According to 2016 China Investment Ecosystem Report, the number of consumer product startups increased by 58% in 2016. Many of these brands were created by young Chinese founders who are born into the digital era, and are competing against international giants. They sure know how to leverage the Chinese social media ecosystem, mainly WeChat and Weibo, to pick up a fight against the biggest market players.

Qing Life 轻生活

Success tip: collaborate with many WeChat KOLs (key opinion leaders)

Female hygiene product is super competitive market. 50% of market share is taken by overseas brands P&G, KAO Group, Kimberly-Clark and Unicharm. The rest is dominated by traditional Chinese brands, cheap, less attractive design, and sometimes poor in quality.

When e-commerce became popular, new Chinese hygiene brands seize the opportunity to introduce new, superior products online. Some examples includes: Qing Life (轻生活), HoneyMate (护你妹), NONOLADY, and Blossom (花煦).

Packaging of NONOLADY looks like gift box.

Let’s take Qing Life as an example: 7 million RMB pre-A round funding this year; 30 million RMB in sales in 2016.

The key to making a sale was by working with WeChat KOLs. Many of them.

According to Sohu Tech New, from May to August 2016, Qing Life worked with 112 WeChat KOL accounts, totaled to an investment total to 1.2 million RMB. By June 2017, Qing Life now has 30 million Official Account followers.

KOLs helped to endorse the product and encourage the early adopters to switch to better quality female hygiene products. KOLs usually wrote long review articles about their experience using the product. This personal review approach helped audience to relate with the KOL and encourage the purchase of the product.

The cost per article read for the Qing Life campaign was between 0.3-0.5 RMB. (This is relatively low cost compare with cost per view today, as the pricing kept raising.)

The campaign paid off. In total, KOL campaigns converted into 6.1 million RMB sales, with average order size of 80RMB.

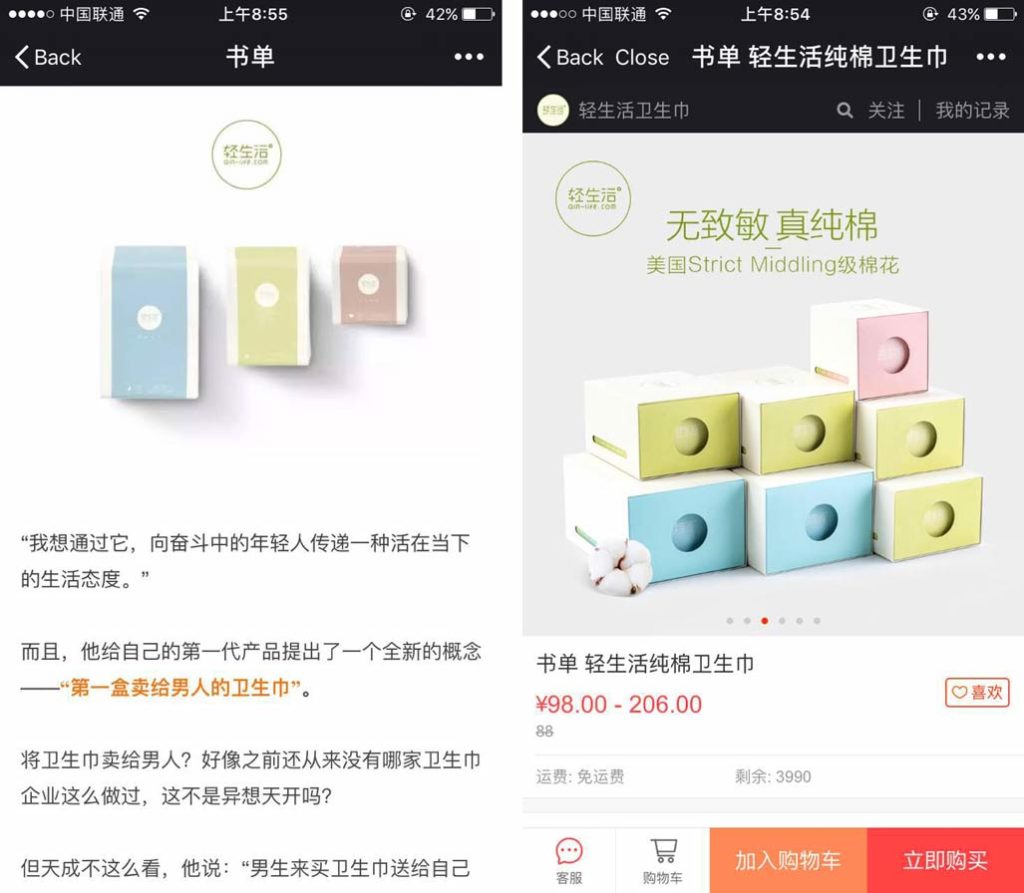

One particular KOL Qing Life works with is called Book List 书单. Their article went viral to get 17,000 views, and brought more than 4,000 orders. Instead of native advertising format (hide the promotion content at the end of the article), this article directly disclosed that it was a promotional article about female hygiene products. This builds the right expectations for the users.

Interestingly, not all Qing Life campaign were successful. One of the KOL Qing Life collaborate with is called Renrencong 人人从. The article got more than 10,000 views, however only 80 unique visitor clicked into the landing page, and only 8 made purchase. When brands collaborating with KOL, make sure to look at the data from all angles: article view, user comments, past conversions, and click through rate. This can help you to eliminate fake KOL accounts.

Nattitude 植观

Success tip: drive traffic from other channels to Tmall

Nattitude is a shampoo and conditioner brand that was founded in 2016. One bottle of Nattitude shampoo costs 99 RMB, almost 3 times more than similar products in supermarket. But in less than a year, it already ranked No. 11 among all hair products on Tmall (data from 2016 Single’s Day sale).

The most impressive data about Nattitude’s Single’s Day sales is that 60% of its sale on Tmall came from social media.

Nattitude partnered with more than 20 Key Opinion Leaders (KOLs) during the Singles’ Day to drive high quality traffic to its Tmall store.

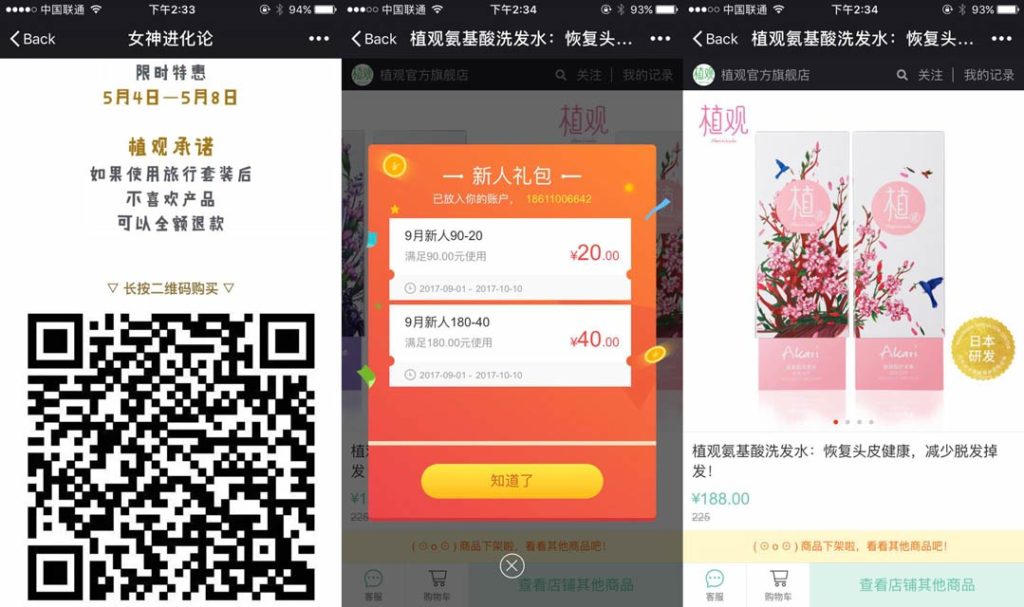

For example, Hi Better Me, a very popular WeChat KOL, wrote a review about experience using the shampoo & conditioner. The article drives traffic from QR code to Nattitude’s WeChat shop. Notice for first time visitor, users will get a 20-40 RMB coupon.

Nattitude also partnered with another Weibo KOL Lisa. Her promotion got picked up by Weibo to be listed on the homepage and drove 9,000 unique visitors to the Tmall page.

Nattitude also has a comprehensive marketing strategy that goes beyond WeChat and Weibo. The promotion also appeared on other platforms including Zhihu (Chinese version of Quora) and Xiao Hongshu (a cross-border e-commerce marketplace). These two channels have users with higher purchasing power and higher education level. Which matches the positioning of an expensive shampoo.

Today, Nattitude already raised its multi-million RMB series A round, and invited Li Xiaopeng, an Olympic champion to join the founding team.

Heytea喜茶

Success tip: limited supply to create buzz on social media

Starbucks announced in July it would close down all of its 379 Teavana shops globally. In contrast, the Chinese tea shop market (ie. milk tea, bubble team shop) has been thriving over the past 2 years. According to FreesFund’s calculation, instant tea is now a 40-50 billion RMB market.

And Heytea is the most famous Chinese tea shop chain.

Heytea is a tea shop chain specialized in milk foam tea and fruit tea. I won’t personally make comments on its taste (I’m not a Starbucks fan either taste wise) but the tea shop has a modern and minimalist design. One cup of Heytea costs 20-26 RMB. And one store can sell 4,000-5,000 cups of tea per day: a daily revenue around 100,000 RMB. The company raised 100 million RMB funding from IDG in 2016.

What’s special about the brand is that it leveraged the network effect of social media. The brand is famous on social media because of the long waiting time to get its product. It uses a controversial technic: scarcity marketing.

Below is a picture of the line when Heytea first launched in Shanghai. Waiting time reached 6 hours!

Many sources even suspect Heytea hired fake customers to stand in line in order to make sure the wait was long enough. The average waiting time is around 2-3 hours.

This definitely made the buzz online. Customers who bought team would proudly take a picture and share it on their WeChat moment when they finally got the milk tea. The waiting time almost became a selling point. Despite the high demand, and huge funding round, Heytea only had 50 tea shops in 1st and 2nd tier cities, partly to keep the waiting time long enough.

Conclusion

Chinese brands continues to use innovative marketing tactics to promote new products. Soon we will see a new wave of new Chinese brands taking major market share from the biggest players in the consumer product category.

Oversea companies can learn from their local competitors to truly localize their marketing strategy: leverage social media to drive traffic to your e-commerce site; use promotion tactics like scarcity marketing and flash-sales; and collaborate with social media influencers to increase e-commerce conversion.

More over, Chinese consumers are more willing to pay a premium for high quality products, this is also an opportunity for new small overseas brands.