The WeChat impact report is back, together with a fascinating Ipsos survey comparing WeChat payment and Alipay.

Is WeChat stealing significant market share from Alipay yet? What do Chinese users do with WeChat? Find it all out bellow.

Rise in WeChat engagement

The amount of time spent on WeChat rose further this year.

The number of users who use WeChat less than 5 times per day decreased to 11% (against 17% last year) while the number of users who use the APP more than 50 times per day rose to 21% (against 16.5% last year).

Type of activities also shows interesting patterns:

- Unsurprisingly, browsing moments and sharing are the most popular daily activities, accounting for respectively 58 and 53.5% of respondents

- Reading content on public accounts scores a fairly high popularity rating, with 40% of respondents indicating they do it daily

- Mobile payment and sending money also turns out to be a daily activity for about a third of respondents

- Social e-commerce and gaming are much more marginal, being a daily activity for only 6.4% of respondents

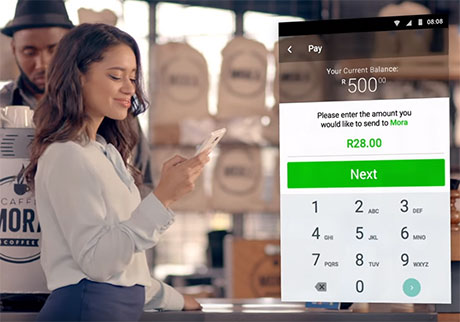

WeChat payment leading P2P transfers

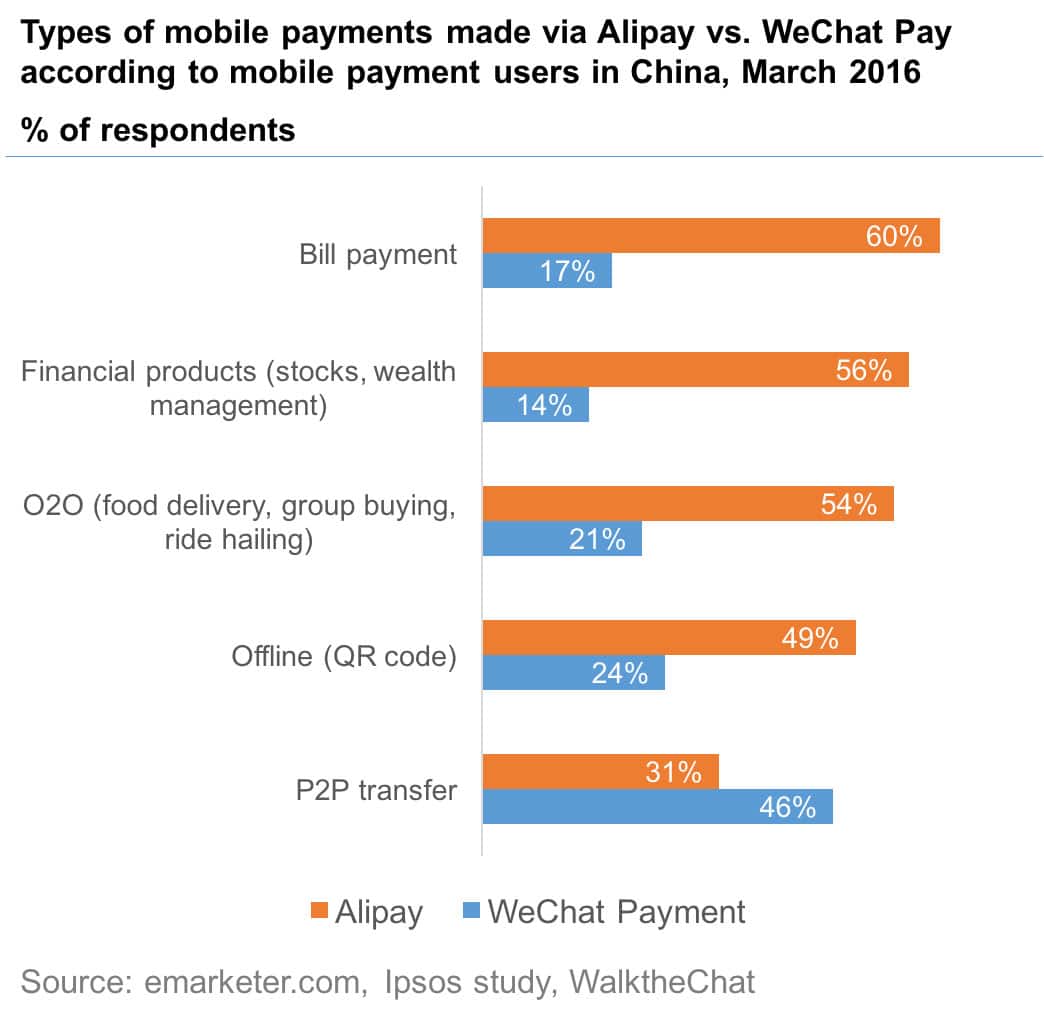

An Ipsos study carried in March reveals interesting trends in the usage patterns of WeChat payment and Alipay in China.

Key takeaways are:

- Through its convenient interface and social focus, WeChat managed to take over Alipay when it comes to P2P transfers, with 46% of respondants declaring they use WePay for their P2P transfers (against only 31% for Alipay)

- WeChat is catching up for offline and O2O payment, although the percentage of respondents indicating they use WeChat payment is roughly half of the amount of participants using Alipay

- Financial payment and bill payment remain two areas where Alipay is largely dominating the market, with 3 times the amount of respondents of WeChat payment

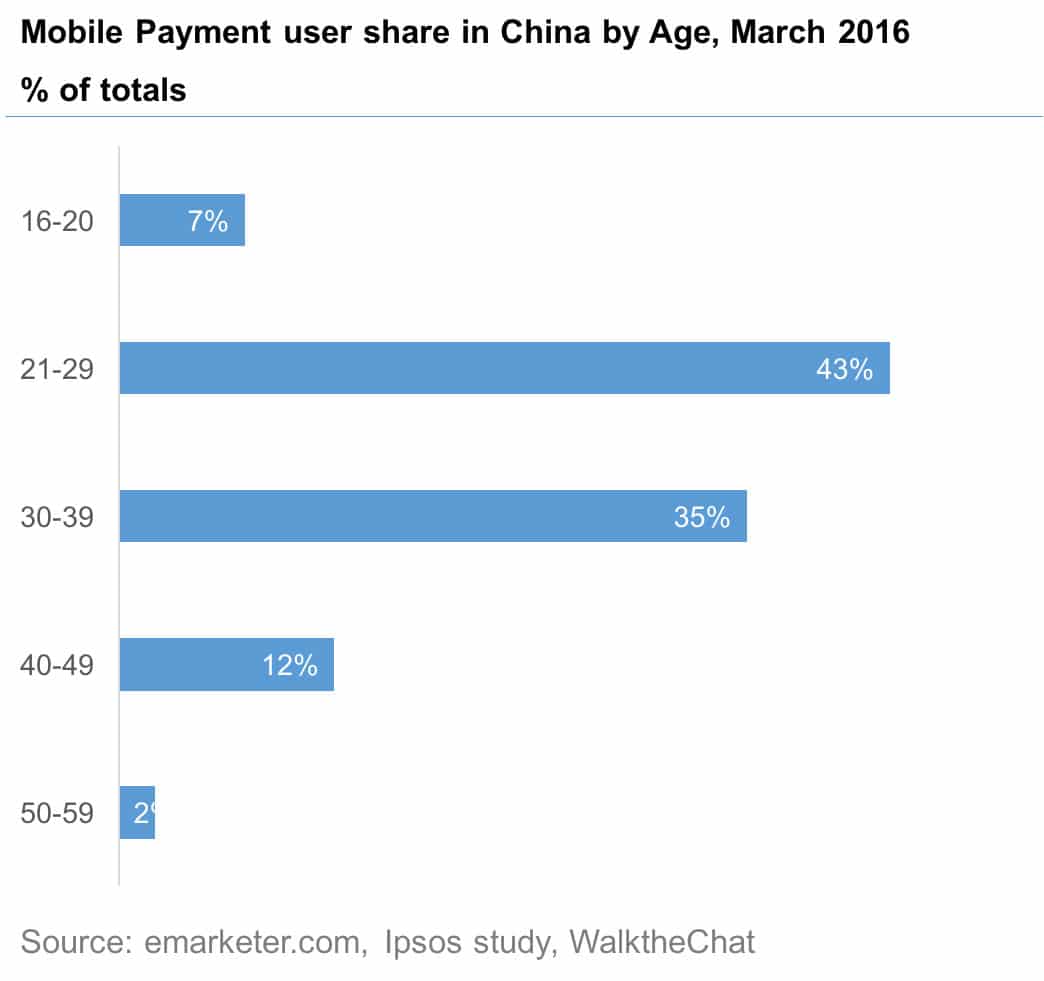

Heavy concentration of mobile payment users between 21 and 39 years old

The same study enabled to shed light on the populations most engaged in mobile payments.

It turns out the percentage of the population using mobile payment is heavily concentrated between 21 and 39 years old (78% of the total).

If this result is not in itself surprising, it is noteworthy that the 40-49 age group is significantly more engaged on mobile payments than the 16-20 age group (12% against 7%).

The power of red envelopes

Why did P2P transfer significantly outperform any other category for Wechat payment? It is of course the extreme success of WeChat Chinese New Year red envelopes (红包) which is accountable for it. 8 billion “red envelopes” were sent over WeChat during Chinese New Year. And it has been overperforming Alipay for a while already. In 2015, “only” 240 million red envelopes were exchanged via Alipay, against 1 billion via WeChat.

Sending money through WeChat is indeed the primary usage of WeChat payment, as indicated by 84.7% of respondents of the WeChat impact report 2016 study.

Rise of WeChat as the number one marketing tool

emarketer.com also shared a report by Forrester indicating WeChat is now leading the way as the #1 tool for marketers in China to reach their audience (as indicated by 92% of respondents).