In the middle of January 2021, Douyin – the Chinese version of Tik Tok – launched a new feature: Douyin Payment.

With more than 600 million Daily Active Users (DAU’s), Douyin is a content powerhouse in China. But will it manage to stand out in the payment market?

What is Douyin Payment?

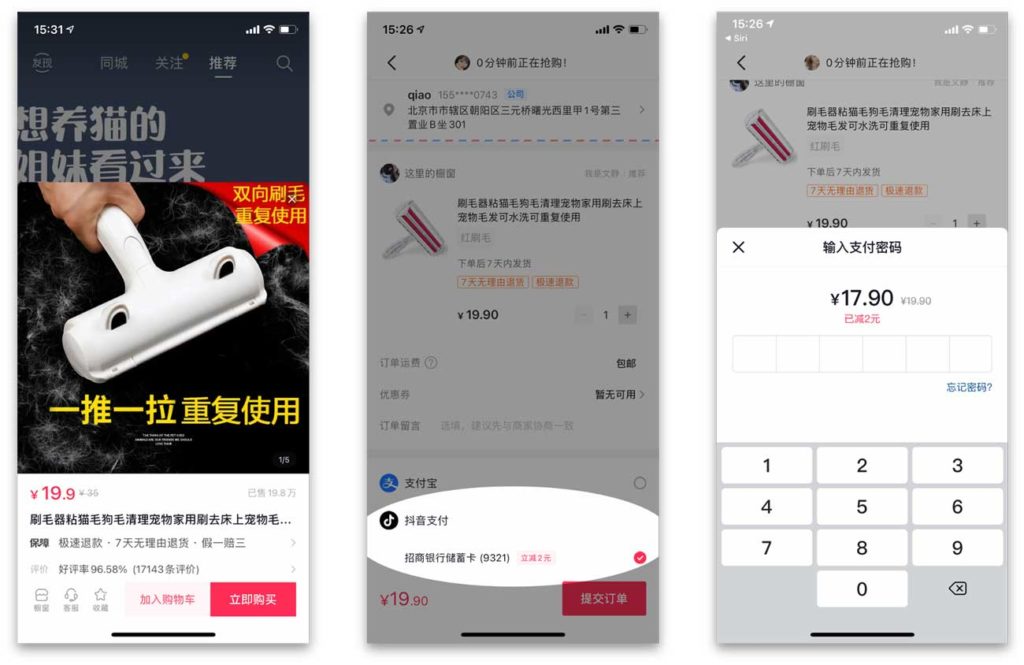

Douyin payment is a payment option provided to users buying products from native stores on Douyin or Douyin live-streaming.

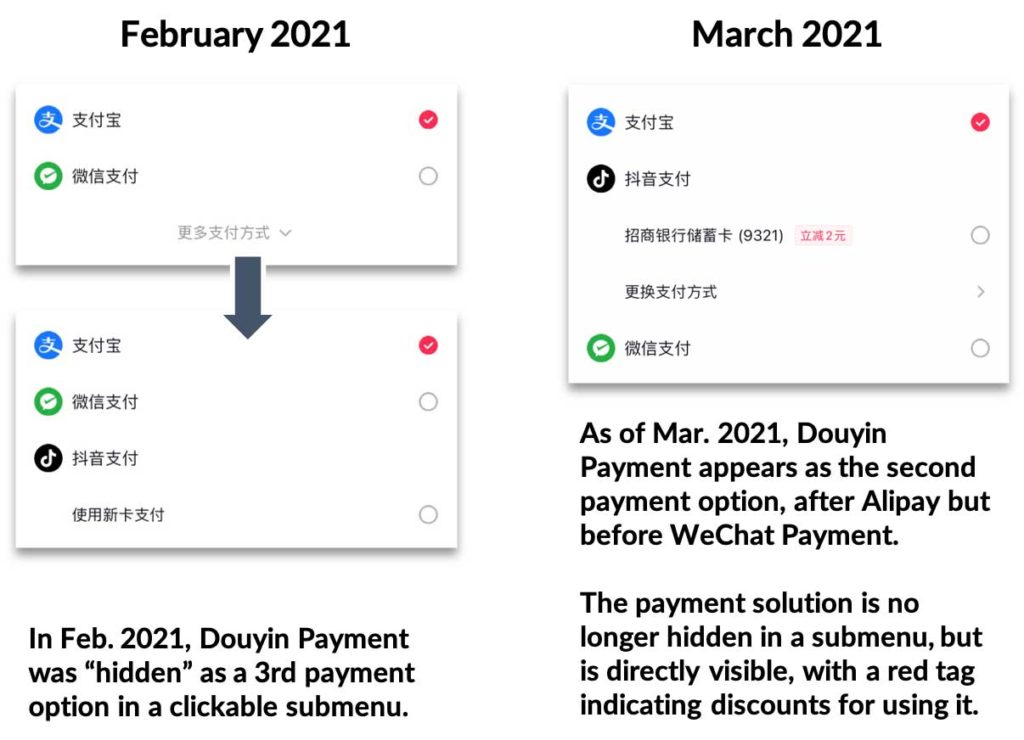

As of the 29th of March 2021, Douyin Payment appears as the 2nd recommended payment method on Douyin, below Alipay and above WeChat Payment.

After linking their bank card with Douyin, users can complete payment by entering a 6-digits payment code.

How is Douyin payment promoted?

The latest payment solution is promoted via a 2 RMB (~0.3 USD) incentive during the check-out. Although the amount can seem small, most of the purchases on Douyin stores fall in the 5 to 100 RMB range. 2 RMB can therefore represent a significant discount.

This tactic is reminiscent of the WeChat Payment launch in 2014. During Chinese New Year, WeChat delivered 1.2 billion envelopes worth on average 0.4 RMB (0.06 RMB) each. Despite the small amount distributed to each user, the campaign gave an incentive to millions of Chinese users to link their bank card with WeChat Pay.

As of now, even after users linked their bank account to Douyin, Alipay is still offered as a default payment method, with Douyin appearing as the second option.

However, Douyin is more and more determined about pushing its own payment solution. In January, Douyin Payment was less apparent in the payment interface, hidden in an “Other payment methods” submenu.

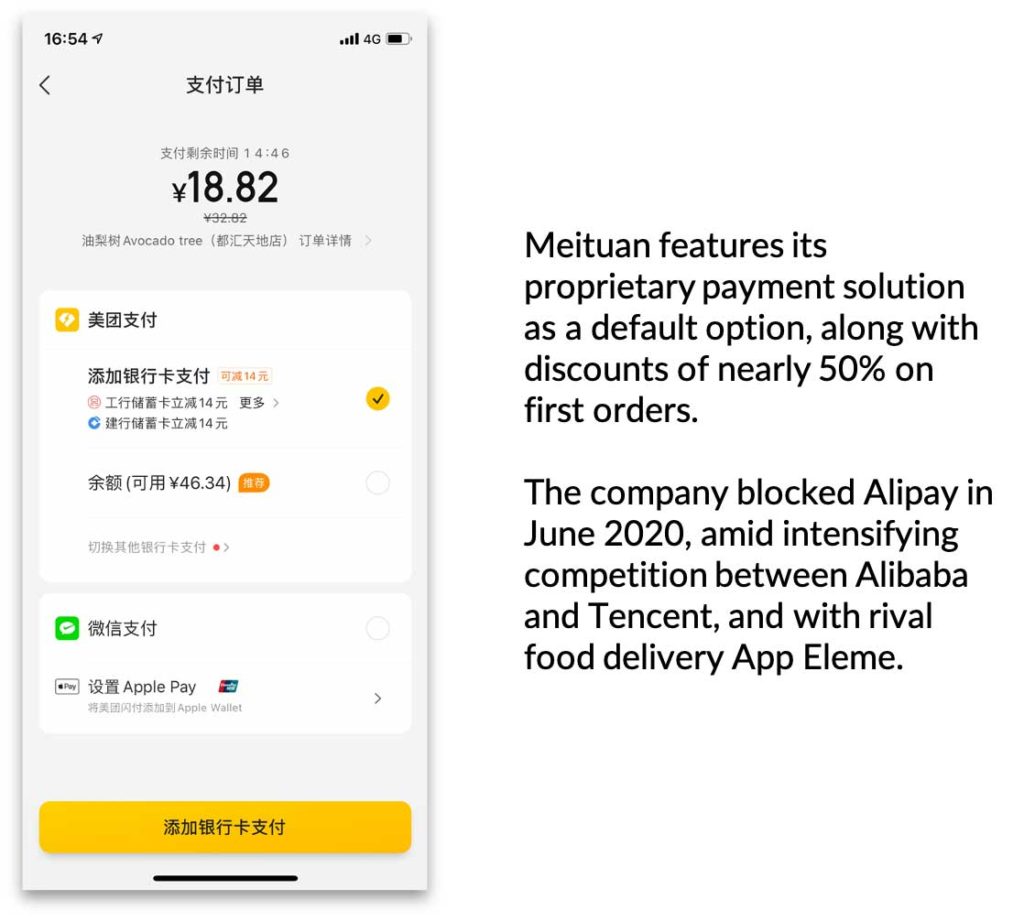

A similar strategy was used by services & food delivery App Meituan, which features its proprietary payment method as the default option, along with a discount of almost 50% on first orders.

We can expect Douyin Payment to become more and more prominent in months to come, most likely becoming the default payment option for users buying on Douyin.

Douyin’s aggressive move in e-commerce

Back in 2019, Douyin and Alibaba stroke a 7 billion RMB deal to support social content and Douyin’s e-commerce ecosystem. Back then Douyin was one of the main video traffic sources for Taobao products. This friendly collaboration between Bytedance and Alibaba didn’t last long: in October 2020 Douyin blocked Taobao and JD store links from Douyin live-streaming. Users could only purchase from the native Douyin stores.

For now, Douyin videos can still link to Taobao products. As Douyin stores become more popular, Douyin might block all links to 3rd party e-commerce platforms.

According to LatePost, Douyin achieved e-commerce GMV (Gross Merchandise Value) of over 500 billion RMB in 2020, 3 times more compared to 2019. Douyin’s e-commerce GMV goal for 2021 is over 1 trillion RMB. Douyin Payment is naturally an important part of ByteDance’s master plan.

Challenges ahead for Douyin Payment

Although Douyin Payment benefits from the large and active user base of its parent company Bytedance, significant challenges lie ahead competing against the Alipay-WeChat Payment duopoly.

Alipay benefited from being part of the largest e-commerce platform in China, while WeChat benefits from being the center of Chinese users personal social interactions. Douyin isn’t as strong in either area.

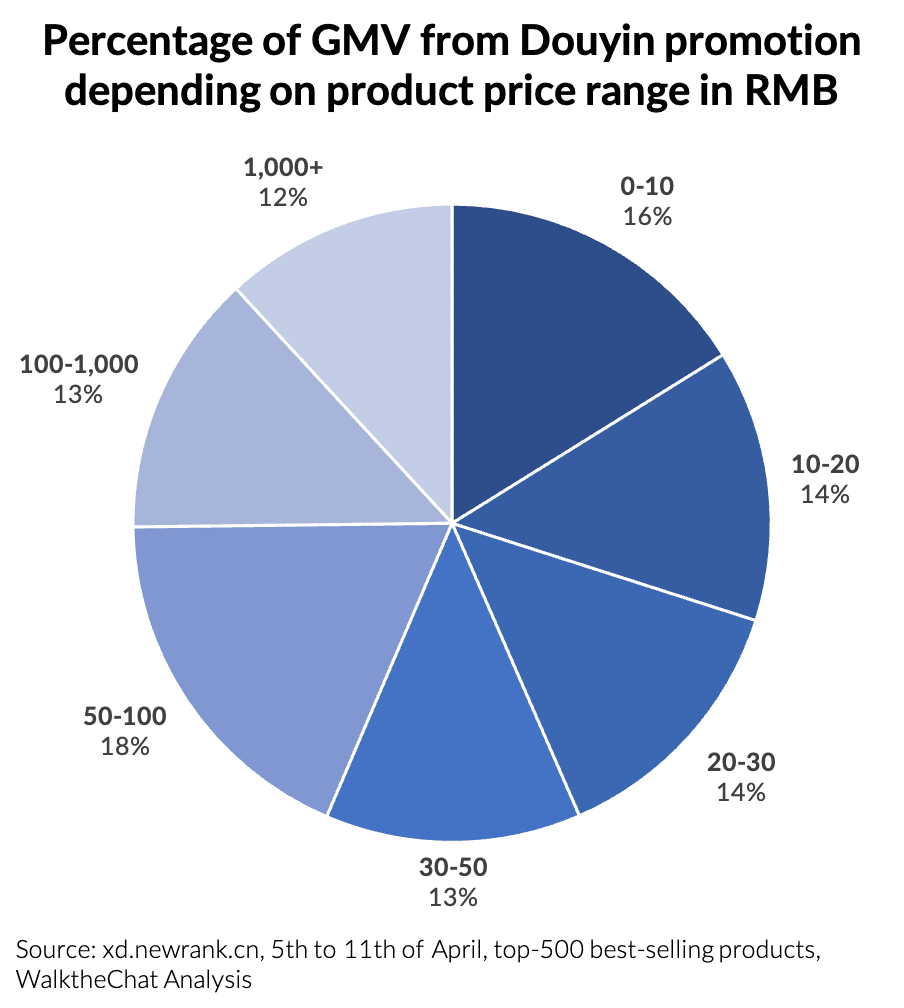

Although Douyin is becoming an increasingly popular channel for e-commerce promotion, the value of products sold on the platform is extremely low. During the week of the 4th to the 11th of April 2021, the average value of products sold on Douyin was 27 RMB (4.2 USD).

75% of GMV from Douyin promotions comes from products below 100 RMB, and only 12% comes from products above 1,000 RMB. In fact, among the top-500 best-selling Douyin products, only one of them is priced above 1,000 RMB (a phone from Xiaomi).

Conclusion

Douyin is the new force in the Chinese social media system, and its new payment method will not go unnoticed.

However, ByteDance is fighting an uphill battle in a market already dominated by WeChat and Alipay. Douyin’s positioning on the very low end of the e-commerce market will make it harder to turn Douyin Payment into a serious contender against entrenched competitors.