Piao Piao

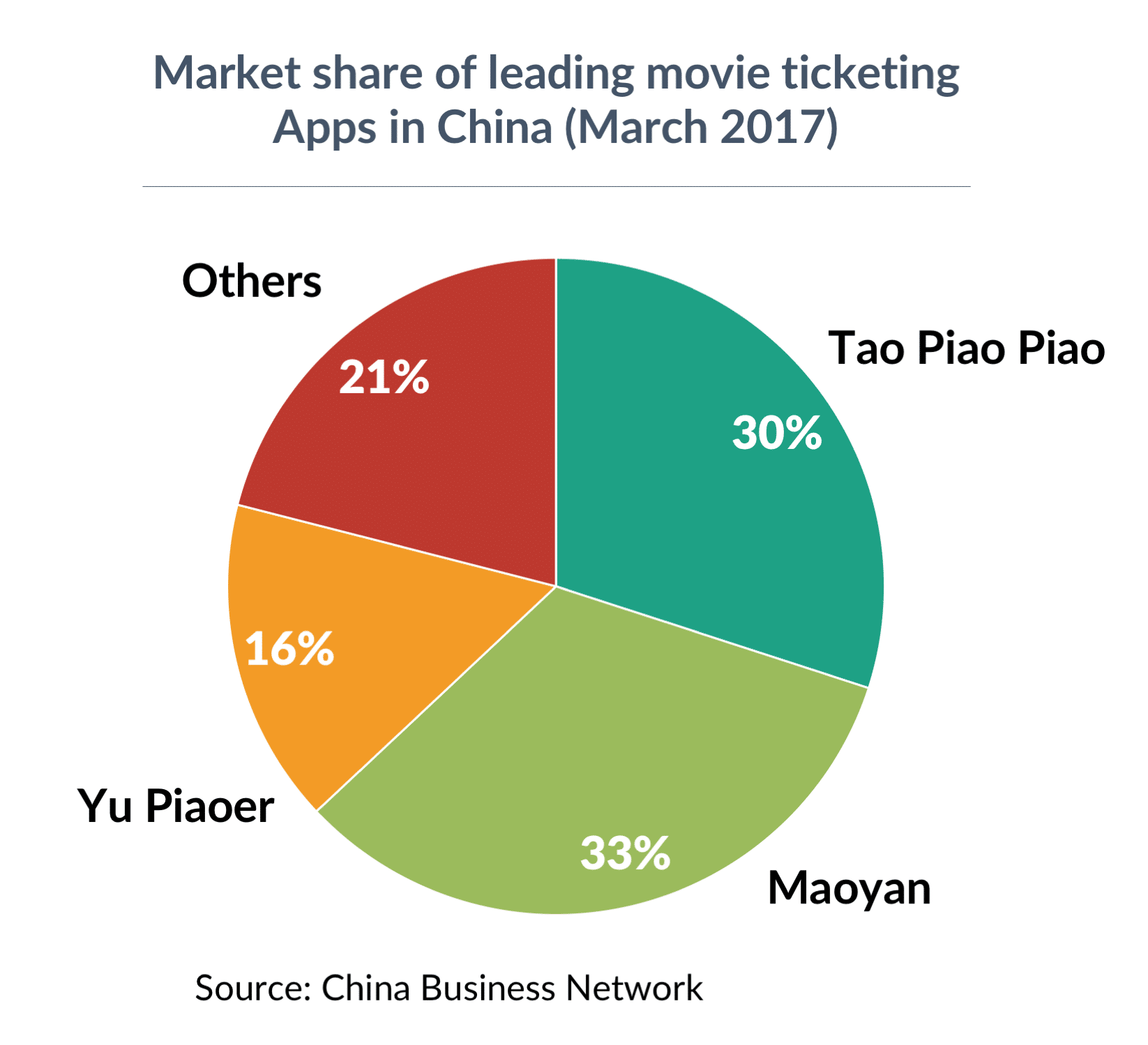

Although it is part of Alibaba Pictures, Tao Piao Piao deserves its own mention. Tao Piao Piao is growing to be the largest movie ticketing App in China, already offering seat selection for more than 7,000 cinemas across China.

Alibaba is investing heavily in Tao Piao Piao: it has tripled its revenue in 2017 and occupies already 30% market share. This up from only 10.6% market share in Q1 2016, an impressive growth rate.

Tao Piao Piao has also expanded its user base considerably: in the newest season of 2018, encompasses 290 million users, with more than 40 million daily active users.

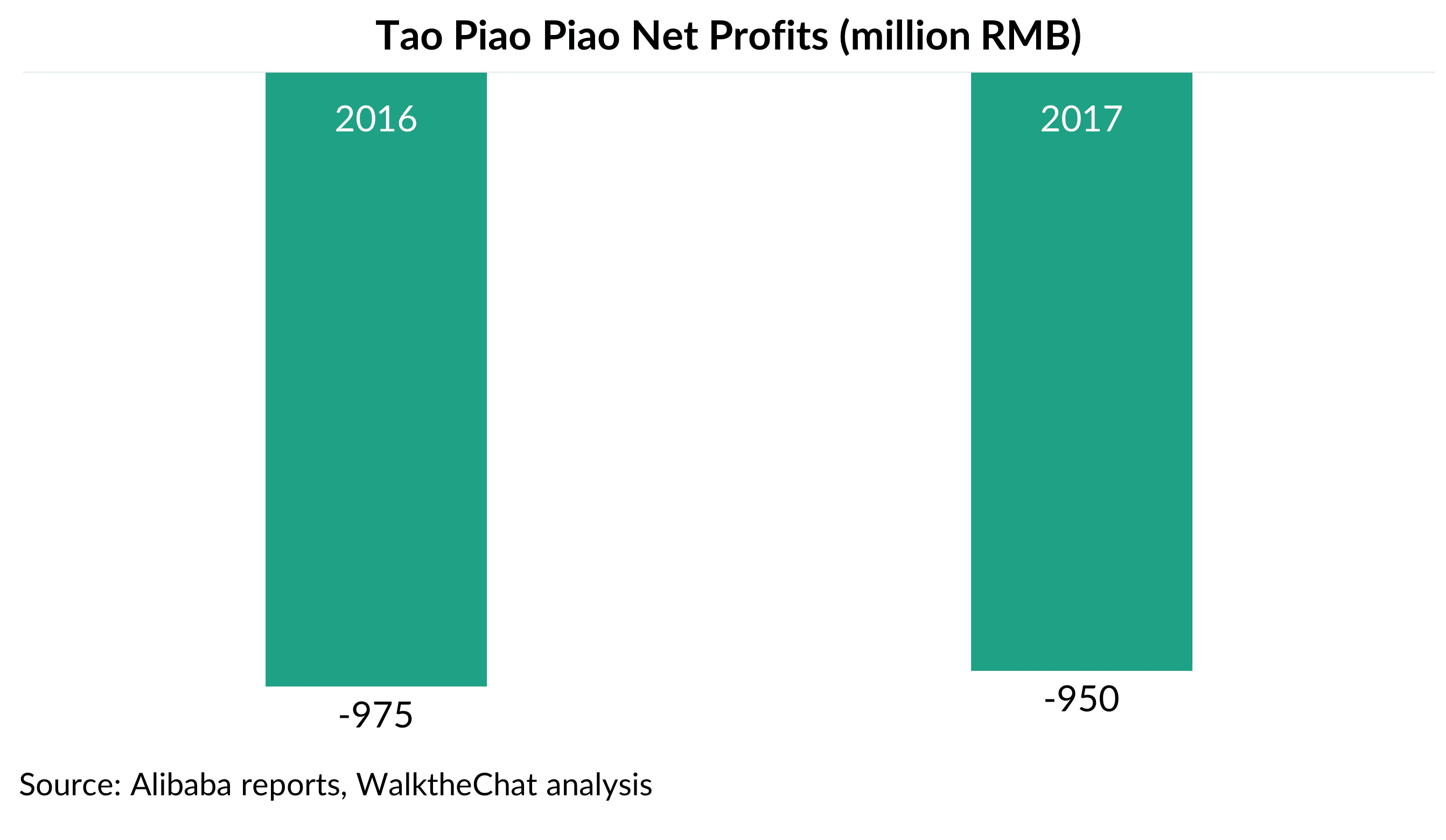

This growth came at a cost: Tao Piao Piao registered losses of 950 million RMB in 2017 (down from 975 million RMB and 2016)

According to chairman Yu Yongfu “As Tao Piao Piao further solidified its market position, it has been able to increase its revenue from both consumers for providing ticketing service, and from film producers for providing promotion and distribution services.”

Indeed, Tao Piao Piao has done an impressive job expanding its user base and acquiring market share, and more importantly, besides being accountable for more than 30% of film’s ticketing sales in China, acted as one of the distributors: it has begun investing in film production and distribution in 2017.

In fact, Tao Piao Piao was part of several successful movie investments: it participated in the marketing of ‘The Adventurers’, ‘Dunkirk’ and ‘A Dog’s Purpose’, one of Alibaba Pictures’ productions.

Damai

Damai is the largest live events ticketing App with 70% market share. They sell concerts tickets, sports tickets, theater tickets, etc. Alibaba had already invested in the company in 2014, and moved forward with a complete acquisition in 2017.

This acquisition is particularly interesting as live events market in China (USD 7 billion as of last year) still lags in size compared to that in the U.S. (USD 29 billion as of last year), Alibaba is all set to seize the opportunities for growth. In fact, they expect China’s live event business to overtake that of the US soon, as with box office ticket sales.

Youku Tudou

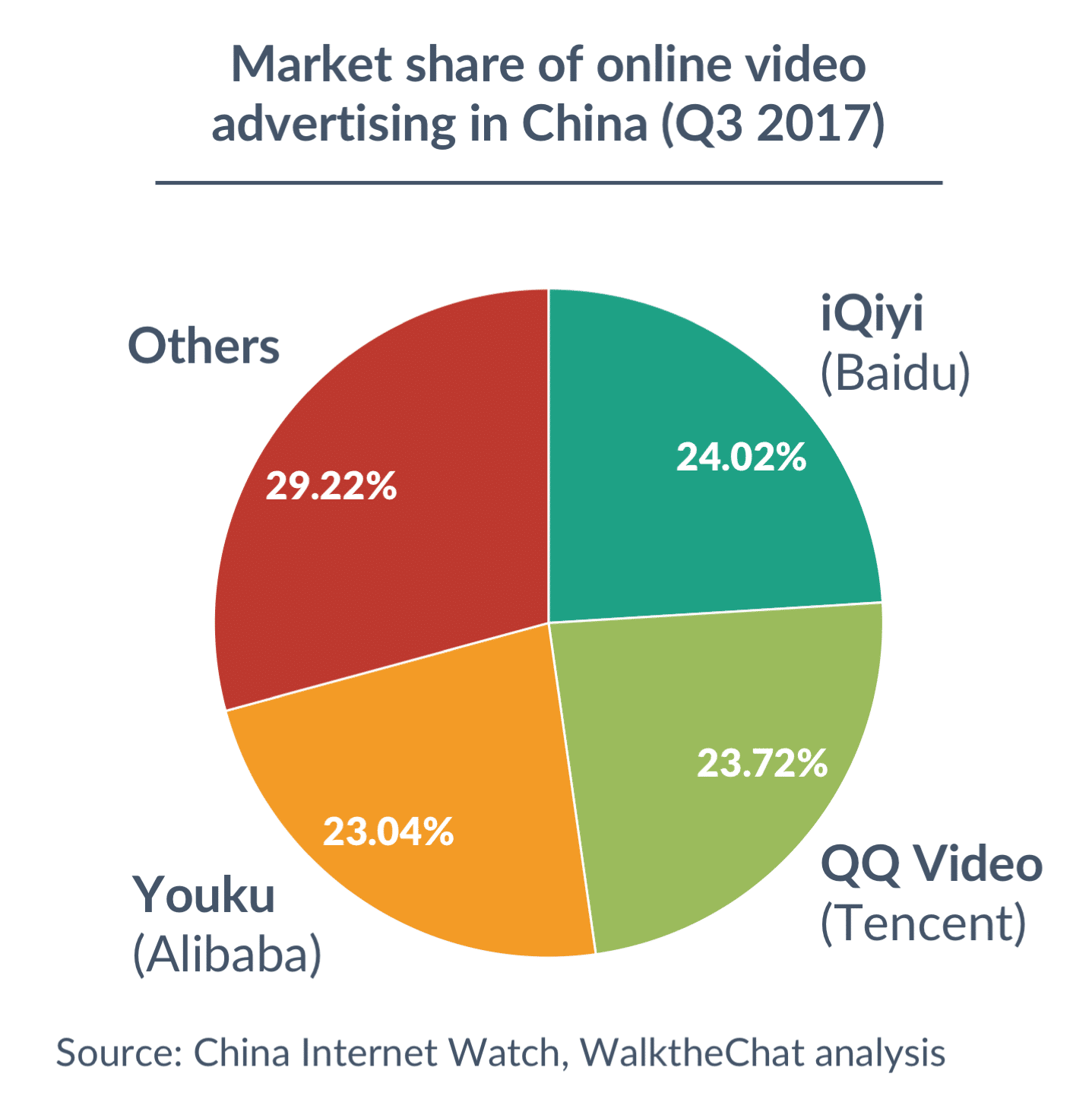

Youku Tudou is one of the leading video streaming platforms in China with 370 million Monthly Active Users and more than 23% of the total market share.

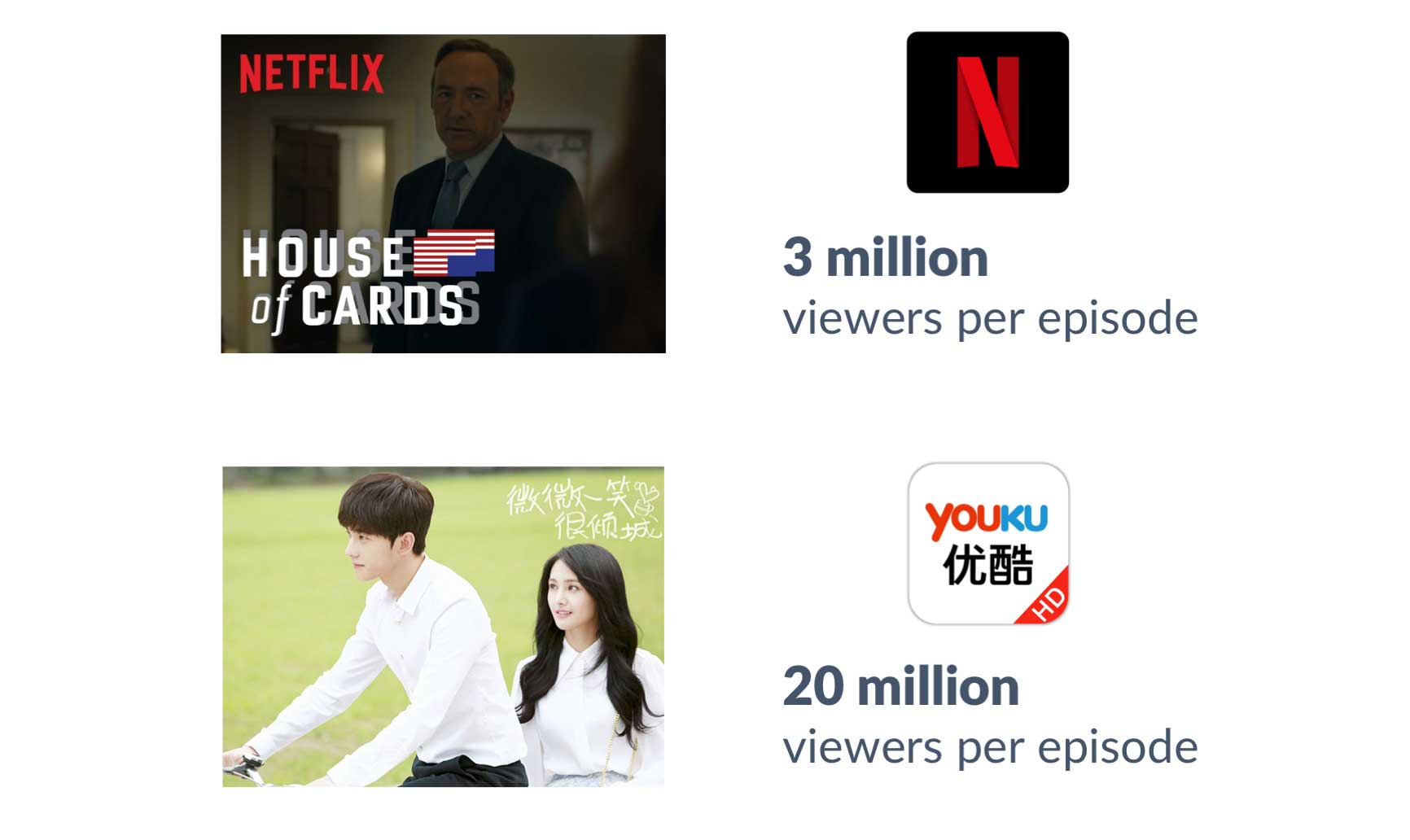

Tudou also stood out by releasing original productions, similar to what Netflix does in the U.S. Youku’s original productions were among the most popular shows on the Chinese Internet.

Mobile browser UCWeb

Mobile browser UCWeb offers mobile search and news feed prioritized by an algorithm that seeks to optimize content on-the-go. The browser has evolved to be a valuable marketing platform for brands, where content creators can plan their strategies around insights into consumption trends.

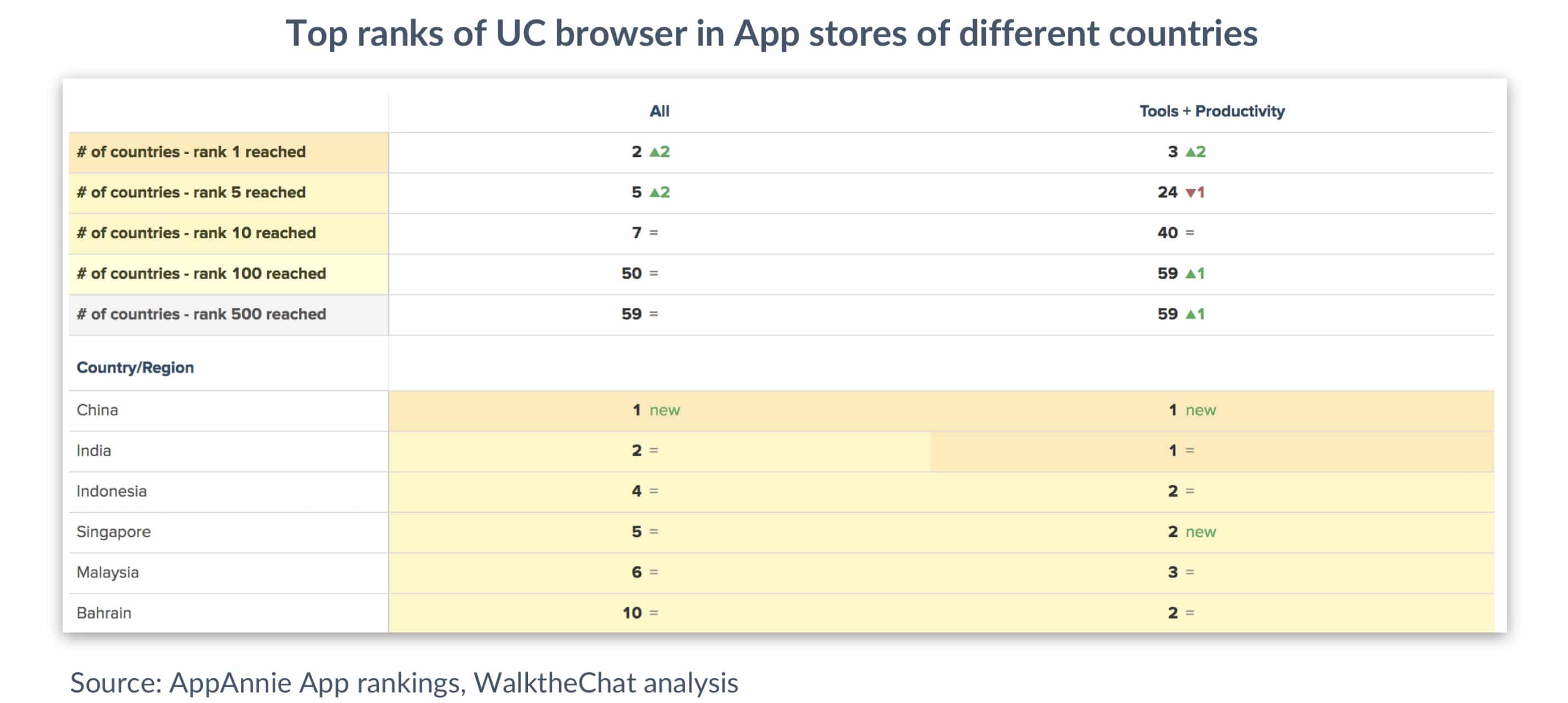

It claims to have 320 million monthly active users worldwide, and to be the top mobile browser in China, India, and Indonesia.

How does Alibaba link entertainment with e-commerce?

Alibaba, is, down to the core, an e-commerce company. How does Alibaba leverage this entertainment ecosystem in order to promote its core e-commerce business?

Single’s day promotion

It’s no secret that Single’s day is by far the most important e-commerce day in China, making for up to 60% of some merchants yearly revenue.

It is the perfect day to leverage Youku’s nearly 400 million users in order to drive more traffic to Taobao and Tmall.

Youku is leveraged in order to stream the “Single’s day Gala” featuring Chinese superstars, while Youku influencers create custom videos to drive traffic to Tmall and Taobao.

Even beyond Single’s day, Youku is an essential marketing channel for Tmall merchants, who constantly create specific content to drive Tmall sales.

2018 Football World Cup

Youku was the official streaming partner of CCTV for the 2018 Football World Cup. This was a unique opportunity to connect content with football-related sales.

This was a great opportunity for Youku to push other football-related content, leading to sales of merchandising, or promoting travel to the participating countries.

But Alibaba went beyond this: links between Youku and Tmall enabled to purchase takeaway food during the games, connecting directly e-commerce with entertainment.

Leveraging the entire ecosystem

Alibaba can now leverage its entire ecosystem to push its entertainment products.

It did so for a hit-series and movie in China: Eternal Love (三生三世十里桃花).

The movie benefited from the support of the entire Alibaba entertainment ecosystem:

- It started out as a series on Youku Tudou

- It was produced as a movie by Alibaba Pictures

- The movie benefited from crowdfunding from Yulebao

- It was then promoted to audiences via the App Tao Piao Piao

- More than 300M RMB of merchandising were sold on Tmall

By leveraging all of these assets, Alibaba can become more profitable when producing and promoting movies in China.

Cross-promotion between Apps

The numerous Apps that Alibaba is operating enables to create traffic from one to the other via cross-promotion.

For instance, Tao Piao Piao, Taobao and Alipay had cross-promotion campaigns during the last Chinese New Year holiday. Free tickets were offered to new Taobao App installs on Tao Piao Piao, while special discounts apply when you check out with Alipay.

According to third-party research, the cross-platform promotions boosted brand recognition of all three apps, especially in first-tier cities where 50% users ranked Tao Piao Paio their top app for ticketing. Completing the full cycle, Alibaba Pictures also licenses merchandising rights on Taobao.

Other cross-promotion took place between Youku and Tmall: trial Youku membership was offered with Tmall promotion, while cash rebates were given on Tmall with Youku subscriptions.

Data and technology

Of course, connecting entertainment and e-commerce is also a great way to gather data in order to deliver more targeted advertising and product suggestions. Users are much more likely to click on an ad on Tmall if they just saw a video on Youku from an influencer promoting the same product.

Damai also developped Maizuo, a platform for live venues to manage their software and hardware. Damai and Alibaba have plans to upgrade the platform (they announced a 500 million RMB investment in the project) which could very well integrate with Tao Piao Piao and bring further technological integration within Alibaba’s entertainment ecosystem.

Domestic competition

The trio that dominates China’s tech scene, Baidu, Alibaba, and Tencent, collectively known as BAT, are each pursuing their own strategic expansion from their core businesses of the search engine, e-commerce, and social network respectively. Despite being the only one that covers the entire entertainment supply chain from financing to distribution, Alibaba faces intense competition from these domestic rivals.

Tencent

Tencent’s entertainment offering encompasses music, film, and TV. It already owns QQ Music, Kuguo, and Kuwo, China’s three biggest music apps by the user base. Following an alliance forged with Spotify in a share swap, users have access to international hits as well as domestic ones.

And their streaming platform Tencent Video, with 460 million monthly active users (compared to iQIYI’s 520 million and Youku’s 370 million) under their belt, claimed that they are the top online video platform in China by paid subscribers (62.59 million as of the end of February 2018).

This is mainly attributed to the success of their self-commission content, including the popular (and addictively sticky) drama series The Nothing Gold Can Stay (那年花开月正圆), and A Love So Beautiful (致我们单纯的小美好).

Baidu

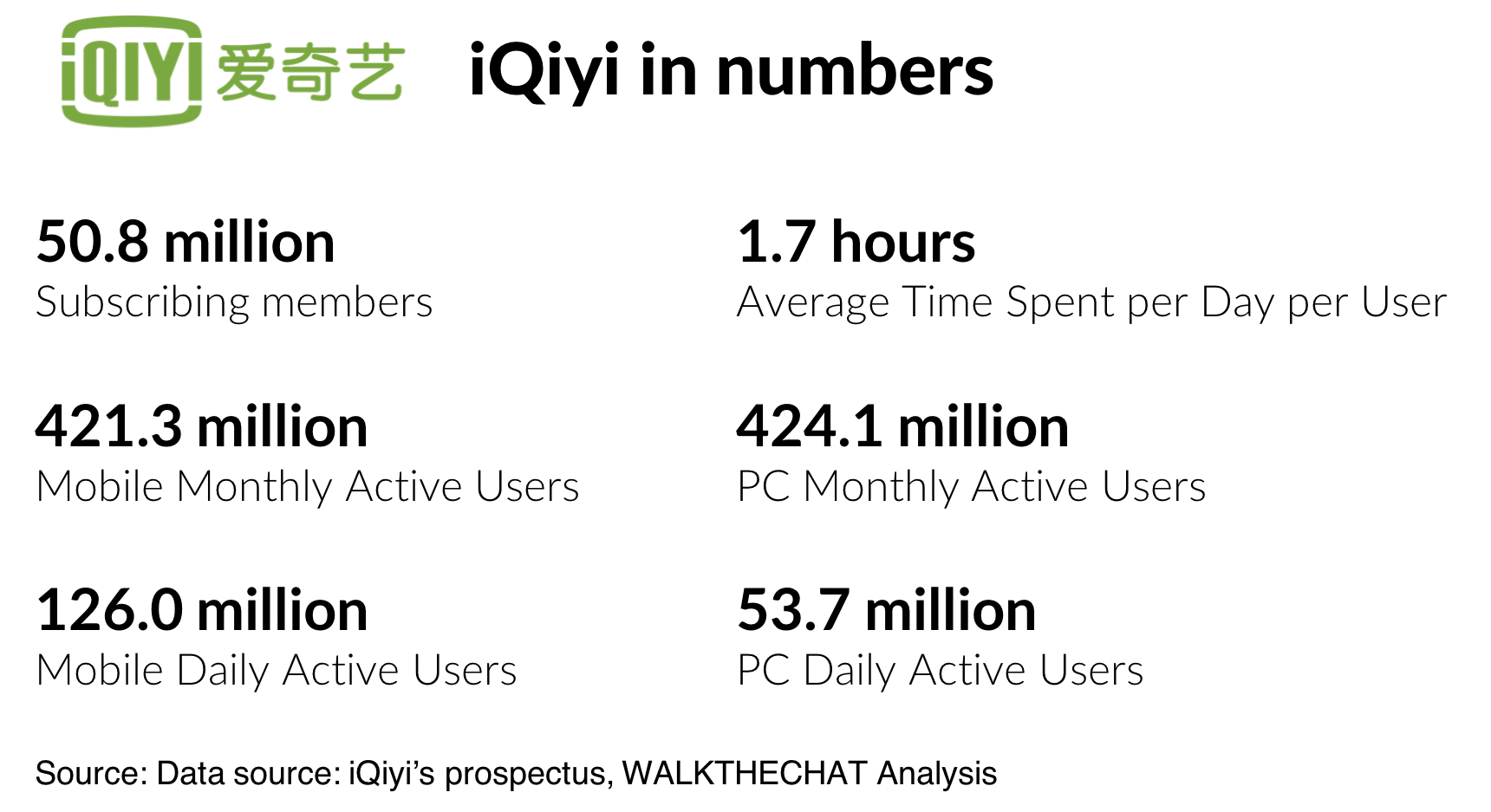

Baidu has been investing much less in entertainment compared to the other two, but its iQIYI is currently the biggest video streaming service by monthly active users, and in many ways similar to Netflix, even though Baidu resists the comparison. In fact, they are steering their model more towards Disney in terms of content, merchandising, video games and other licensing opportunities.

Here are some of the iQiyi numbers as of March 2018:

iQIYI’s recent “one for two” promotion in collaboration with JD, where users just have to subscribe to either service to benefit from both subscriptions, resulted in more than a million new paying users in a week.

Conclusion

The BAT giants have always been battling for supremacy in almost every front of the business. They are all benefitting from and fostering a growing market, yet so far only Alibaba has permeated through users’ way of living.

Few would argue that Alibaba has a solid and the most comprehensive foundation to tap China’s entertainment business, although the power of WeChat might make Tencent a strong contender.