The COVID-19 epidemic is deeply affecting companies across the globe. However, China is already way past the peak of the outbreak. What can Western brands learn from the experience of Chinese companies over the past few months?

Three phases to the epidemic: Peak, Recovery and Bounce Back

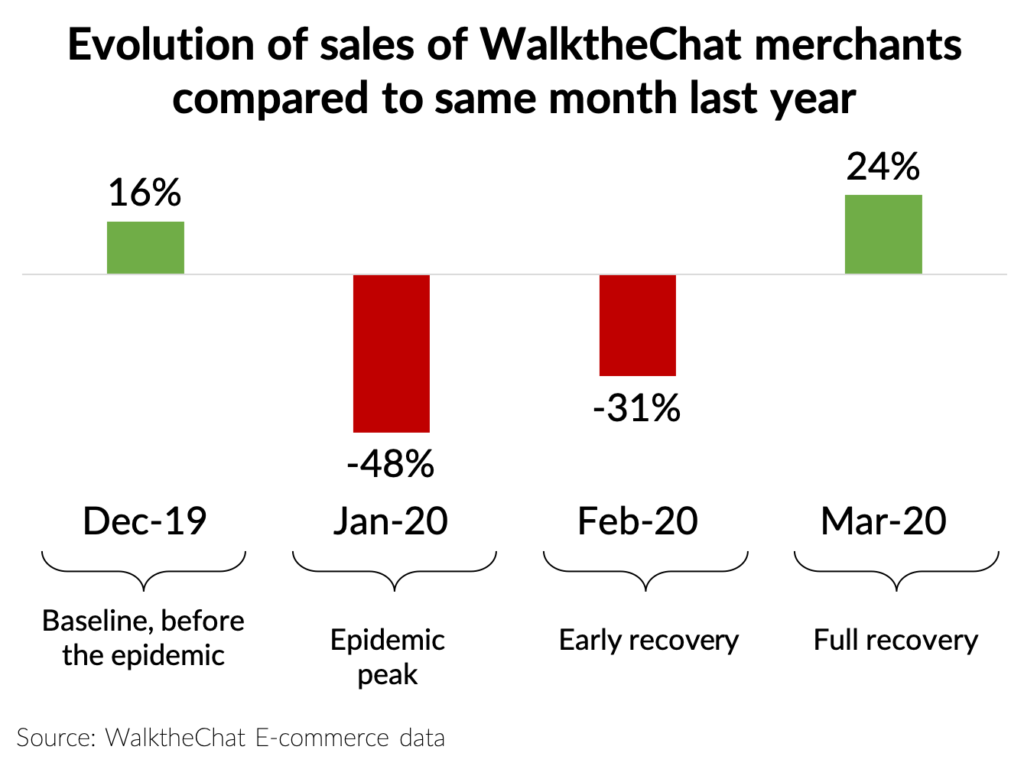

The peak of the epidemic in China was reached between the middle of January and the middle of February. As early as March, customer confidence increased, and e-commerce sales bounced back.

To better understand how various Chinese companies reacted to the crisis, we will divide the epidemic response into 3 phases:

- Phase 1: Peak. Customers are feeling strong anxiety about the future. Business and people’s livelihood are heavily disrupted

- Phase 2: Recovery. The situation improves rapidly. Business is still disrupted, but people are confident about the future

- Phase 3: Bounce back. Business is back to normal. People consume heavily to compensate for previous anxious times

Phase 1: peak

During the first phase of the epidemic, most Chinese companies tried to show empathy and support, rather than emphasizing profits.

Amid the outbreak, UNIQLO managed to win the heart of Chinese users by focusing on supporting community and providing relevant health advice.

Instead of sending promotional messages, the company sent detailed instructions helping their readers remain safe.

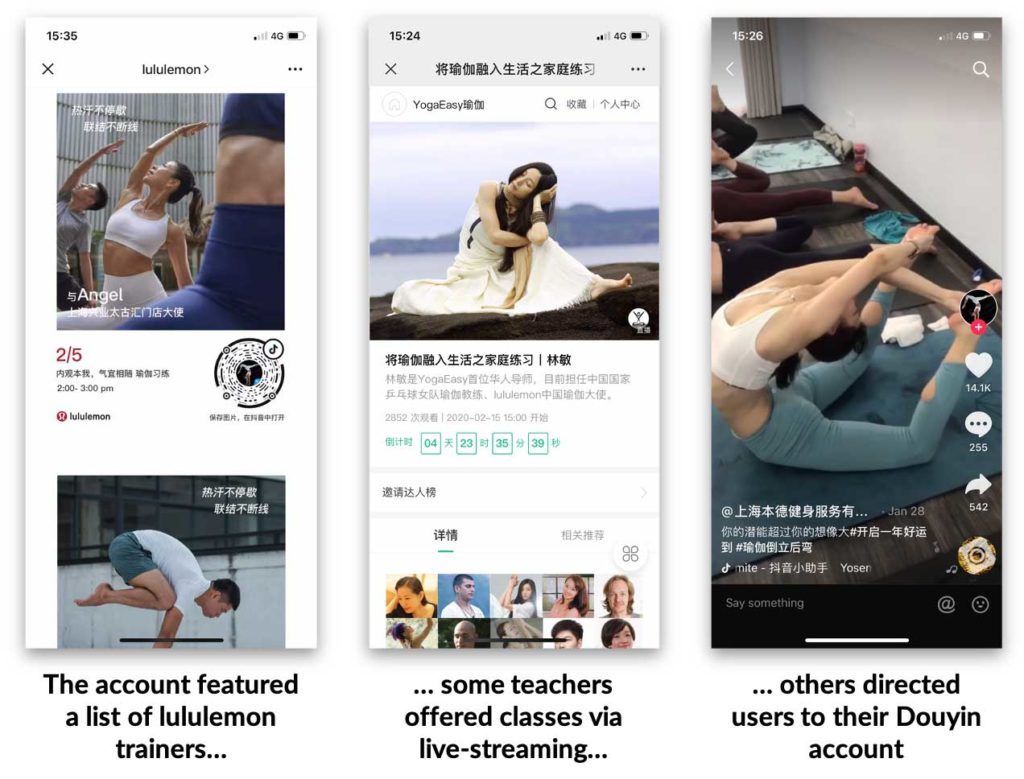

Lululemon managed to stay empathetic while providing a response in line with the company’s business. They did so by addressing a common concern of their followers: the need to remain active while stranded at home.

Lululemon offered free online yoga classes through the company’s in-house trainers. The WeChat Official Account of the brand featured a list of links to WeChat Live Streaming and Douyin Accounts that users could follow to design their home workout schedule.

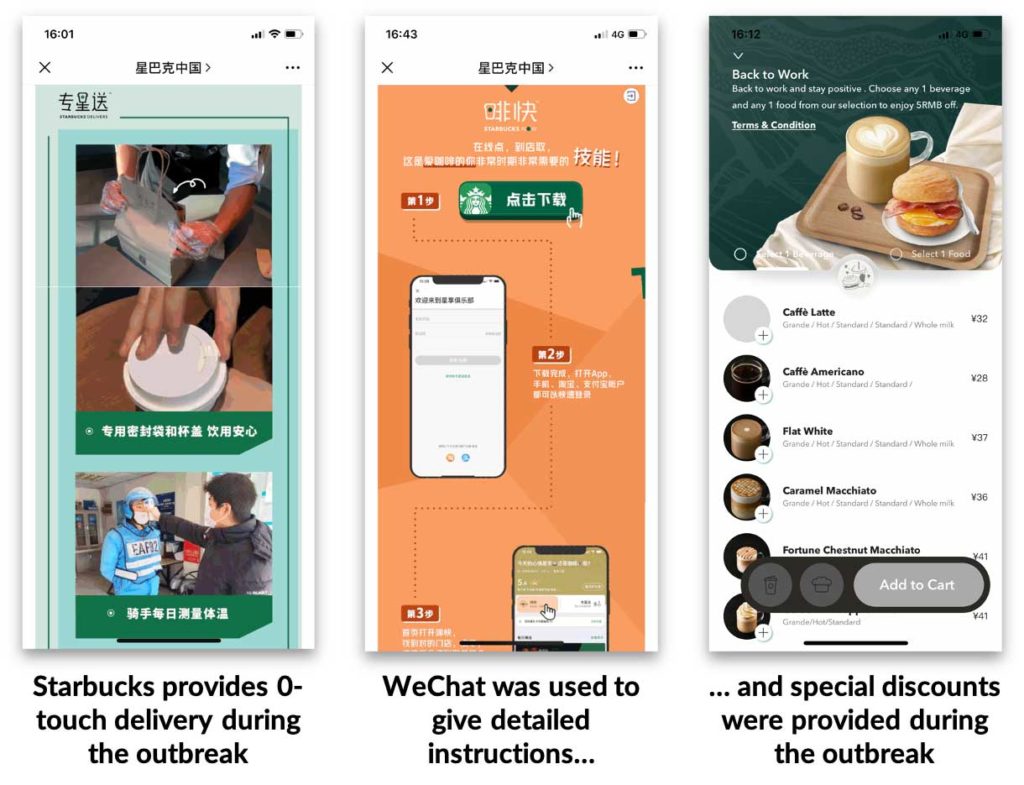

For other brands, supporting customers meant continuing to provide services. That’s the path that Starbucks chose: the company designed a new 0-touch delivery system that enabled online orders while ensuring maximal safety.

Because a lot of Starbucks customers were not accustomed to ordering online, the brand also offered detailed instructions on how to use the upgraded coffee delivery service.

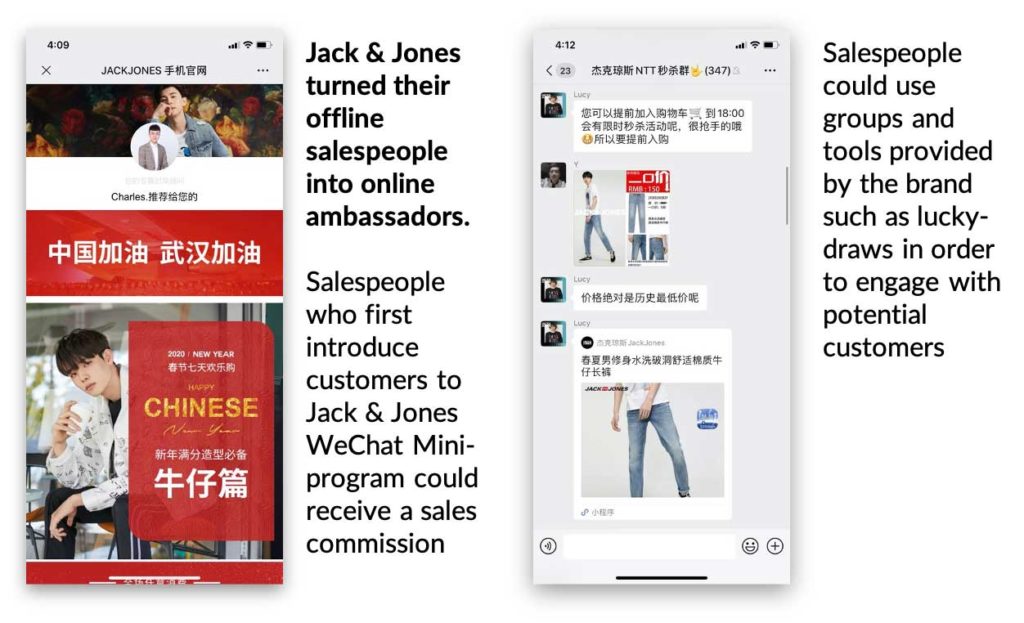

BESTSELLER (which owns brands such as Jack & Jones, Only & Vero Modo), took a more sales-driven approach. The Danish company decided to support both sales and employees by offering commissions to its salespeople who could help promote products via WeChat.

The commission-based Mini-program supported sales while providing a complement of revenue to employees during the crisis.

WeChat Mini-program sales boomed after the introduction of this commission-based incentive, quickly overtaking the brand’s offline sales during the beginning of the epidemic.

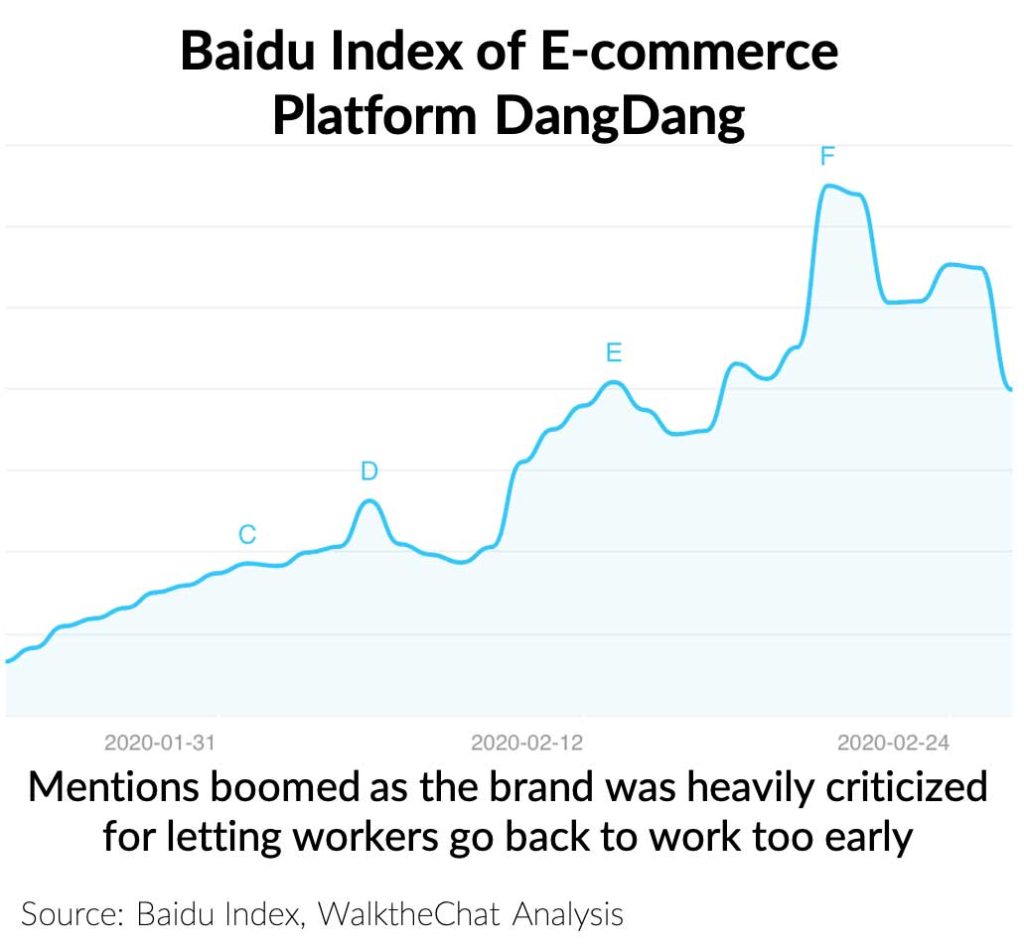

Not all Chinese brands did well managing the COVID-19 crisis. E-commerce platform DangDang called workers back to the office as early as the 10th of February, while it would have been possible for them to work remotely.

One of the employees contracted the coronavirus, forcing 82 of her colleagues to be quarantined as close contacts, and causing a large amount of negative PR for the brand online.

Phase 2: recovery

During the second half of February and the month of March, the health and economic outlook in China improved and a lot of brands started to look into more sales-driven strategies.

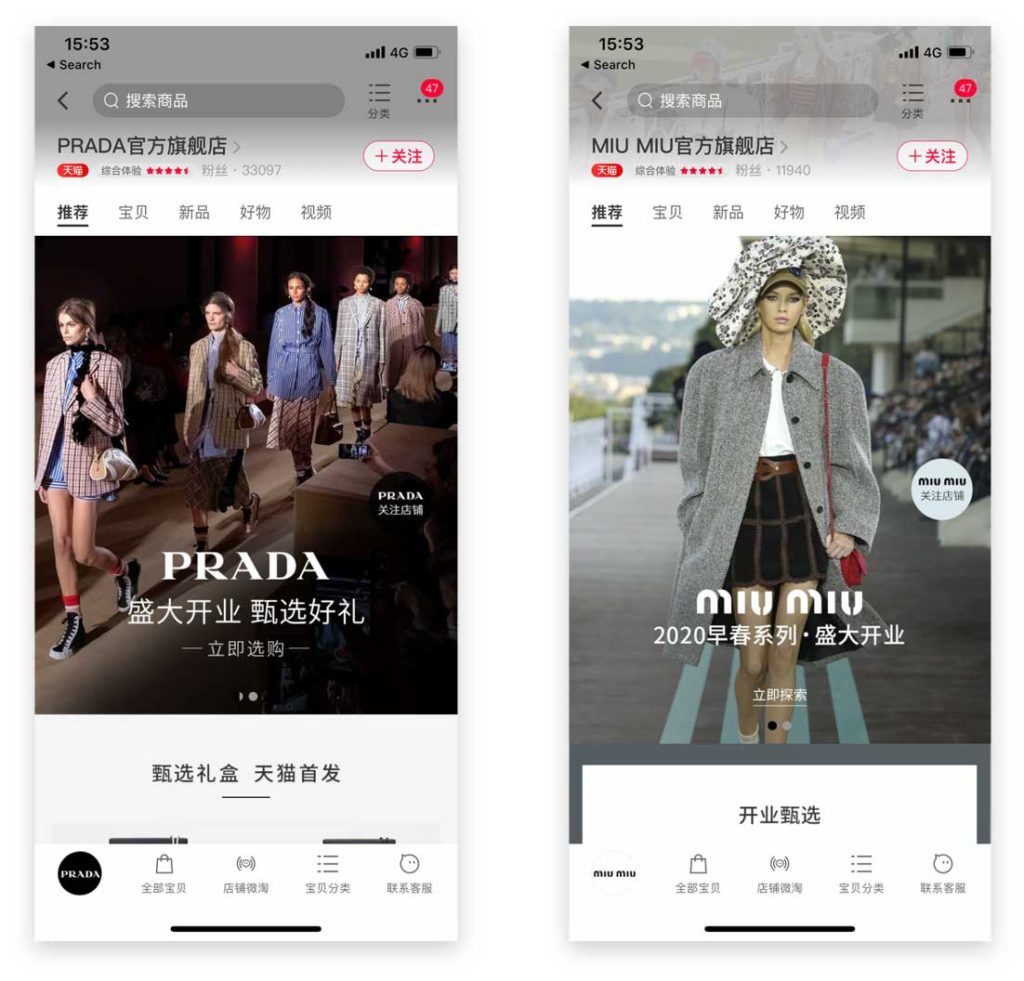

Things were not back to what they were before though. Offline-focused brands such as Prada had to look for new online solutions.

The Prada Group launched two flagship stores on Tmall within 10 days: on the 14th of March for the brand Prada, and on the 24th of March for Miumiu. The two stores respectively gathered 47,000 and 24,000 followers within a couple of weeks after launch.

Other brands that launched their Tmall store during the epidemic include IKEA, BMW and Nuda Beauty.

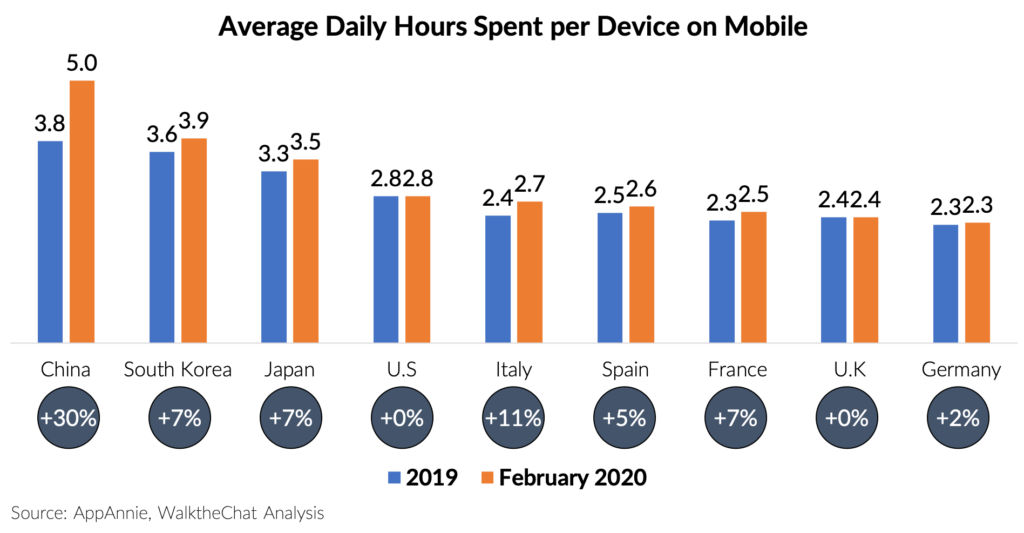

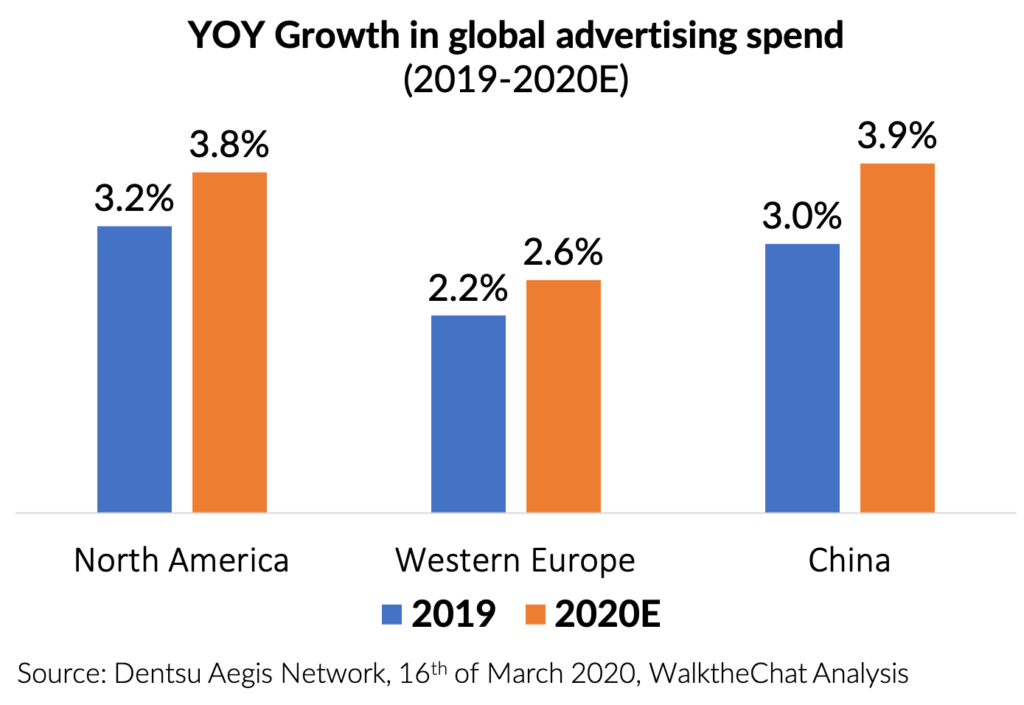

The COVID-19 also caused, predictably, an increase in online engagement from Chinese users.

As brands are unable to reach customers offline, additional budgets were directed towards online acquisition.

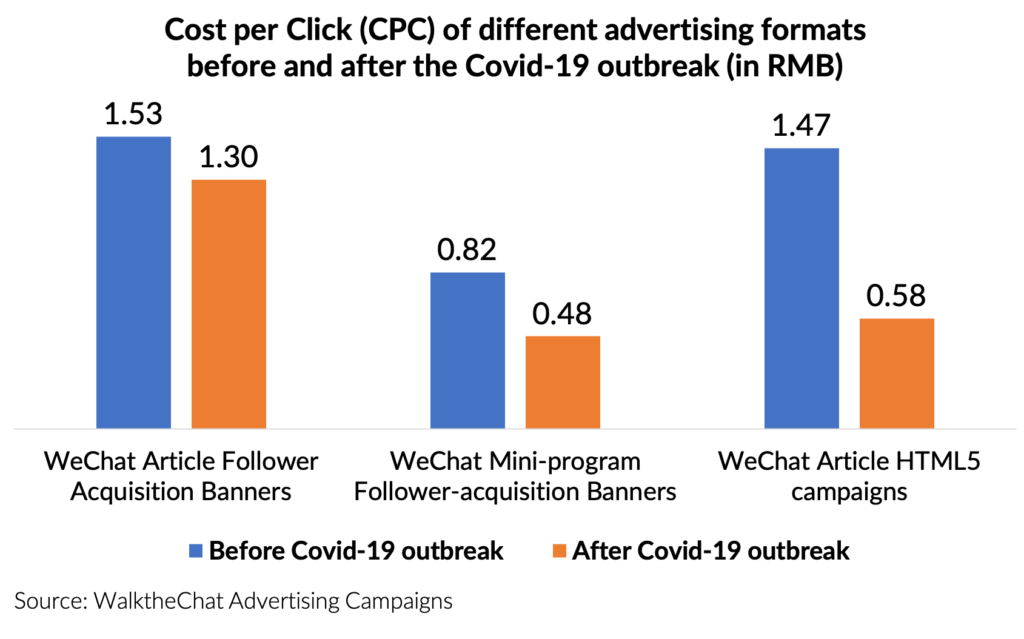

The additional time that users are spending online compensates for the increase in advertising demand. Overall, the cost of online advertising has decreased dramatically after the COVID-19 epidemic.

Many brands have leveraged this lower cost of user acquisition in order to grow their follower base during this recovery period.

Phase 3: bounce back

As daily life returns to normal or to the “new normal”, customers feel relief and spending increases sharply.

This the trend expected in China in the coming months, especially during the upcoming shopping festivals. Brands are already preparing for June 18th, one of the largest Chinese shopping holiday.

A lot of brands have already anticipated this uptake in sales, and large influencers are already fully booked well into the month of May.

In order to prepare for the upcoming festivals, brands can:

- Invest in followers acquisition, leveraging the lower cost per follower

- Collaborate with micro-influencers via product gifting in order to increase the number of mentions and reviews

- Book paid influencer campaigns early, as this sales season is expected to be particularly competitive

Conclusion

Companies in China have been exceptionally creative in order to support both their followers and their business during the toughest time of the epidemic.

Brands in other parts of the world can learn a lot from this experience, and apply it to their own market. In these special times, and for better or worse, the decisions taken by brands will make them stand out.