Amid the Covid-19 epidemic, Tencent released its Q4 2019 results.

The performance is overall good, with a large uptake of Mini-program transactions and revenues from FinTech sector.

A service ecosystem moving toward Fintech

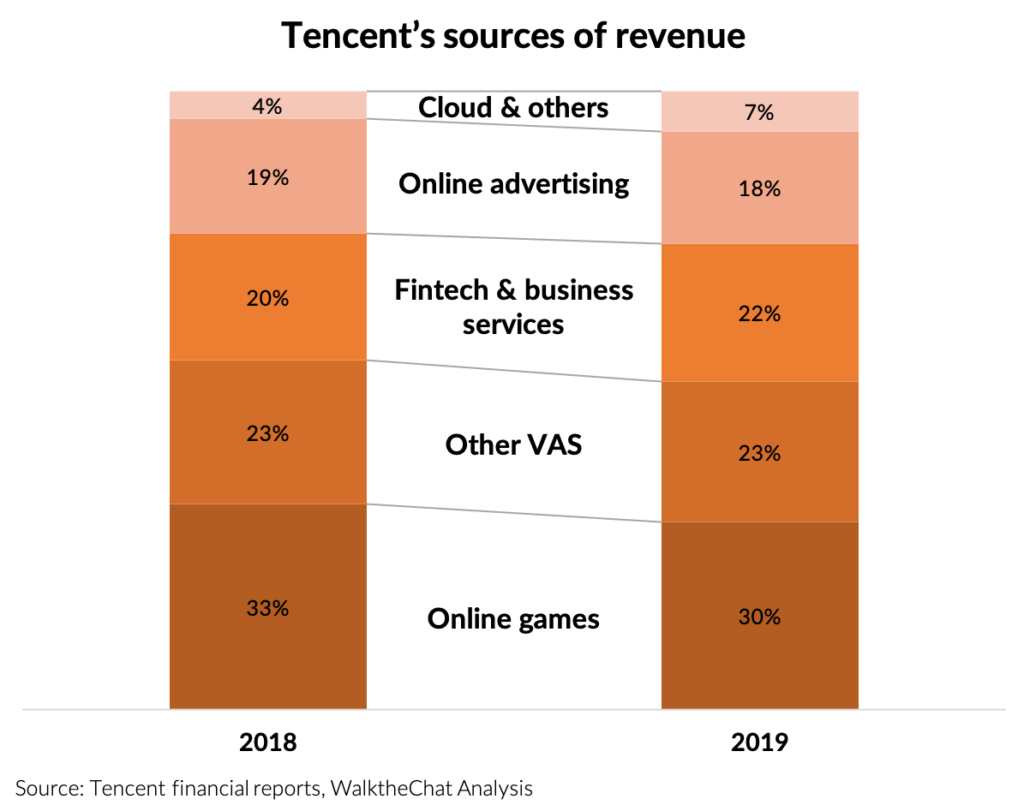

Tencent seems determined to stand out among Tech giants. It definitely doesn’t want to be an advertising company and is even diversifying away from gaming revenues.

Instead, Tencent seems to have two main goals:

- Becoming an ecosystem of service, leveraging the ubiquity of WeChat and WeChat Mini-programs

- Driving revenues from FinTech products, leveraging the strength of WeChat Payments.

And this strategy seems to be working: WeChat mini-programs generated more than 800 billion RMB of transaction in 2019.

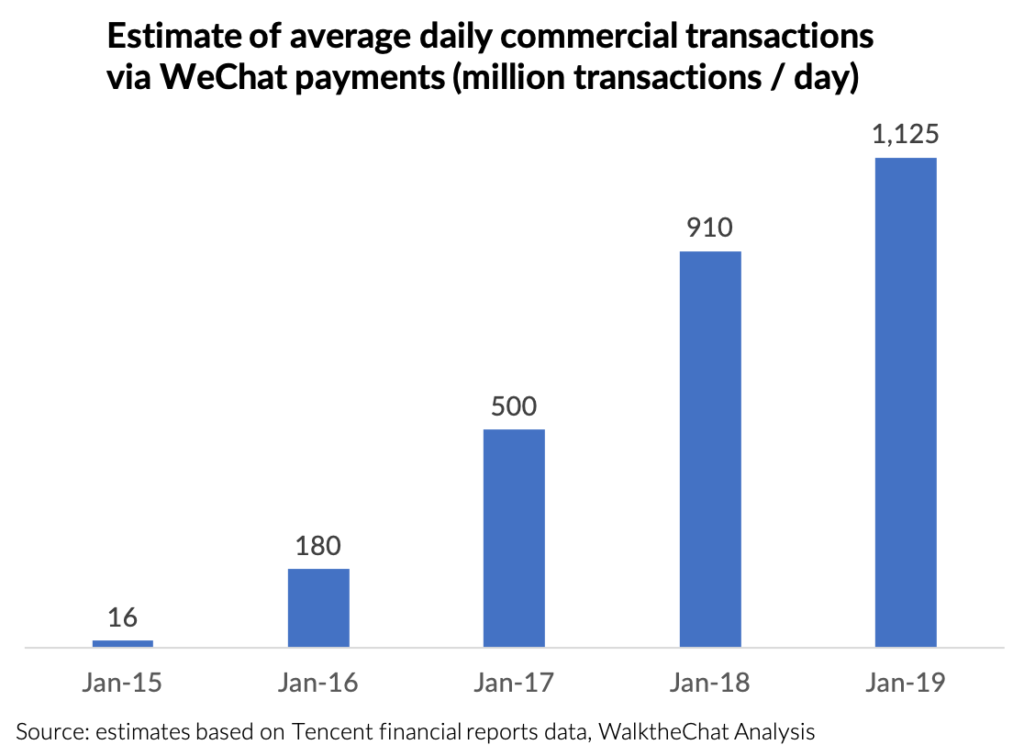

WeChat Payment is also booming: the number of commercial transactions exceeded 1 billion WeChat Payment commercial transactions/ day during Q4 2019, covering 800 million monthly active users and 50 million merchants.

WalktheChat estimates that WeChat Payment daily commercial transactions grew 290% YOY, from 16 million transactions/ day in December 2015 to more than 1 billion transactions/ day in December 2019.

Tencent indeed seems to be moving to a more and more diversified business model.

Between 2018 and 2019, online advertising decreased from 19% to 18% of revenues, online games decreased from 33% to 30% of revenue, while FinTech grew from 20% to 22%, and cloud services grew from 3% to 5% of total revenue.

Tencent is increasingly growing into a diversified company with a strong service and FinTech vertical.

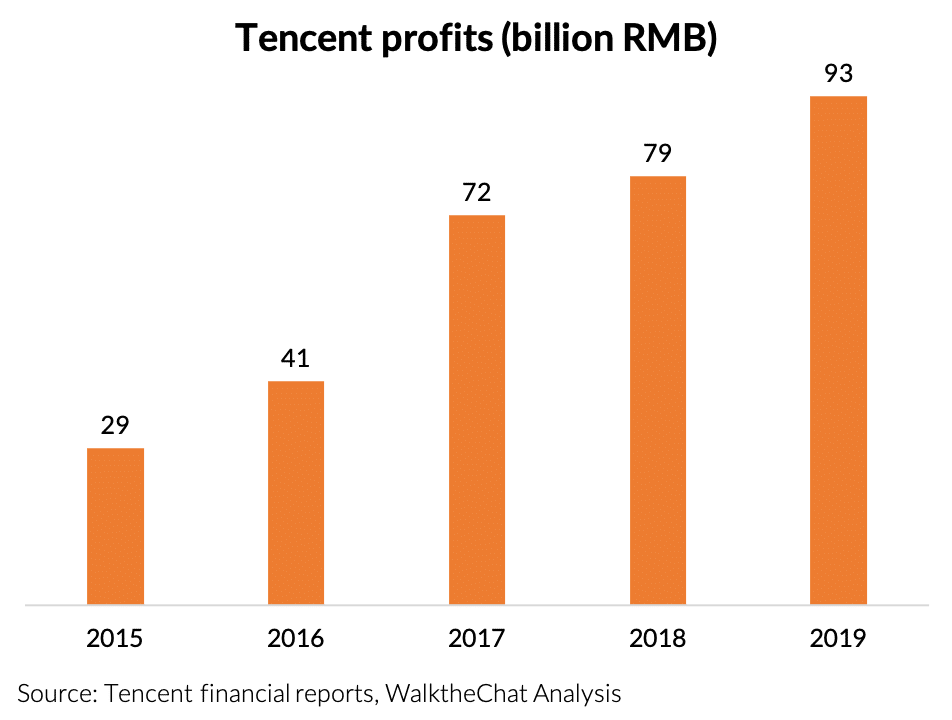

Steady growth of revenue & profits

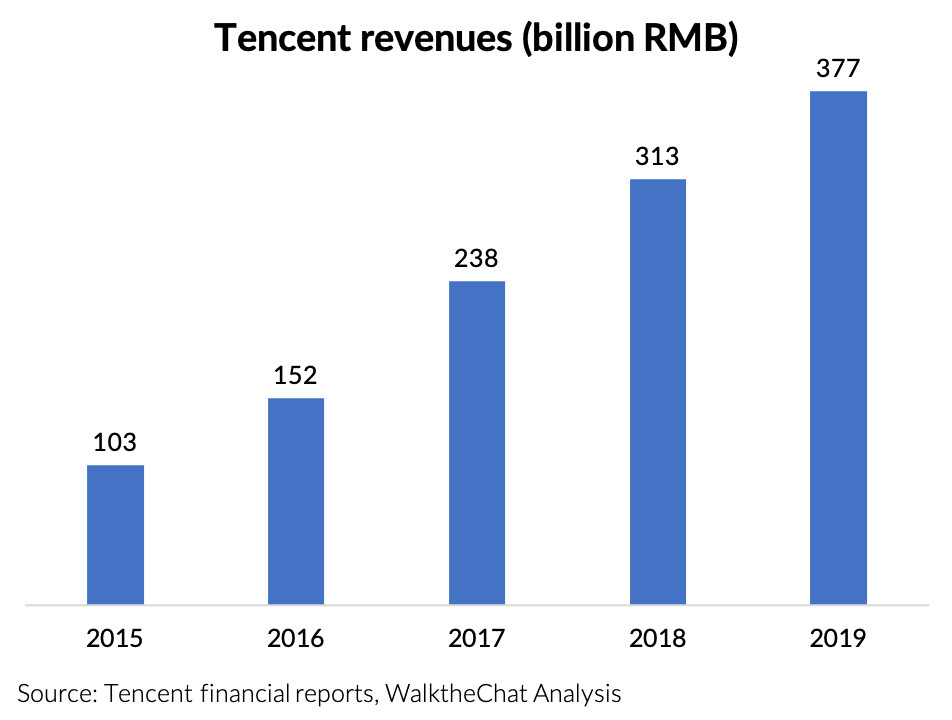

Tencent reported robust revenue growth of 21% year-on-year to 377 billion yuan (US$54 billion).

Profits grew even faster, at a 22% YOY rate, reaching 93 billion RMB.

But Tencent stock still fell 5.1 % as the company reported lower-than-anticipated net income of $3.1 billion, below estimates of $3.66 billion.

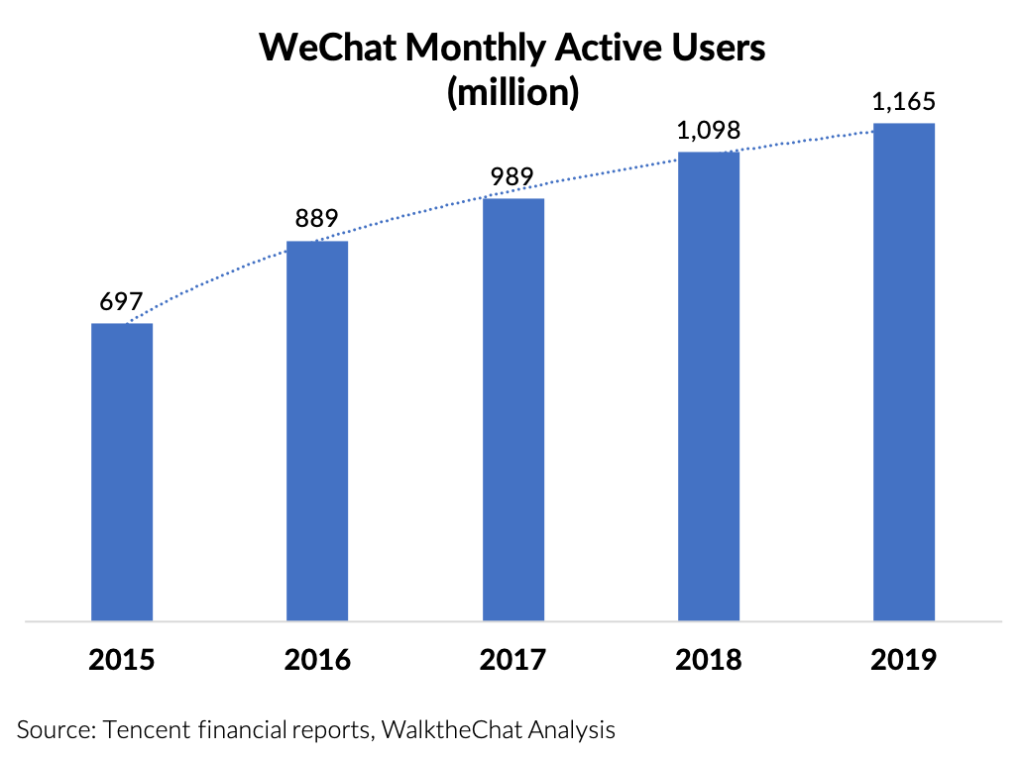

Continued growth of WeChat MAU’s

WeChat Monthly Active Users (MAU’s) kept growing at a 6.1% YOY growth rate, reaching 1,164 million. However, growth is slowing down for WeChat.

Tencent also reported that the number of WeChat messages sent during Q4 increased by 15% over year.

Although encouraging, this statistic also shows that Tencent is worried about the decelerating growth of WeChat. They are therefore looking for more “positive” metrics to report on.

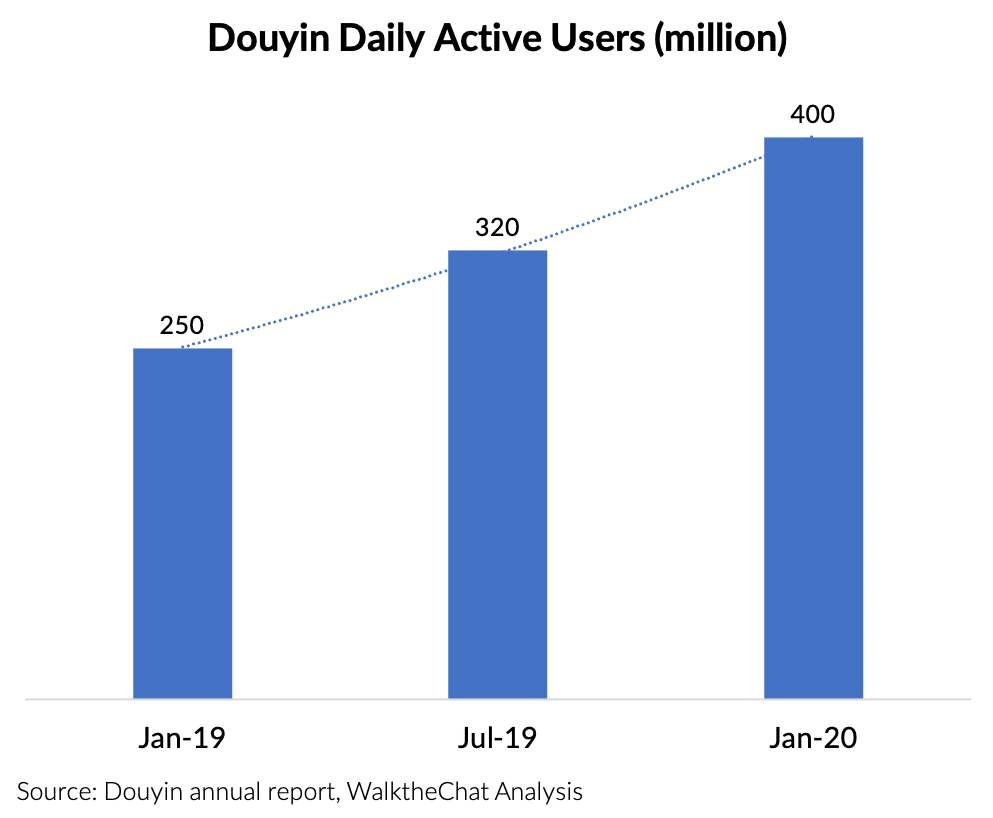

These figures are especially low when compared to Douyin’s performance. ByteDance’s short-video App grew its Daily Active Users (DAUs) by 60% within a single year, reaching 400 million Daily Active Users.

Although the reach of Douyin is still more limited than that of WeChat, it is getting dangerously close.

Winning the ecosystem battle, losing the user-attention war

Tencent seems to have won the battle of developing an ecosystem used by 50 million merchants across most industries. From making payments to booking flights or buying movie tickets, WeChat is the one ubiquitous App of China.

This ecosystem is however based on one important fact: that mobile users in China should spend a significant amount of time on WeChat. As attention seems to be shifting away from Tencent and toward ByteDance, this ecosystem could very well slip away from WeChat’s grasp.

WeChat has created significant barriers to entry for new competitors, and Douyin will have to overcome the network effect of social and payment in order to beat WeChat. Tencent should, however, remain vigilant. Its number one App is not as unbeatable as it was just a couple years ago.