According to Accenture, competition from PayPal, Alipay, WePay and the likes could reduce traditional bank revenues by one third by 2020. This phenomenon represents a major challenge to the banking sector, as one quarter of banks’ revenues are generated from processing payments. Let’s look deeper into it.

1) The Banking System: How banks make money?

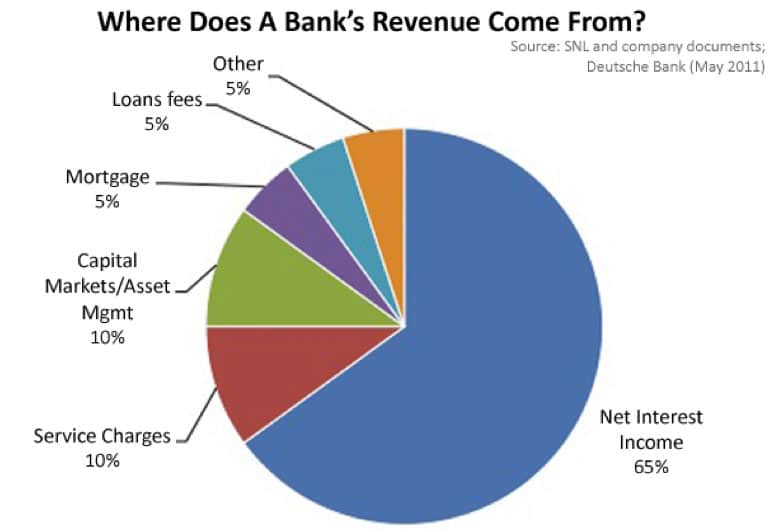

Let’s first have an overview of financial institutions and how they make money in order to understand why new payers in finance are threatening them.

When it comes to consumer banking, there are mainly two types of financial institutions: traditional banks (for-profit financial institutions) and credit unions (not-for-profit financial institutions). They both accept deposits, make loans, issue checks and ATM card, and offer investment services. However, the real difference between these two financial institutions is that credit unions can charge lower interest rates for most financial services and as a member-owned institution; they return surplus income to their members in dividends.

2) Who are the new players in finance?

Today, non-banks such as PayPal and Alipay are deploying new technologies to compete in the banking space.

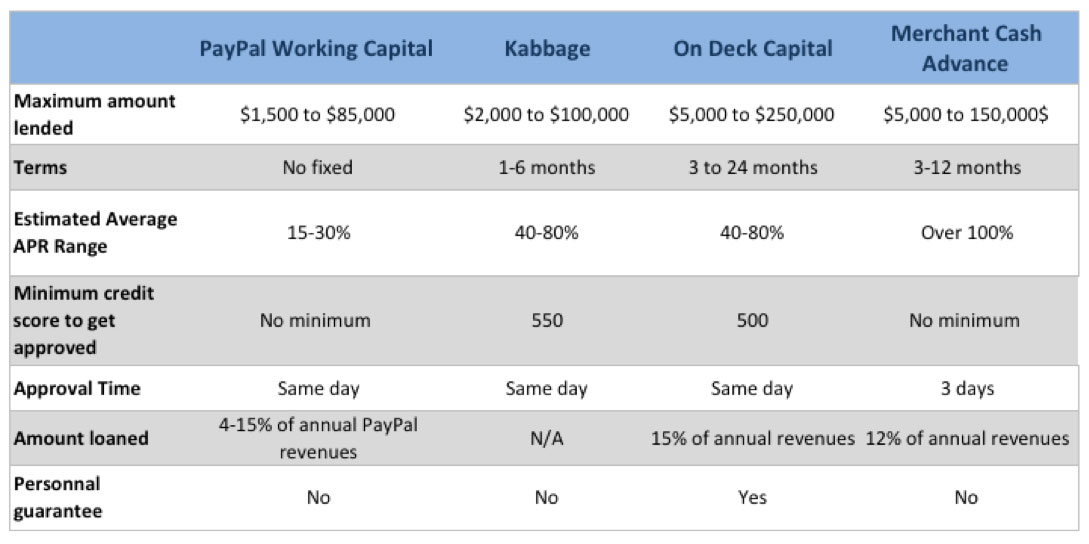

In Western countries, PayPal is known as the faster and safer way to send money, make online payment and receive money. With PayPal Working Capital, businesses that process payments on PayPal can also qualify for small loans that that comes from WebBank, Paypal’s lending partner. Thus, as banks loans to small businesses are declining, alternative lenders such On Deck or small business-focused Kabbage, have come with new funding options, which caters to the needs of customers.

Here’s a review of the 3 top providers of short term financing.

With this new service, PayPal is going head-to-head with the P2P lenders, such as Lending Club, America’s #1 credit marketplace, which has formed a partnership with Alibaba. This venture marks another steps in Alibaba’s mission to conquer the Chinese banking system. The Chinese Giant Alibaba is leading a digital finance revolution in China. According to the most recent figures, Alipay has more than 400 million registered users in China and 17 million overseas. China’s most popular online payment service works much like PayPal, except that it offers much more services including transferring money to other bank accounts with payment made within two hours, paying credit card bills, paying utility bills, top-up mobile phone with credit, buying bus tickets, checking bank balance, paying for products in-store, etc. All of these services are free for transactions in China, which is quite disrupting for banks. Besides, Alibaba’s other banking services, Sesame Credit, Ant Microloan, Ant Financial Cloud, Zhaocaibao, YueBao, and MyBank, as well as its home competitor Tenpay, have all begun to interfere with territory traditionally occupied by Chinese state banks.

Unlike traditional banks, most of Alibaba’s mobile-friendly banking services require no minimum deposit, eliminate transactions fees, and most importantly, provide depositors with returns superior to those offered by state banks, which has started the war.

3) The impact of Internet finance on banks

– Commercial banks are loosing deposits on their financial statements

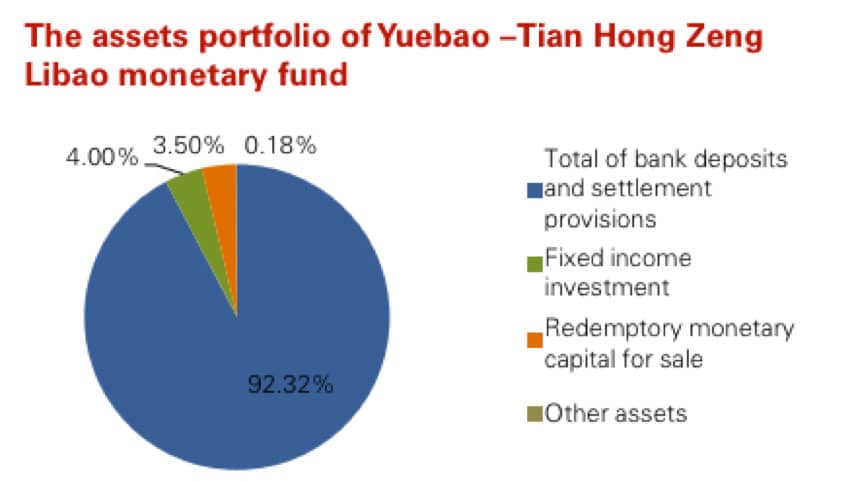

Yuebao, as a variety of Internet wealth management product, has increased steadily its market size since it was launched in 2013. Bank deposits and settlement provisions represent more than 90% Yuebao’s monetary fund, which draws money away from bank deposits.

Besides, as the seven-day annualized interest of Yuebao is five times higher than the current deposit interest rate in the banks, Alipay’s Yuebao constitutes a higher-yielding alternative to traditional savings. For commercial banks, this is leading to a decline in income from individual customers and therefore is squeezing their profit margin.

As well as Internet wealth management products, P2P lending platforms, which core is based on financial disintermediation, are impacting conventional banks business.

Non-banks (e.g. Paypal, E-wallets) are just ordinary intermediaries, as they cannot accept direct deposit, offer checking accounts, or pay interest, and therefore play no direct role in the payment system. However, they compete with banks and each other for lending opportunities. To pursue their destiny, the new lenders will need to offer all the services of a bank.

What’s next?

In an effort to stay ahead of the curve, banks are starting to create their own mobile application to cater to members. Some are choosing to partner with mobile payment providers, while others are developing apps to move further into the commercial lives of their customers.

But by doing so, they might be taking the weaker-end of the deals. And in a far far future, this blurring line between banks and IT companies might become an existential thread for the traditional banking system.