WeChat has been losing momentum as a content platform for years. As brands suffer traffic loss, mainly on WeChat Official Accounts, many are forced to buy fake views and comments to keep the engagement. Is WeChat dead? How to smartly leverage WeChat for your China marketing in 2023?

In this article, we will take a few brands as examples to analyze their WeChat marketing strategies, success and loss. We will cover international brands of different tiers, from Louis Vuitton, Fendi, Burberry, Ralph Lauren, Lululemon, to Zara, and Uniqlo.

WeChat has lost momentum as a content marketing platform

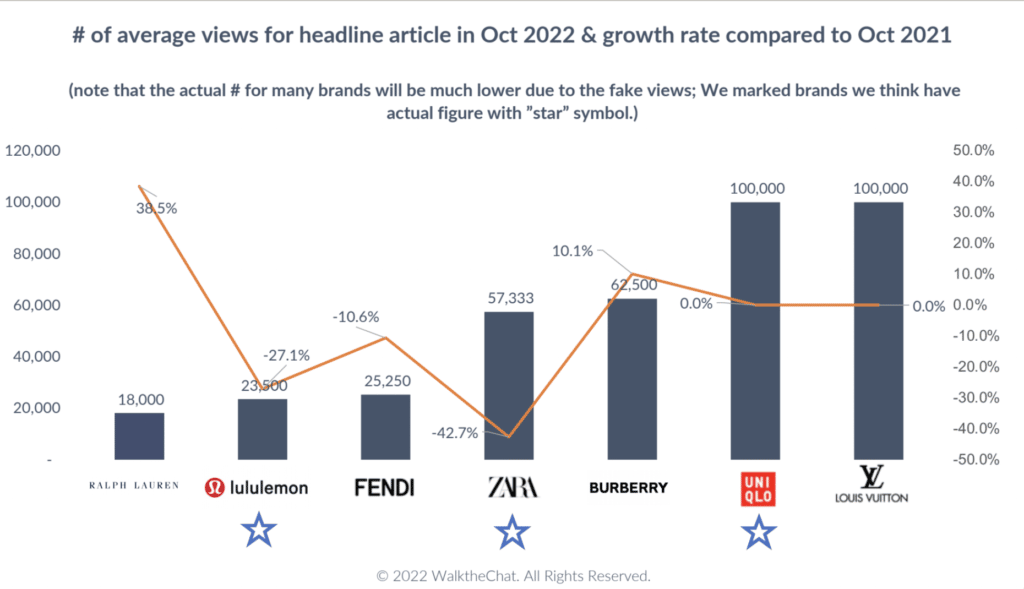

We analyzed the number of average views of headline articles on WeChat in October 2022. What is worth more attention is the general decline of viewership compared to October 2021.

Well-established fashion brands such as Zara suffered a -42.7% drop in average views. Even the new star Lululemon seems to have lost momentum on WeChat with a -27.1% decrease.

Uniqlo and Louis Vuitton remain at 100k+ views, but keep in mind this data can be misleading as WeChat doesn’t disclose the number of views after 100k (so we can simply say that they both remain at a very high number of views, but can’t actually comment on the change).

Amid this turmoil, Ralph Lauren seems to be doing well, growing at a lovely pace of 38.5% in average views. However, if we look further, there is more under the iceberg.

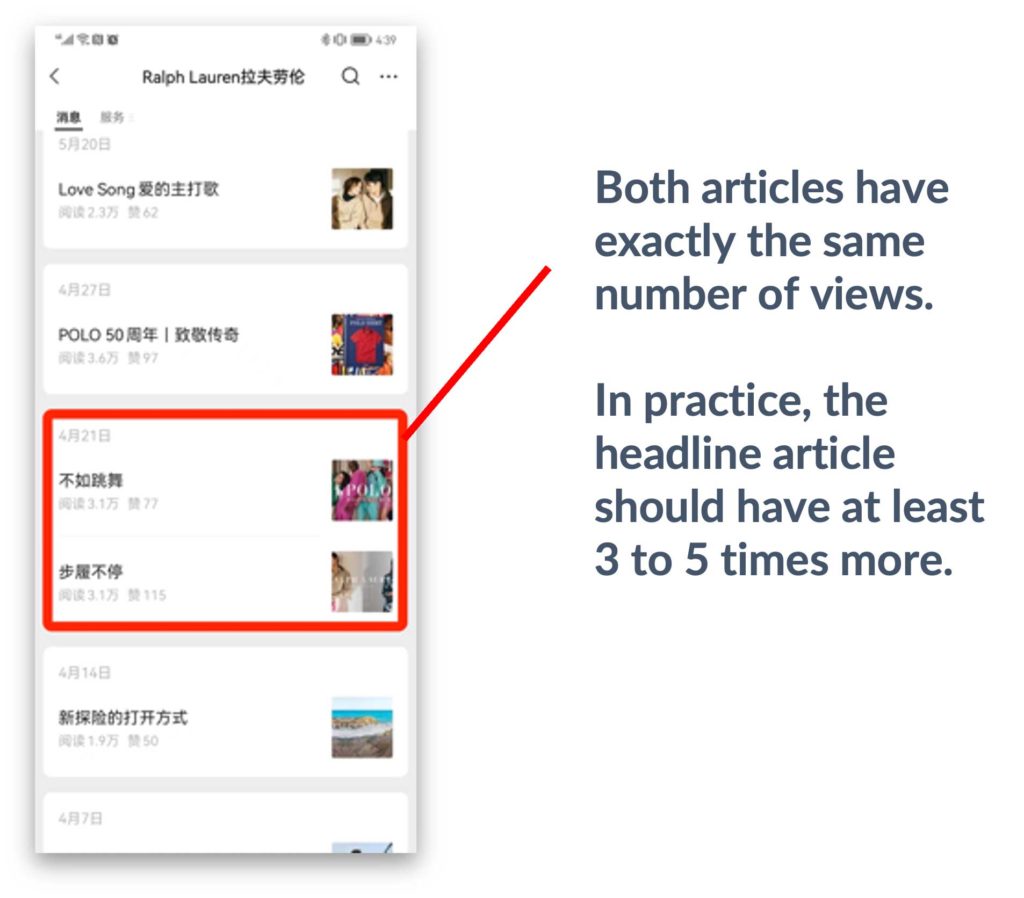

For example, in some of Ralph Lauren’s WeChat publications, all articles published on the same day gathered exactly the same number of views (for instance: 31,000).

On WeChat, brands or influencers can include several articles and send them all in one publication. The headline article has a much larger call to action and cover picture, and usually has the highest number of views. The second article manages, at best, 15% – 30% of the headline article’s performance. Although this is no definitive proof, having an equal number of views for the headline and secondary article looks abnormal and may indicate fake numbers.

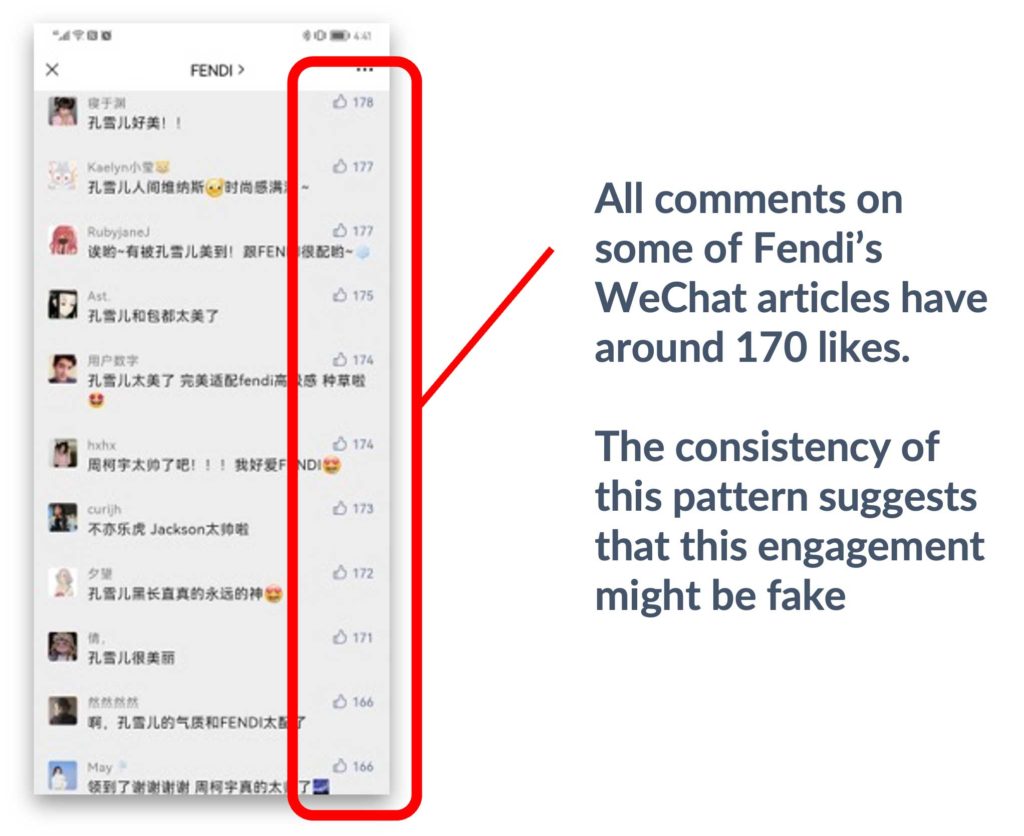

Fendi’s numbers also seem a bit fishy. All the comments on their accounts receive an “equalitarian” number of 170 likes. In practice, as on all social platforms, top comments should have the highest number of likes. This very uniform distribution of engagement suggests that some of it might have been bought or faked.

Once again, here, we can’t prove whether the engagement on Fendi’s account is fake or not; we do only point to the data.

So, why is this happening?

The truth is, WeChat is losing momentum as a content platform, as it is losing ground against Douyin, Red and other competitors.

So this is happening:

- WeChat gets harder to market on

- Brands’ headquarters don’t always know that (or won’t hear it)

- Unattainable KPIs are set

- Fake views/engagement have to be bought to meet these KPIs

- KPIs are met (thanks to fake views/engagement)

- Higher KPIs are set (while, in the meantime, WeChat only got harder to market on)

- More fake views are bought

And thus, the vicious circle of fake WeChat views is closed. Customers are fooled, brands are fooling themselves, and eventually hurting their sales and brand image with meaningless data that they end up believing.

Conclusion: is WeChat dead for marketers?

No, WeChat is not dead as a marketing platform.

WeChat is a wonderful platform for community engagement. It is still the #1 chat platform in China. It has a vibrant ecosystem of Mini Programs.

Do you want to keep in close touch with a tight group of VIP customers? Use WeChat Groups

Do you want to give your customers outstanding services at their fingertips? Use WeChat Mini Programs

Do you want to offer a private shopping experience to select VIP shoppers? Use WeChat stores

But if you’re trying to gain organic traction through publishing WeChat content, you’re likely fooling yourself. Even worse, you might be pressuring your teams into unethical behavior that will eventually hurt your brand.