Known as China’s Instagram counterpart, Little Red Book should not be approached in the same way as Instagram. Here are a few key trends for 2024:

- Xiaohongshu stores are booming: 6.9x YOY in GMV for Xiaohongshu stores and a 4.2x YOY increase in GMV from live-streaming sales in 2023.

- Foreign brands are required to localize their content more extensively, driven by a surge in national pride post-COVID

- Engagement rates are higher on Xiaohongshu than on Instagram; in Q2 of 2024, the average comment-to-like ratio was 8%, compared to Instagram’s 2%. Brands can utilize the rich feedback from comments for understanding niche and affluent groups, offering detailed consumer feedback and enabling effective crisis management.

Learn more about the complete Little Red Book marketing guide here.

Trend #1 Zoom: Xiaohongshu stores are booming as live-streaming picks up

Xiaohongshu has been rapidly expanding its live-streaming e-commerce capabilities as part of a significant pre-IPO effort. In April 2024 compared to the same period last year:

- A 5x increase in brands starting official account live-streaming

- A 12x increase in customers placing orders during these live sessions

- A 7.4x rise in the number of brand stores achieving over 1 million RMB in sales

For the upcoming 6.18 shopping festival, the platform is offering over 0.1 billion RMB in discounts and increased traffic for Red store brands, further emphasizing its commitment to growing its e-commerce segment.

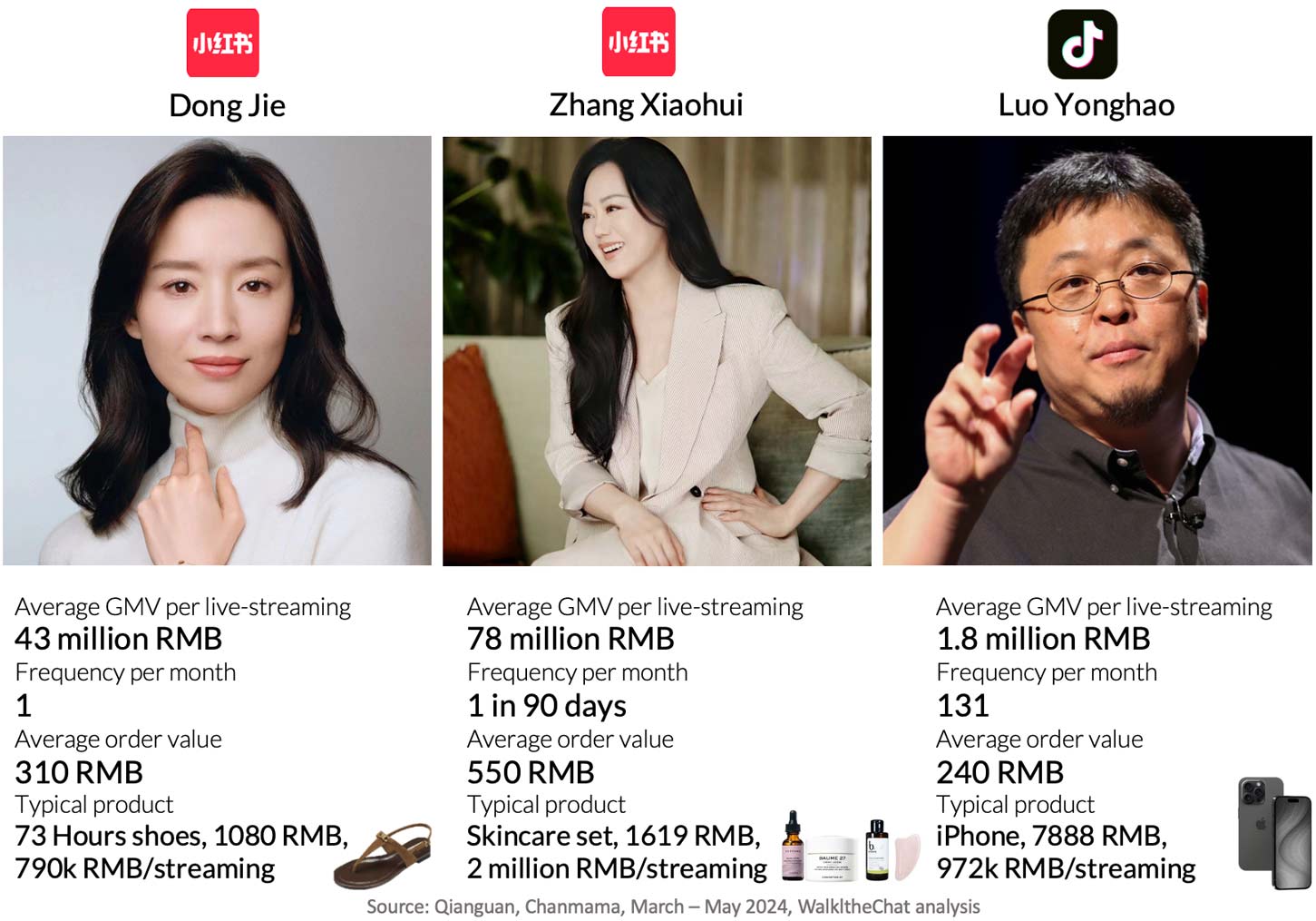

Celebrity live-streaming

The platform’s live-streaming success is largely driven by celebrity influencers who, despite having limited shows, generate impressive sales figures.

For instance, Dong Jie and Zhang Xiaohui, both prominent figures on Little Red Book, achieved average gross merchandise value (GMV) per live-stream of 43 million RMB and 78 million RMB, respectively. These influencers focus on high-value products such as fashion items and skincare sets, which resonate well with the platform’s user base.

However, these Red superstar live-streamers are celebrities, not full-time live streamers, thus their livestreams are rare. For instance, Zhang Xiaohui only did one streaming in the past 3 months, while Douyin’s top celebrity Luo Yonghao’s account had 131 shows in one month. Despite the limited number of shows, these celebrities drive high engagement and sales due to their star power.

While top Red live-streaming influencers are achieving results comparable to those on Douyin, such influencers are rare. On a normal day, fewer than 20 live-streamers on Little Red Book manage to achieve over 100,000 RMB in sales. While on Douyin this number on any given day is way over 100 influencers.

The average order value on Little Red Book is potentially 2 times as high compared to Douyin, emphasizing the platform’s focus on premium products. This makes it an attractive channel for brands looking to market higher-end items.

Brand’s official live-streaming

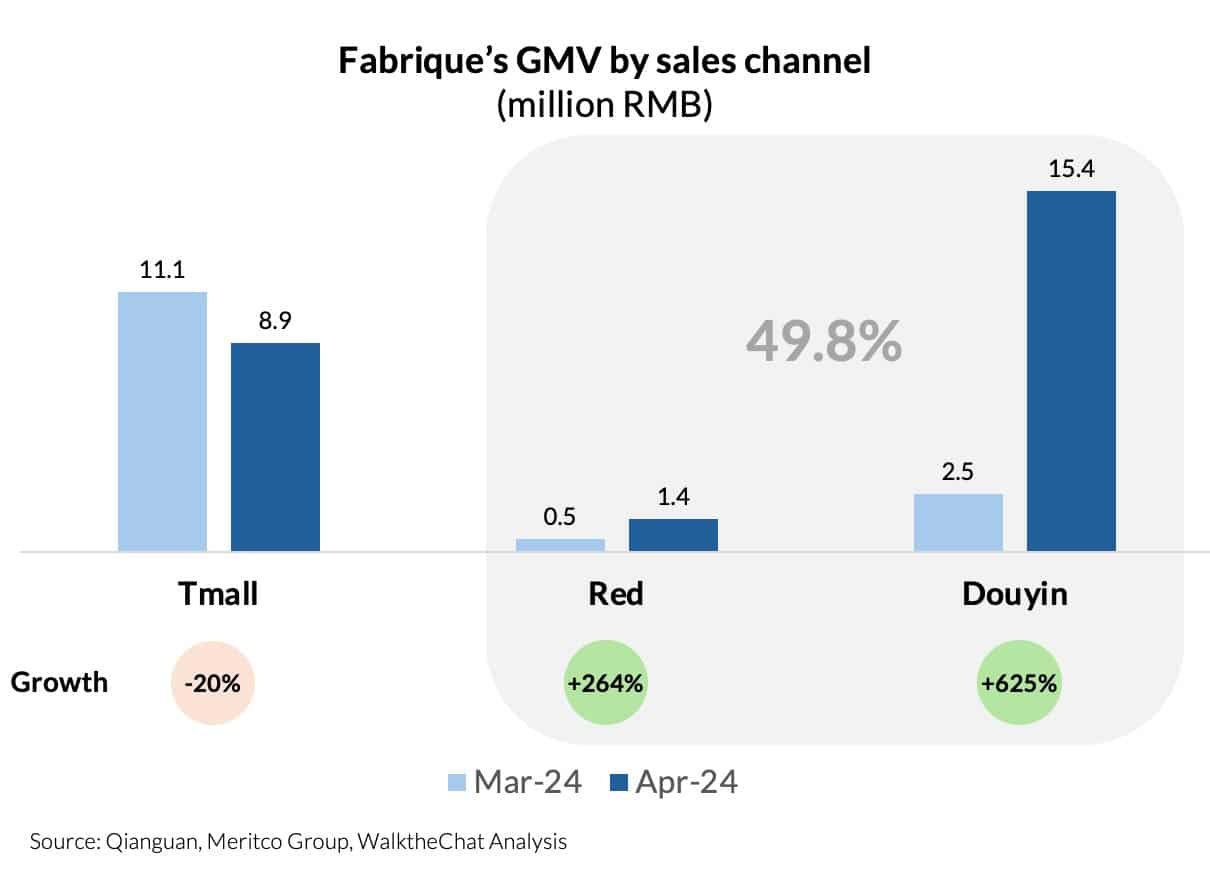

Brands like Fabrique have started to leverage official live-streaming, beginning in March 2024.

Launched only two months ago, Fabrique’s Xiaohongshu live-streams have already achieved significant traction. In April alone, sales from Fabrique’s official live-streaming on Little Red Book reached 16% of their Tmall sales.

While Little Red Book’s official live-streaming sales currently represent only 9% of Douyin’s overall store sales, there is strong potential for growth.

Tmall typically performs well during traditional e-commerce holidays such as 3.8, 6.18, and Double 11. However, during “off-season” months like April, total sales from social media platforms Douyin and Little Red Book can account for up to 65% of total sales (49.8% for both months). This highlights the potential of social commerce for premium fashion brands, demonstrating that social media channels can significantly boost sales outside peak shopping periods.

Trend #2 Zoom: foreign brands need to localize content for Chinese audiences

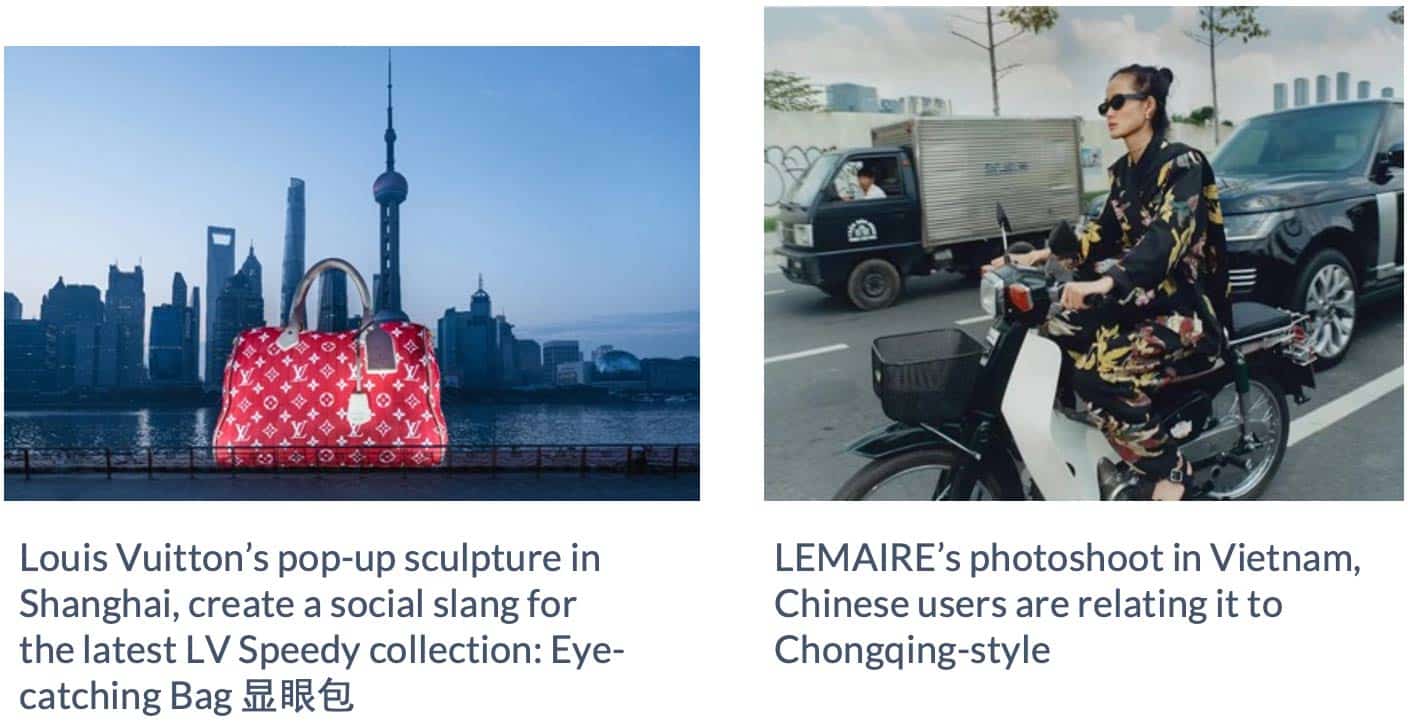

In light of the rising wave of nationwide patriotism post-COVID, foreign brands now need to localize their assets more than ever to resonate with cultural norms and nuances.

Luxury brands such as LV and Lewoe are taking a more aggressive China-localization approach in 2024.

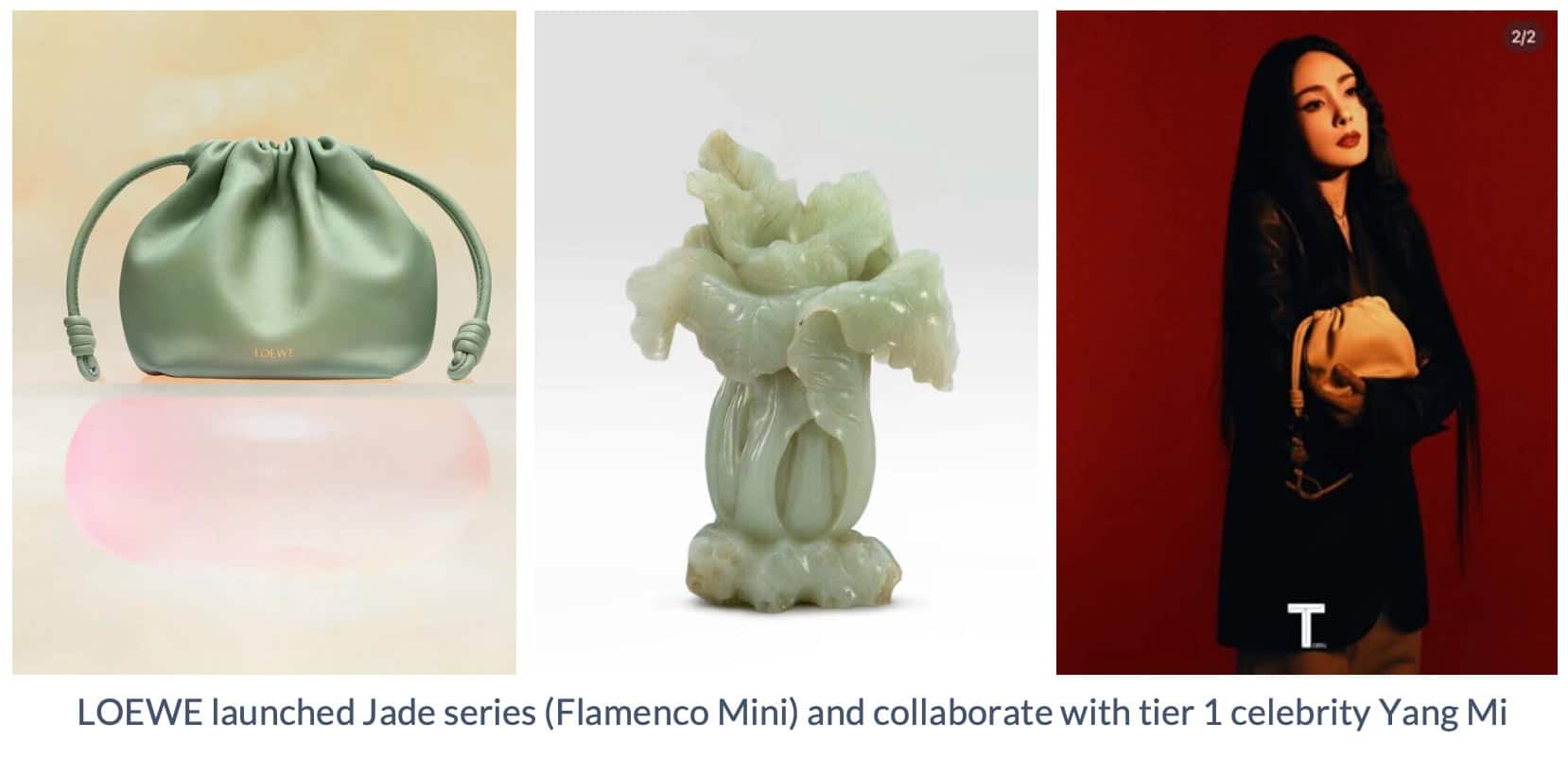

To celebrate the Chinese New Year of 2024, LOEWE collaborated with three jade carving masters to create three limited-edition jade pendants (Jade is highly in line with Chinese preferences). Drawing color inspiration from six ancient Chinese jade carvings, LOEWE launched 6 new colors for the Flamenco Mini handbag and invited the global ambassador Yang Mi to shoot branding assets.

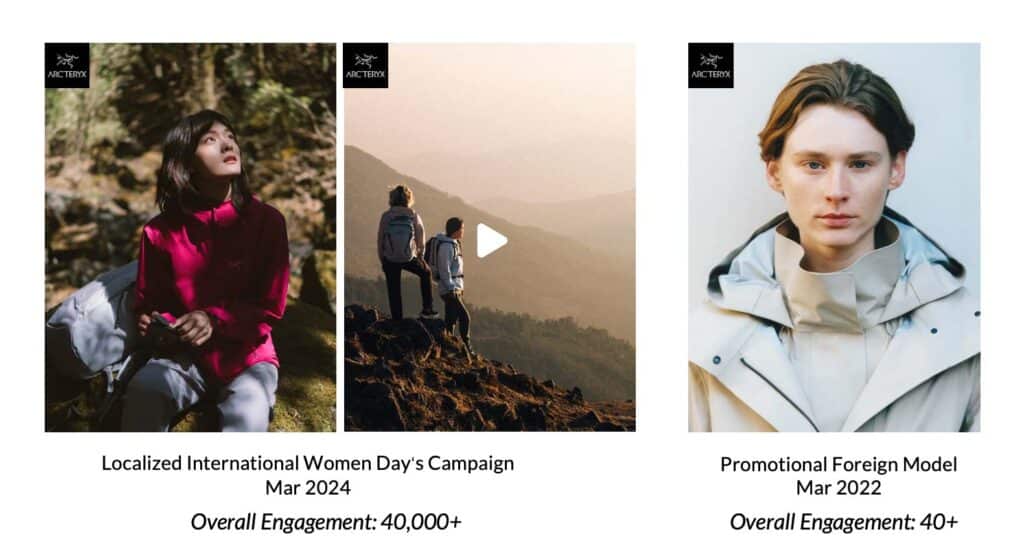

The success of Arc’teryx’s localization in the 2024 IWD (International Women’s Day) campaign lies in its deep understanding of its audience. The brand integrates the concept of “softness” with strength in its marketing, resonating profoundly with outdoor enthusiasts who appreciate both the delicate and powerful aspects of nature.

This approach not only highlights the product’s functionality but also connects emotionally with viewers by reflecting on their personal experiences and values. Compared to previous content, this campaign gained huge engagement and brought social buzz to the brand.

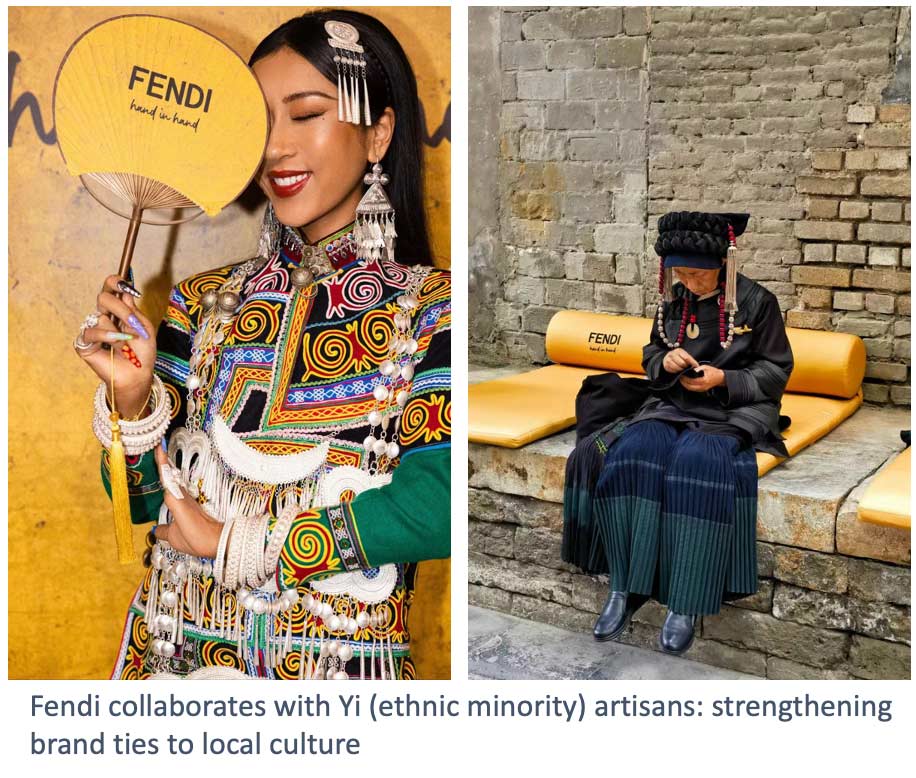

Fendi collaborates with Yi (ethnic minority) artisans: strengthening brand ties to local culture, they also selected a temple as the offline exhibition venue and inviting Yi ethnic craftsmen for live embroidery demonstrations enhances the cultural experience.

AI could play a pivotal role in tailoring global brand assets to resonate with local Chinese cultural nuances. A case study from WalktheChat demonstrates this strategy with Le Creuset’s marketing adaptations for the Chinese New Year and the Dragon Boat Festival. By deploying AI, brands can swiftly modify their global campaigns to appeal to Chinese aesthetic and cultural preferences, enhancing engagement and market relevance.

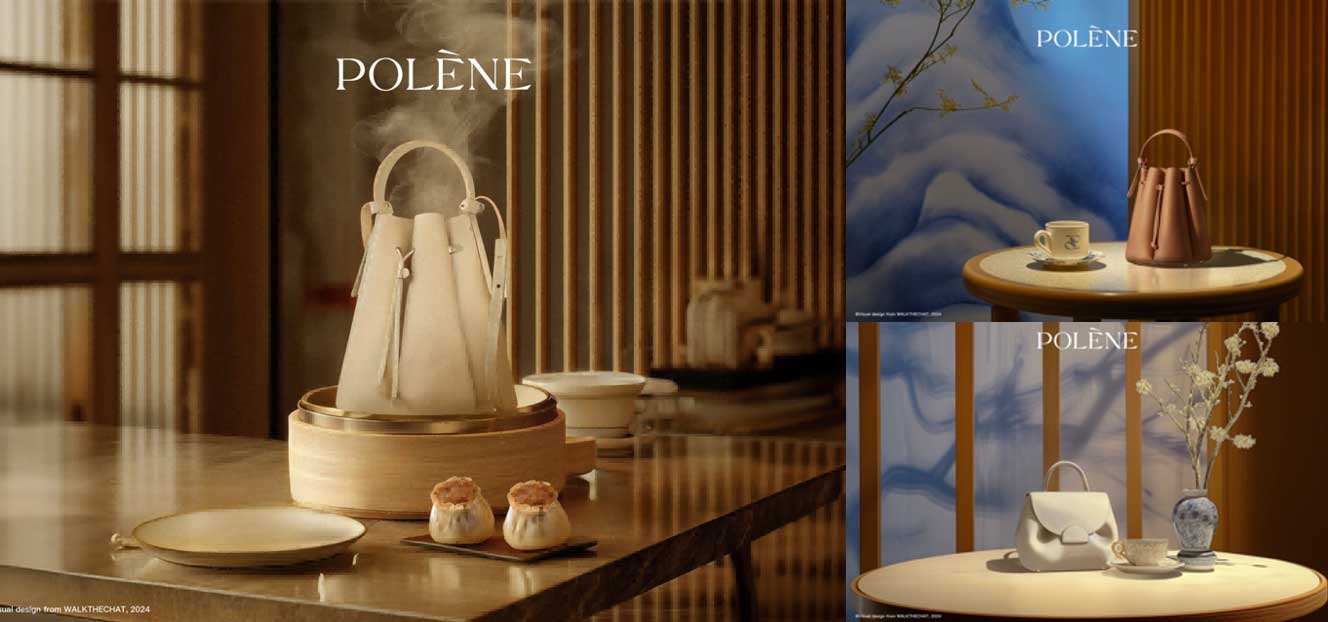

This is another of WalktheChat’s showcases of AI localization. We helped to put Polène’s Series Eight handbags in a Chinese-style setting, incorporating culturally resonant elements such as Chinese bonsai and motifs reminiscent of dim sum and dumplings. This demonstrates how brands can deeply engage with Chinese culture, blending traditional elements with contemporary design to resonate with local consumers.

Marimekko launched a 60th-anniversary celebration campaign in Shanghai, creating an engaging campaign with the famous Shanghai landmark.

Marimekko’s Unikko Foreveer Pop-up event in Shanghai. Video created by WalktheChat. This asset got over 1 million likes worldwide

Trend #3 Zoom: Leveraging Little Red Book’s Engagement for Deep Brand Insights

Little Red Book’s community engagement significantly outshines Instagram, with an 8% average comment-to-like ratio in Q2 of 2024, compared to Instagram’s 2%.

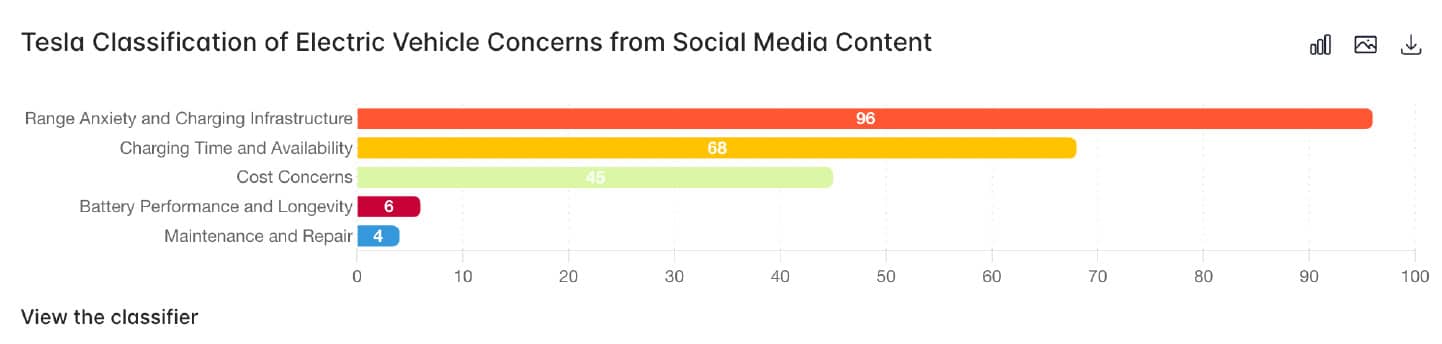

Comments on Little Red Book offer brands a goldmine of information, especially useful for understanding niche and affluent groups. For example, an analysis of 2,000 posts from Tesla drivers taking road trips during the national holiday provided detailed feedback on their experiences.

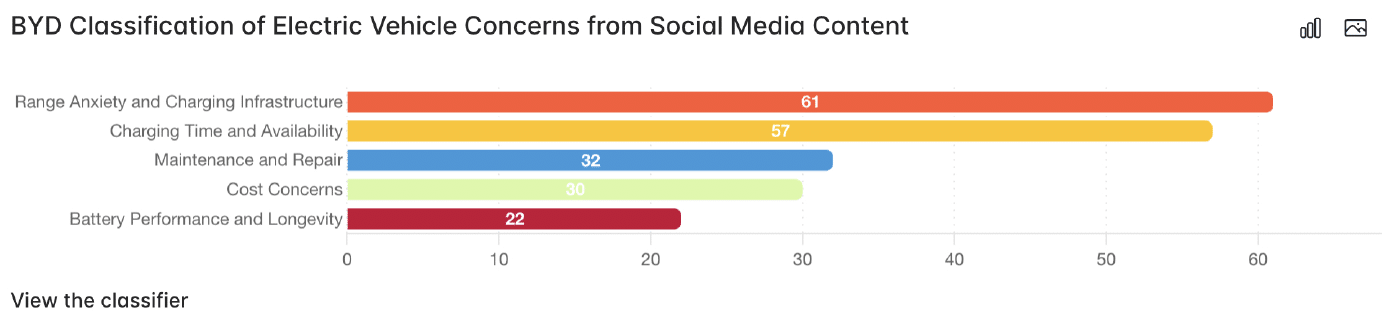

In contrast, BYD drivers frequently discuss issues related to maintenance and battery performance. This stark difference underscores Little Red Book’s potential as a crucial resource for brands seeking actionable and detailed consumer feedback.

Little Red Book also serves as a critical platform for crisis management. Brands can effectively monitor and analyze user sentiment, identifying emerging issues swiftly and accurately.

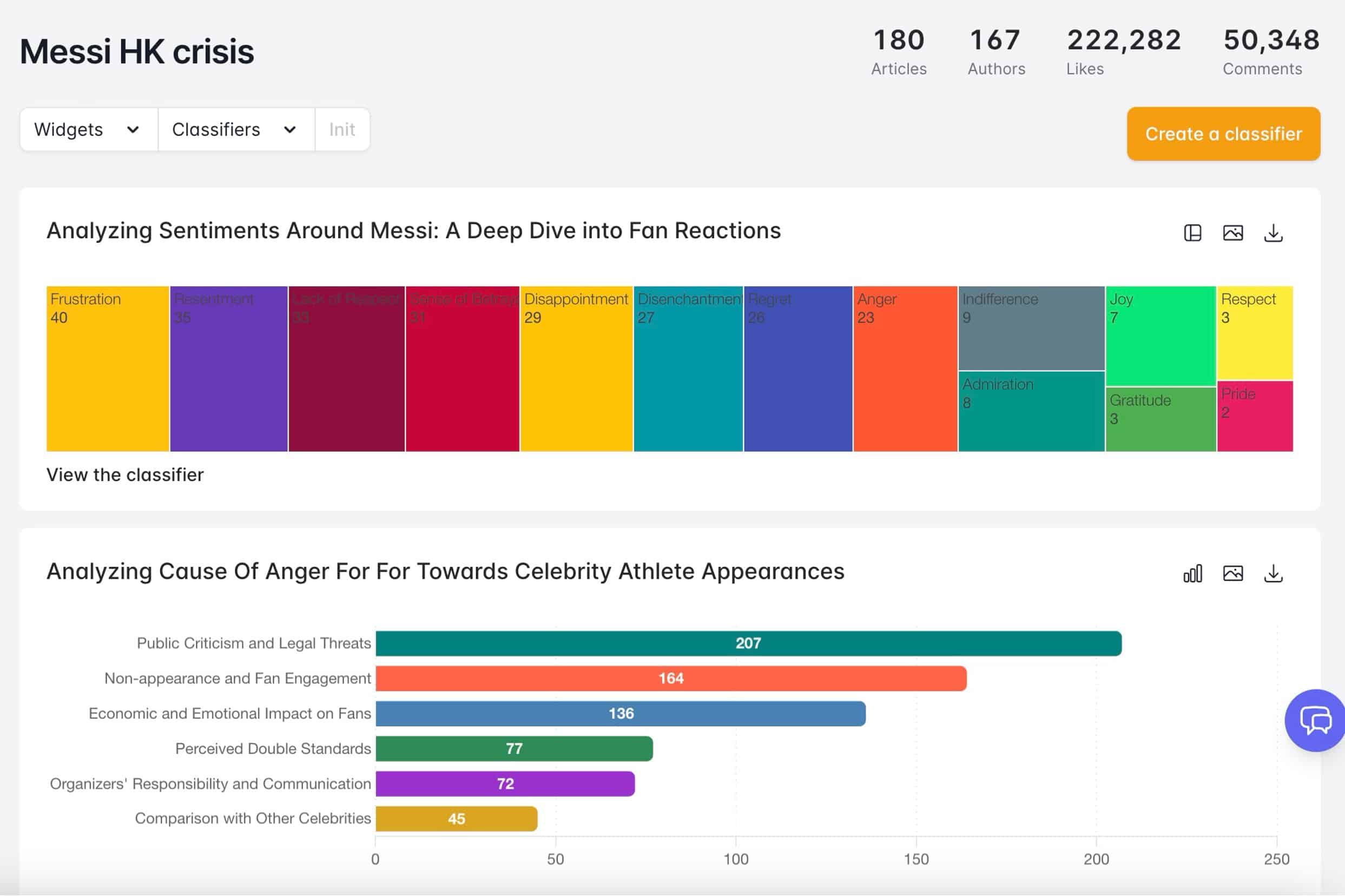

For example, by using WalktheChat sentiment analysis tool Doris, here is the Messi HK crisis visualization to understand the root causes of negative reactions. By analyzing 50k comments, we get a much clearer picture of the anger is coming more from lack of fan engagement than economic impact on fans.

Little Red Book comments are like a gold mine of authentic users’ feedback. It allows companies to proactively address concerns, manage public relations issues, and mitigate potential damage to their reputation. By visualizing user emotions and the underlying causes of dissatisfaction, companies can strategize more effectively, ensuring swift and appropriate responses to maintain consumer trust and loyalty.

Conclusion

Little Red Book’s evolving landscape presents a unique opportunity for brands to tap into China’s dynamic market by leveraging booming live-streaming sales, embracing extensive localization to align with cultural nuances, and utilizing high engagement rates to gather rich consumer insights. By strategically incorporating these trends, brands can significantly enhance their presence, drive growth, and maintain a competitive edge in 2024 and beyond.