COVID around China became a problem over many months this year, disrupting the supply and depressing consumer confidence. Businesses have now resumed in most cities but are still under the ever-present threat of lockdowns following the “dynamic zero covid policy”. As Chinese consumer confidence continues to drop, how should international brands react in a tough time like this?

Chinese Consumer Confidence vs. Global Level

Chinese consumer confidence continues its decline

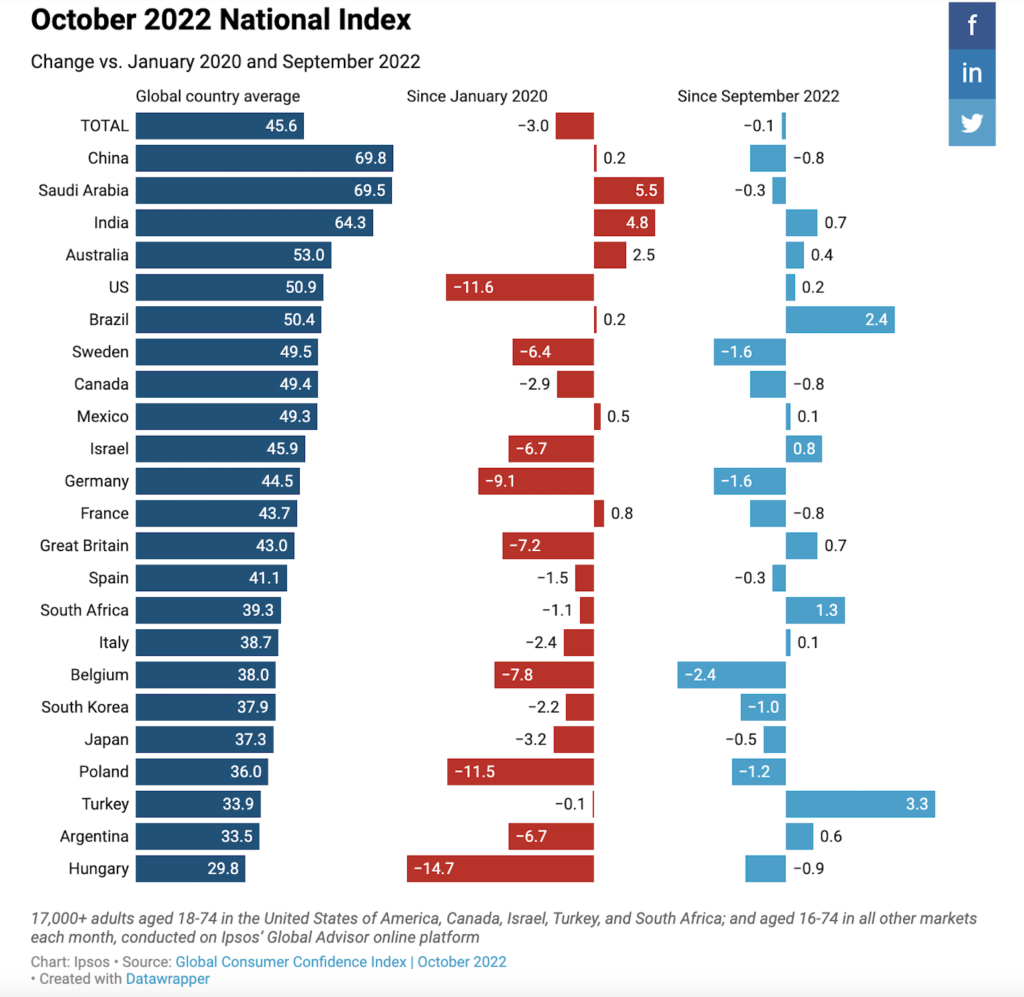

According to data from Ipsos, Chinese consumer confidence has reported a 69.8 in October 2022, a further decrease of -0.8 compared to last month. The score dropped to the same level as in January 2020 when COVID first hit hard in Wuhan.

But still rank as No.1 in global consumer sentiment

Global consumer sentiment has continuously weakened over the past eight months, with an average pessimistic overview scoring at 45.6. China, although not at its best time, still holds the No.1 position (69.8), followed by Saudi Arabia (69.5) and India (64.3). These are the only three countries scoring above 60.

Australia (53.0), the U.S. (50.9), and Brazil (50.4) are also above the 50-point mark, showing a somehow neutral economic outlook; while European countries look more pessimistic in general. The energy crisis, increased production costs, inflation, war in Ukraine, and serious concerns about the global stability have been rising.

Consumption Trends

Consumption is also not optimistic. During the “Golden Week” Holiday this year, 422 million people traveled, a further decrease of 18% from last year. Touristic revenue also dropped by 26%, which means less than half (44%) of the pre-covid level in 2019.

Many Chinese families chose “staycation” or “traveling” without leaving the city (going to parks or nearby camping) to avoid the risk of being held in random lockdowns that could disrupt the holidays. The strict restriction is not a huge surprise considering the upcoming Party Congress this month. Although, with the ongoing “zero covid” policy, it’s unlikely to have a “revenge consumption” like two years ago. Chinese people have turned to a more rational lifestyle, trying to save more money to face future uncertainty.

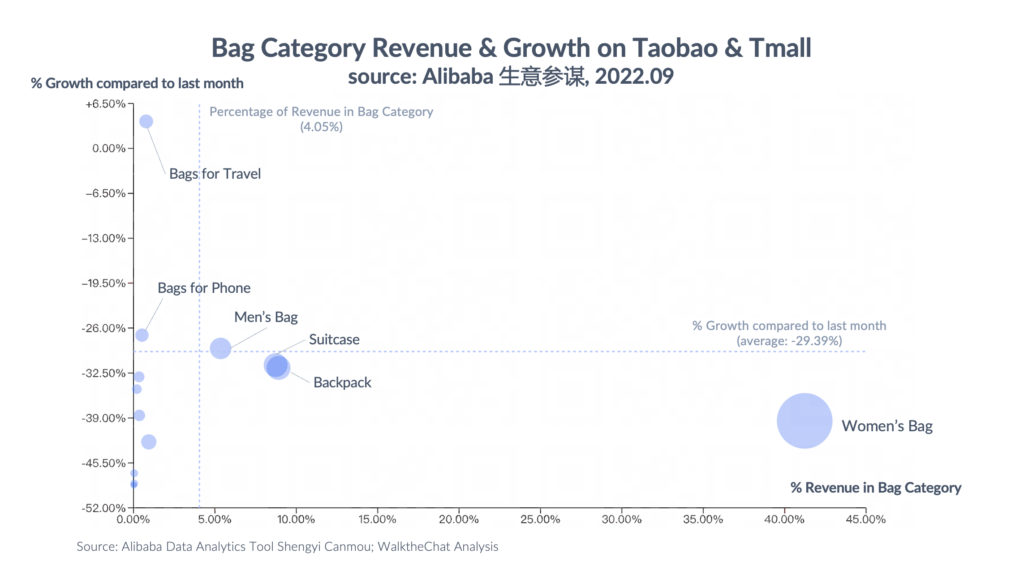

The same trend is happening in consumer’s online purchases. Take the Bag category, for example; the sales revenue and growth rate continued to shrink during September. Almost half of the sales (44.23%) come from the Women’s Bag sub-category, but the revenue has dropped by -39% compared to last month.

The same is happening with suitcase category for understandable reasons.

On the contrary, the sub-category Bags for Travel has shown an encouraging growth of +3.9%. As people chose nearby destinations for trips, demands for bags that could fit a lot of utilities but were not as big as suitcases increased. However, this niche category only represents less than 1% of the total sales in the bag category. It could be a growth opportunity to add to your brand’s collection, but it won’t change the whole picture.

Learn more about trends in bag industry:

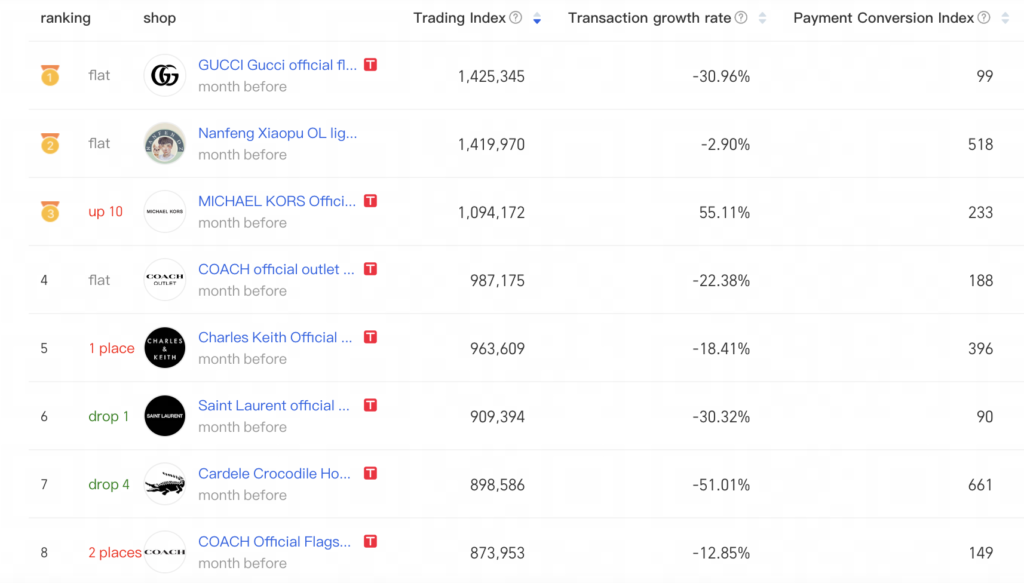

It’s not an easy time for big international names neither. Premium and luxury brands have also suffered descending sales: GUCCI (-30.9%), COACH outlet (-22.38%), Charles Keith (-18.41%), Saint Laurent (-30.32%). MICHAEL KORS was the only brand that achieved growth in the Top10 ranking.

Conclusion

It’s high time that brands carefully review their investment and overall strategy in China. As consumers and investors turn towards a more rational and risk-averse direction, international brands need to spend every coin with more caution and focus on marketing efforts that can bring value.

Thank you for your attention reading till here. If you want a customized consultation for your brand, feel free to leave us a message below, and we will be in touch with you soon.