Kuaishou and Douyin are the two largest short-video platforms in China. However, due to the difference in their audience demographics, the 2 platforms have evolved quite differently:

- Kuaishou has 3-5 times higher e-commerce conversion rates compared to Douyin

- Kuaishou is more likely to evolve as a closed e-commerce ecosystem while Douyin signed a strategic partnership with Taobao

- Kuaishou’s is more social-driven while Douyin focuses more on algorithmic recommendations

- Kuaishou is less popular for brands to advertise on, while Douyin’s main revenue source is advertising

Size & demographic

Kuaishou just released its latest performance report this week:

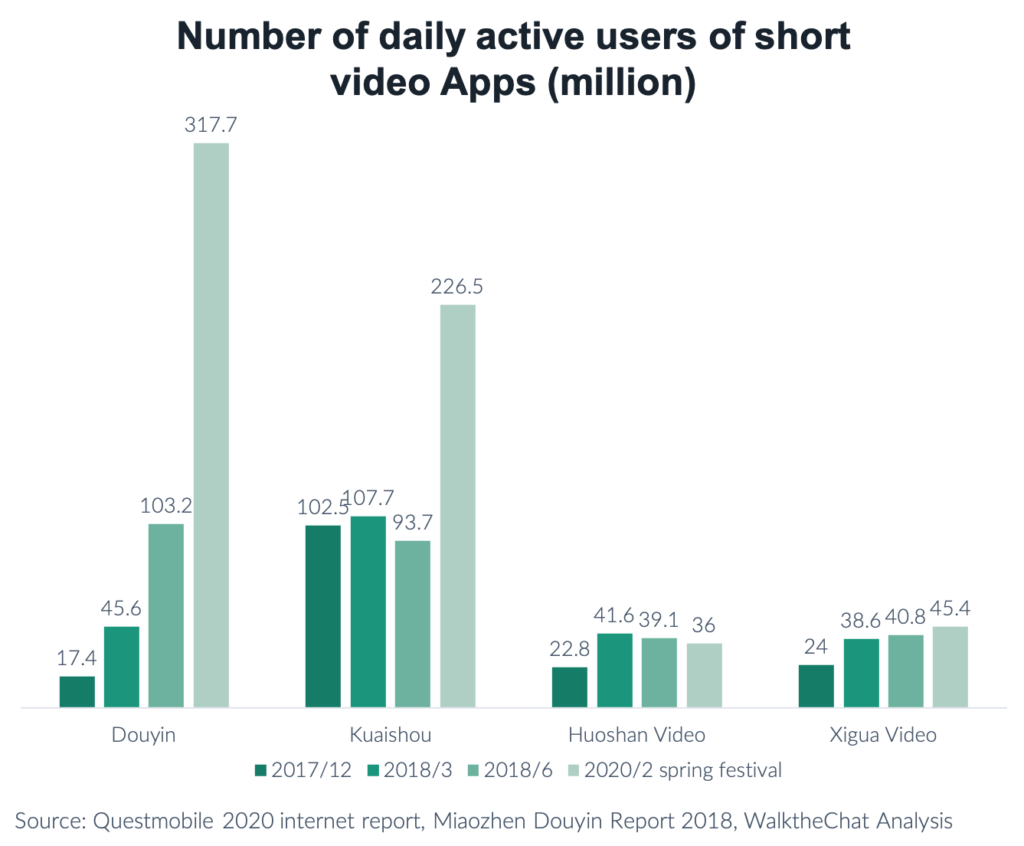

- Daily Active User (DAUs) reached 300 million

- Kuaishou stores over 20 billion videos, the largest short-video library in the world

Comparatively, Douyin has a larger audience, with 400 million DAUs as of Jan 2020.

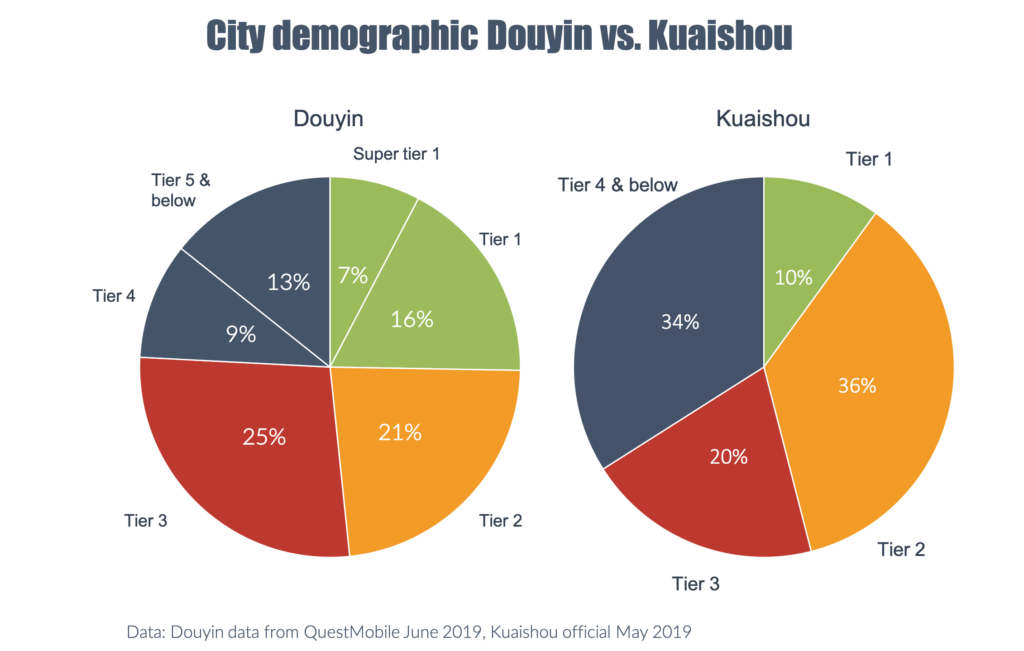

The major difference between Douyin and Kuaishou is the user demographic. 24% of Douyin users come from tier 1 cities, against only 10% for Kuaishou. Kuaishou has 34% of its users coming from Tier 4 cities or smaller, against only 22% for Douyin.

This difference in the user profile is the key difference between Douyin’s and Kuaishou’s social engagement, e-commerce conversion, and advertising potential.

Kuaishou’s strong focus on social engagement

Relationship-based vs. algorithm-driven content distribution

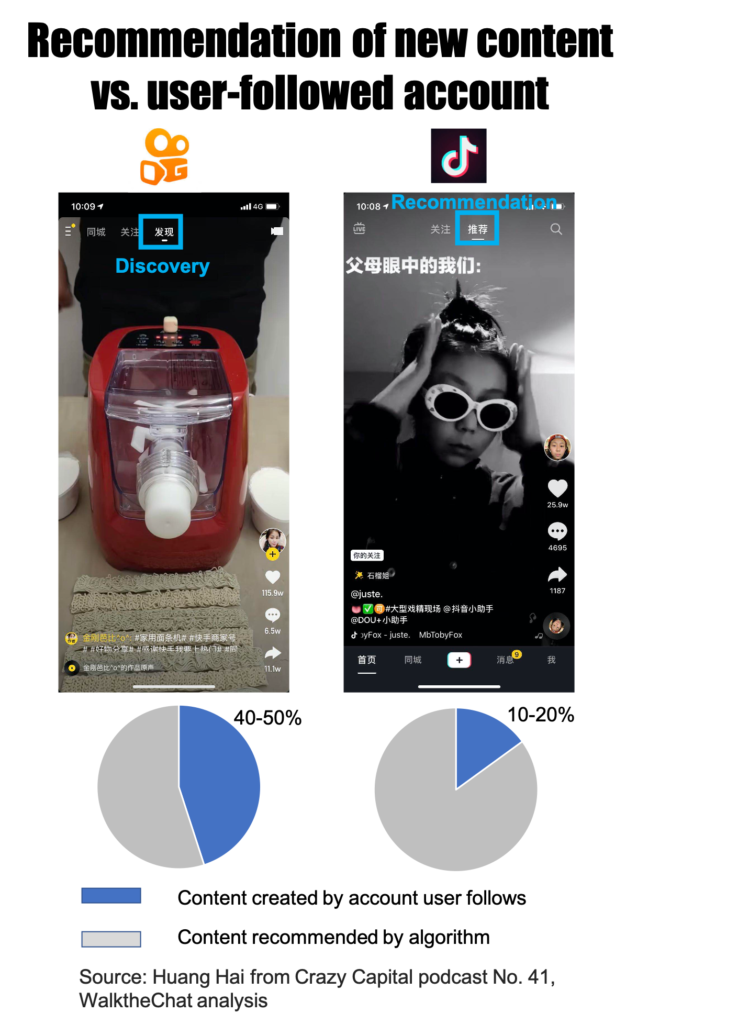

According to Huang Hai, from the VC firm Frees Fund, Kuaishou’s main “Discover” section distributes 40-50% of content from accounts that the user already follows. In contrast, Douyin will show 80 to 90% of content from new accounts which are popular among other users.

Douyin has more users living in tier 1 and tier 2 cities. These users are more likely attracted to high-quality content. Thus Douyin will display the best and most viral content to entertain urban users. This also shows in its mission statement “record your beautiful life”. This emphasis on beauty translates to professional content with viral nature created often by top KOLs.

Kuaishou has more followers living in villages, with a tighter social circle. Mundane content created by someone who they might know offline is still interesting.

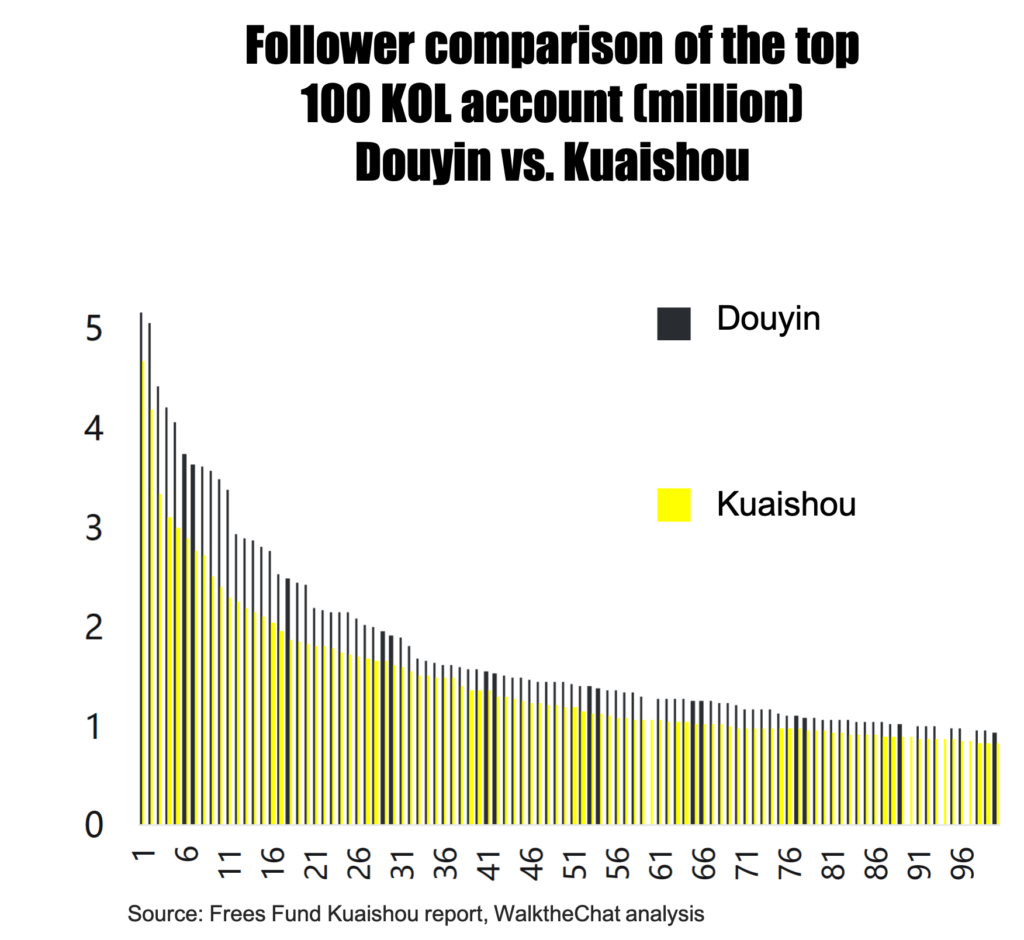

The graph below shows the number of followers that top-100 KOLs have on Douyin and Kuaishou. Kuaishou’s curve (yellow) is a lot smoother compared to Douyin’s (black).

Douyin puts a heavier weight on premium content distribution, so the top KOLs would get more traffic. Kuaishou distributes content more evenly among KOLs.

Thus users and smaller KOLs are more likely to upload content on Kuaishou since they are more likely to become viral. Kuaishou already has 20 billion videos uploaded, which makes it the largest short-video content platform (by the number of videos) in the world.

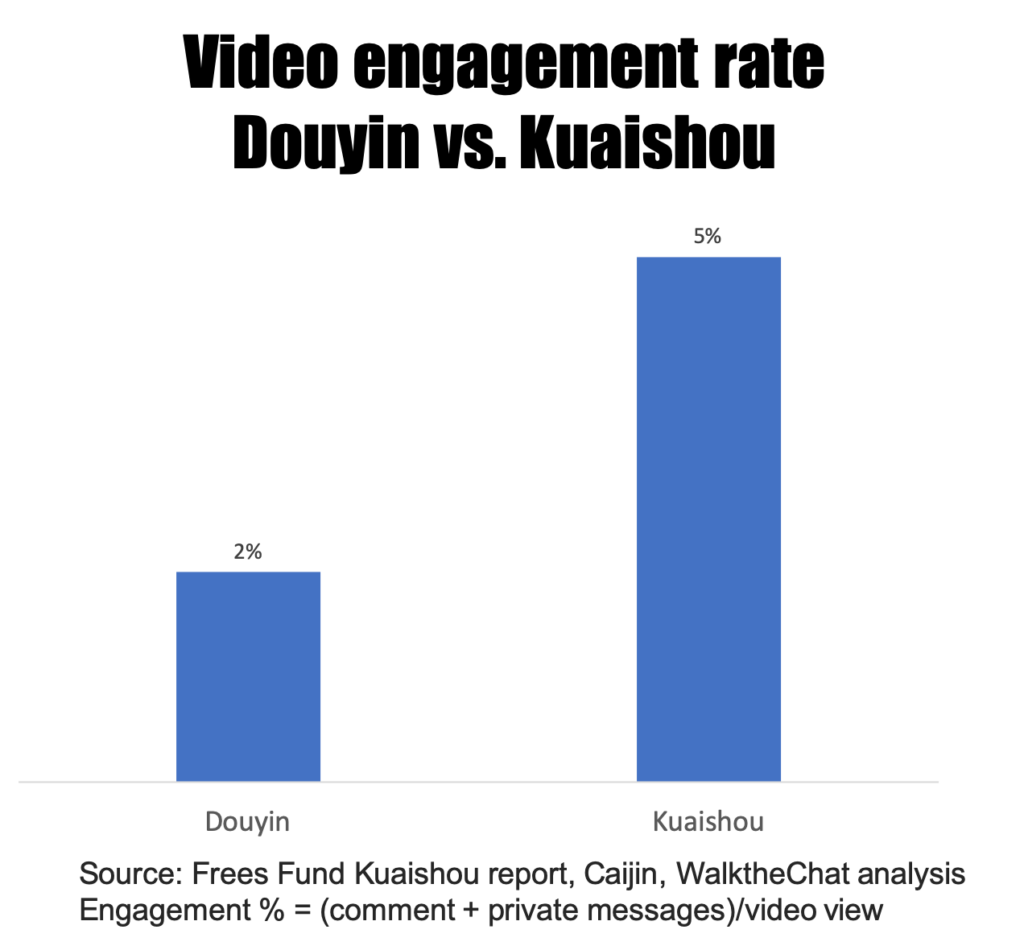

Engagement

Since Kuaishou users live in smaller communities, Kuaishou content is distributed based on users’ social relationships. The content on Kuaishou, therefore, has a higher engagement rate compared to Douyin.

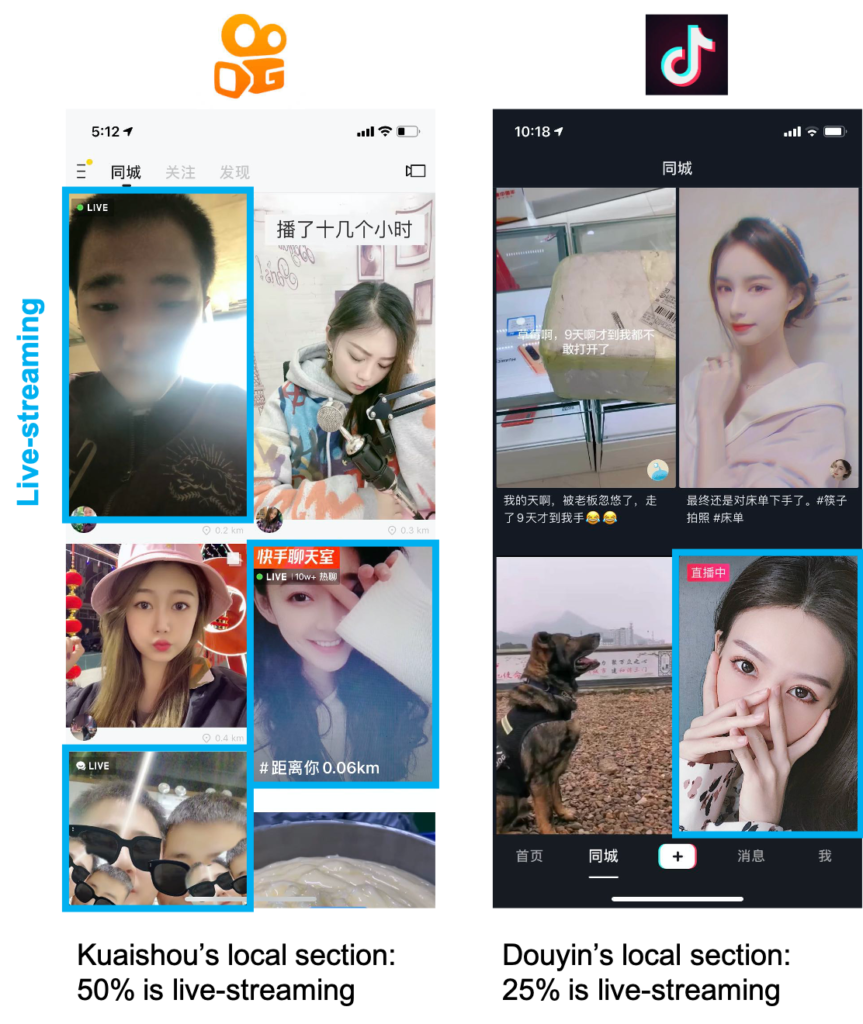

More live-streaming on Kuaishou

Kuaishou has 50% live-streaming content in its Local Content section, Douyin only has 25%. Kuaishou users are more likely to start or watch a live-stream.

The top-ranking live-streaming is often not the most popular one, and often only has less than 5 viewers. The viewers can thus engage with live-stream hosts on a more personal level.

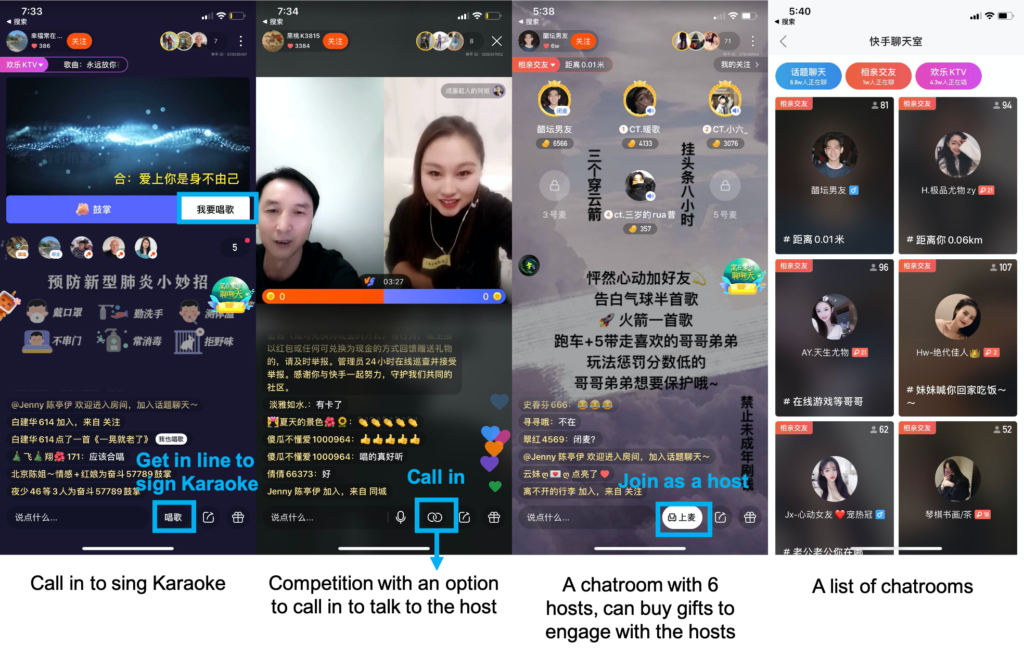

Kuaishou’s live-streaming has quite a lot of features. For example, you can sing Karaoke with the audience from your city listening-in. Many live-streaming hosts allow call-in to a chat room. Some live-streaming thus become a casual chatroom of 2 strangers.

Kuaishou even provides a chatroom for up to 6 users to co-host the live-streaming. Each chatroom has its own rule, often sending specific gifts in exchange for asking the host to give a performance (such as singing a song, sharing their personal WeChat account, or private messaging).

Such intimate engagement between the host and followers is driven by the social-driven recommendation system of Kuaishou.

E-commerce conversion

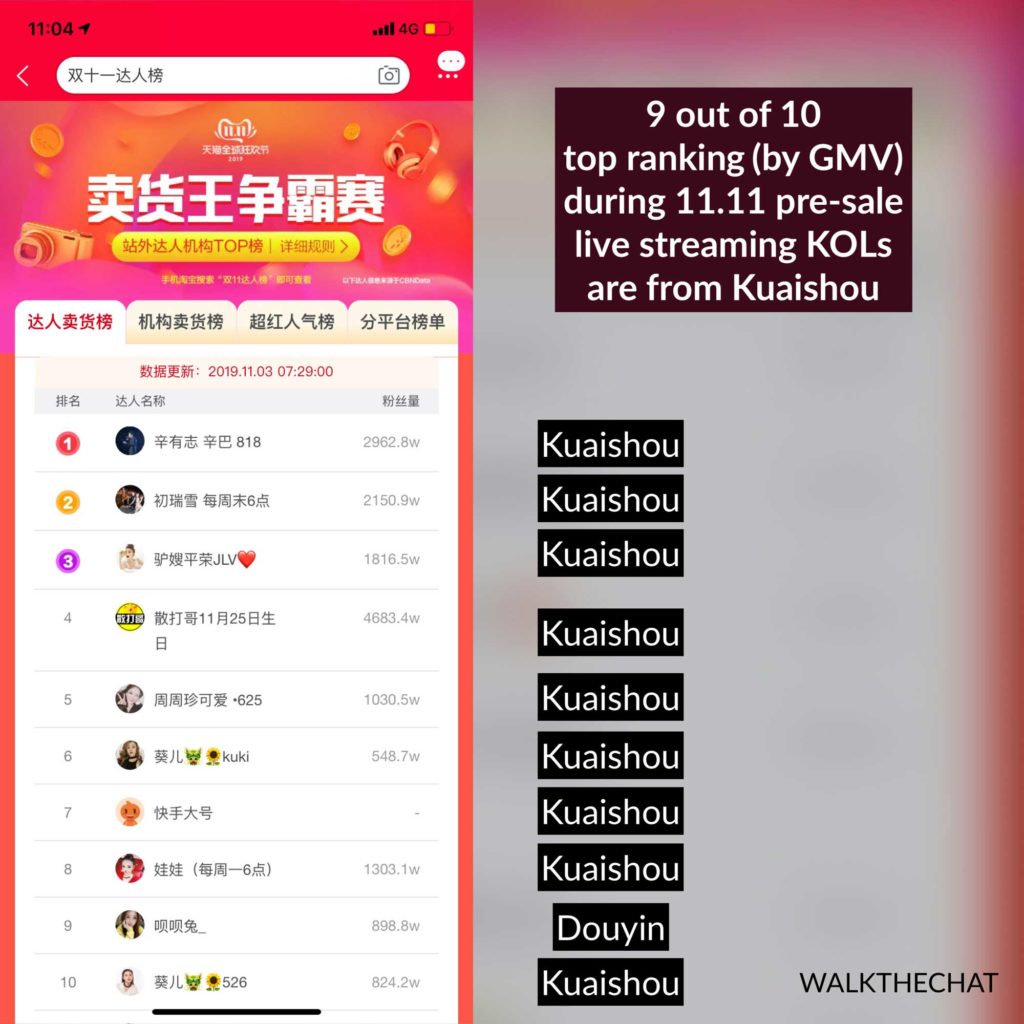

Kuaishou is a stronger relationship based platform, thus the e-commerce conversion rate on Kuaishou is higher than on Douyin.

According to Kuaishou Report by Frees Fund, Kuaishou’s e-commerce conversion is 5 to 10 times higher compared to Douyin. The monthly sales via the Kuaishou platform in 2019 reached more than 10 billion RMB.

For example, 9 out of 10 top-selling Taobao third-party live streaming during the Double 11 (excluding native live-stream from Taobao) last year were from Kuaishou. Only one of them was from Douyin.

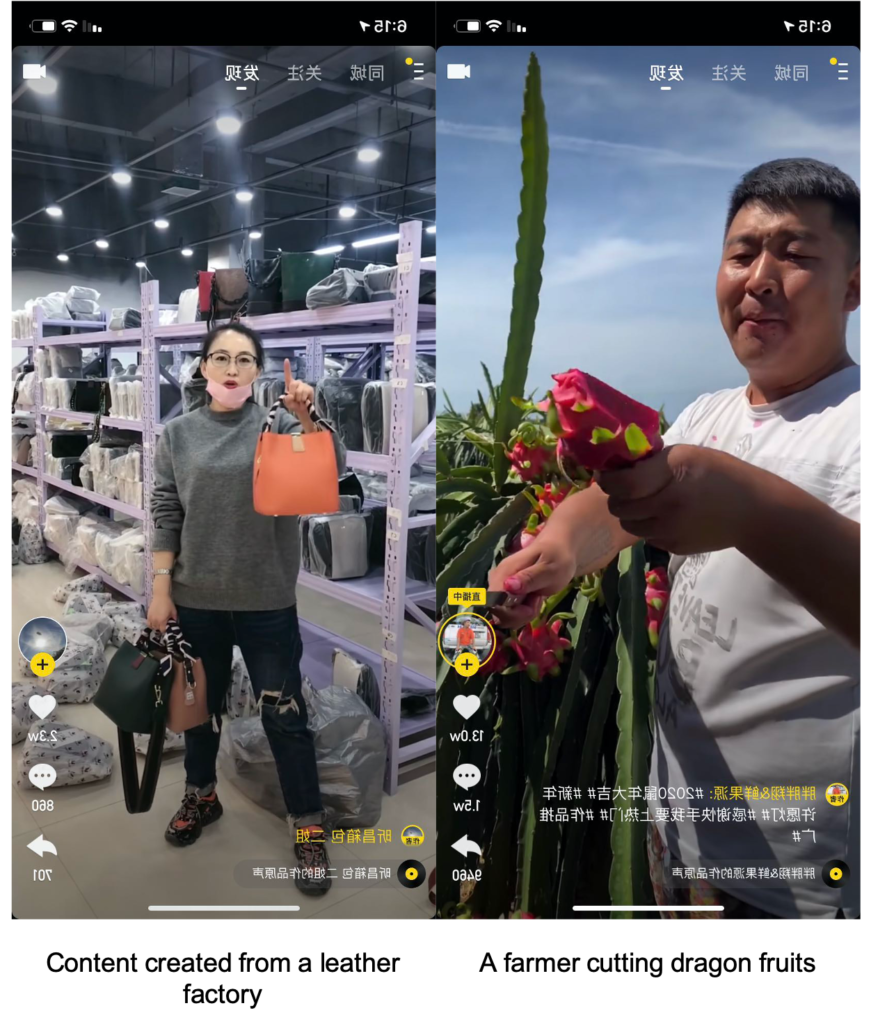

Many top-selling Kuaishou influencers are owners of small businesses or factories. They often create content related to their day to day business. For example, the production steps for packing a product. This type of content creates trust from the users, thus is more likely to convert into sales.

Not all kinds of products sell well on Kuaishou. The top 3 categories of products sold on Kuaishou are low-price cosmetics, clothing, and food.

Kuaishou is heavily pushing its built-in e-commerce system. It currently integrates with 6 e-commerce platforms and requires most platforms to share e-commerce data. According to the Kuaishou Report by Frees Fund, Alibaba refused to share purchasing data with Kuaishou. It’s likely Kuaishou will continue to develop its own e-commerce solution.

Kuaishou is blocking any content that tries to drive traffic to a third-party platform. For example, if a live-streaming host mentions his/her number to add on WeChat, it’s possible to shutdown live-streaming and penalize the host by limiting access to the live-streaming features for a certain time.

On the other hand, Taobao has signed a strategic alliance agreement with Douyin to spend 7 billion RMB in Douyin ads. Huang Hai from Frees Fund Capital suspects that, in return, Douyin will give up on its proprietary e-commerce infrastructure and focus on Taobao integration.

Kuaishou is weak in ads revenue

Despite the strong KOL e-commerce conversion, Kuaishou is weak in attracting display ads investment. The biggest category for Kuaishou ads is performance-driven ads such as gaming and App downloads.

According to Huang Hai from Frees Fund, in 2019, Kuaishou had around 10-15 billion RMB display ads revenue; Douyin made 50 billion RMB in ads revenue during the same period.

Conclusion

Kuaishou has stronger user engagement, more live-streaming content, stronger e-commerce conversion, more social features but is weaker in generating advertising revenue.

These differences create interesting opportunities for e-commerce players trying to pick the right platform to promote their products.

Reference: Crazy Captial Podcast ep 41:https://crazy.capital/41