Tencent just released its results for the third quarter of 2016. Given the company’s dominance in Chinese social space, these are much awaited news. What are the highlights? We break it down for you.

-

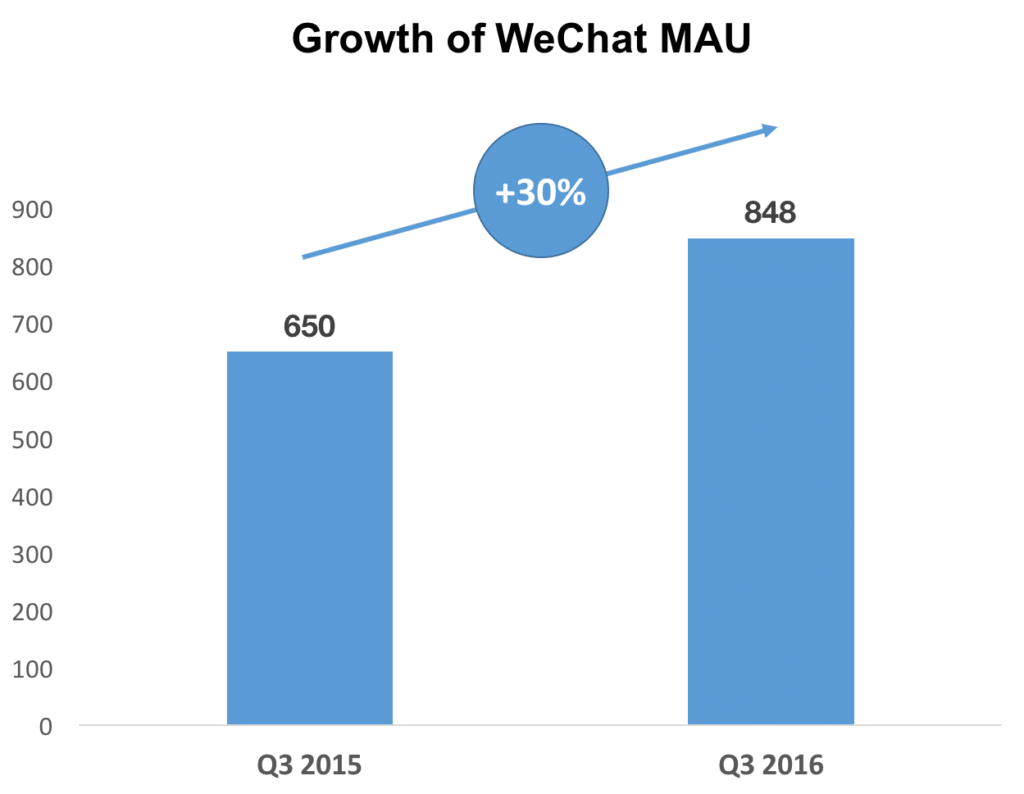

WeChat is still booming

The one statistics that stands out among these quarterly results is the healthy growth of WeChat. The social network records a 30% YOY growth, reaching 848 million Monthly Active Users (MAUs).

-

QQ is losing momentum

Meanwhile, QQ is struggling to maintain its growth. QQ MAU have been growing at a mere 2% YOY (to 877 million)

QZone, the “blog” platform of QQ, is seeing an even darker future was 632 million, a decrease of 3% MAU YoY.

It is starting to seem inevitable that WeChat will soon push its predecessor aside.

Although it’s worth noticing QQ’s rebrand itself for a “younger” audience. An Internet Watch report released early this year indicates 65% of QQ users were born after 1990, and 35% were born after 1995. It’s will be interesting to see the potential of this younger users.

-

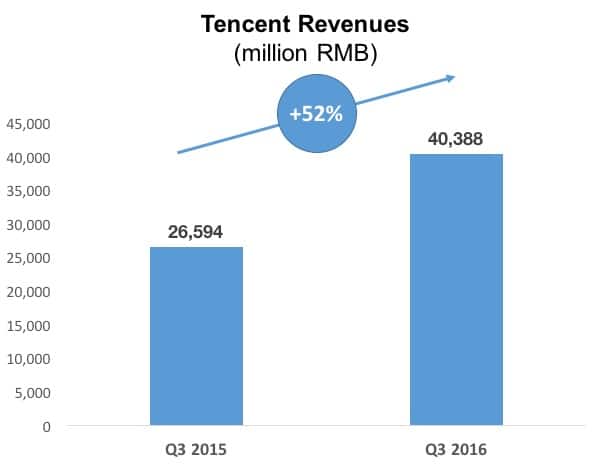

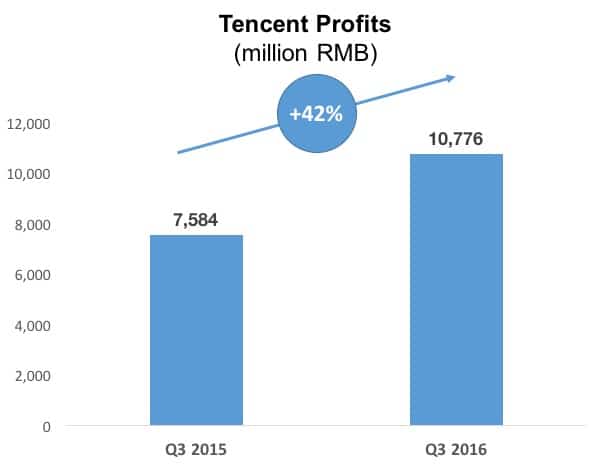

Revenues and profit are soaring

The uncertain fate of QQ didn’t stop Tencent’s revenues and profits from soaring across its properties.

Tencent saw a YOY 52% increase in revenue and 42% increase in profits

-

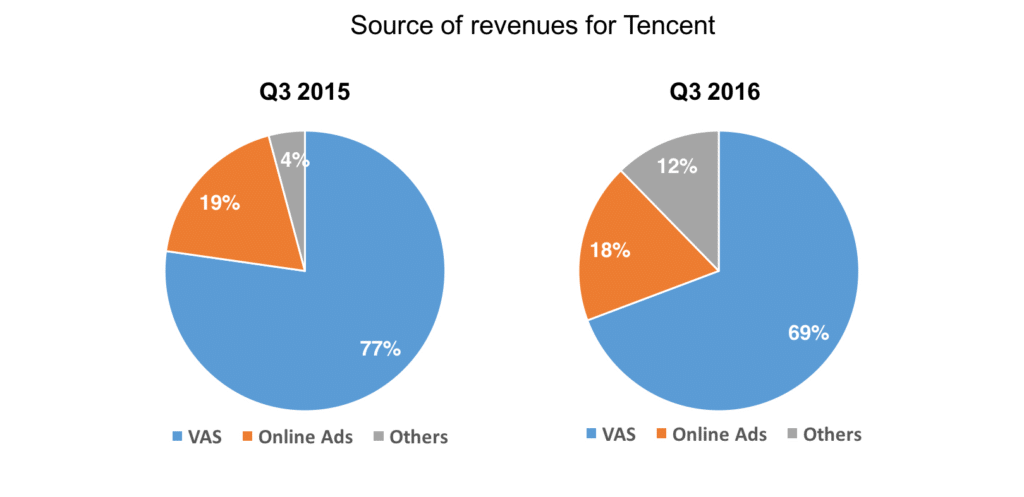

Advertising share of revenue remains stable

Tencent has been trying hard to increase the share of ad revenues as part of its overall mix (with initiative such as Moment Ads, new banner format for ads, etc…)

However, the share of ads as part of the total revenue remains stable, and actually experienced a slight decrease from 19% to 18% of the revenue mix.

Interestingly, the growth in ads revenues seems to be primarily driven by WeChat. Tencent states that “ Performance-based advertising revenues increased by 83% YoY to RMB4,368 million, primarily due to higher contributions from advertising revenues derived from Weixin Moments, our mobile news app, and Weixin Official Accounts”

Interestingly, the growth in ads revenues seems to be primarily driven by WeChat. Tencent states that “ Performance-based advertising revenues increased by 83% YoY to RMB4,368 million, primarily due to higher contributions from advertising revenues derived from Weixin Moments, our mobile news app, and Weixin Official Accounts”

Tencent also states that “Neighbourhood LBS advertising in Weixin Moments is gaining popularity among local advertisers from industries such as real estate, wedding services, and auto dealerships”

-

Online game are key contributors to revenue growth

Online games are responsible for 87% of the growth in revenue.

This is both good and bad news for Tencent:

- Good news because it shows the success of Tencent strategy for online games, in particular the successful acquisition of SoftCell.

- Bad news as it highlights the fact that Tencent is failing to diversify its revenue streams to different channels such as advertising and payments

-

Increased adoption of offline WeChat Payment

Offline WeChat payment adoption increases. Although Tencent does not reveal exact figures, they point out that the “cashless day” was joined by 7 times more merchants than the previous year.

Conclusion

Overall, Tencent has been performing well, in line with expectations from the market. The steady growth of WeChat is a very positive sign for Tencent. The downfall of QQ is a negative but predictable event. The markets reacted positively to the release.

However, Tencent seems to be struggling to diversify its revenue streams beyond games. The new ads formats released this year might make a difference if they are opened up to a broader audience. But so far, this challenge is still ahead for Tencent.