The movie “囧妈” (Lost in Russia) is, in many ways, tailor-made for the Chinese New Year festival. It features superstar actor Xu Kun. The protagonist gets stuck on a 6-days train ride to Moscow with his mother, during which he will have to tackle the unspoken issues of their relationship.

It is a family-centric show targeting people visiting their loved ones during the Chinese New Year holiday. So: why did it release on short-video platforms Douyin and Xigua instead of movie theaters?

The choice to release on short-video platforms

At first, the decision can appear as surprising. The movie was gearing up for a big splash on the big screen, with 46M RMB in pre-sale tickets.

But this year’s was no usual new year. Health concerns are pushing people to stay indoors, and especially to avoid crowded places such as cinemas.

The production company, Huanxi Media, chose to mitigate its risks and accept 630 million RMB from ByteDance to distribute the movie for free via Douyin and Xigua.

A powerful distribution machine

By signing this agreement, Huanxi Media didn’t only get money. They received the backing of the powerful ByteDance ecosystem to promote the movie.

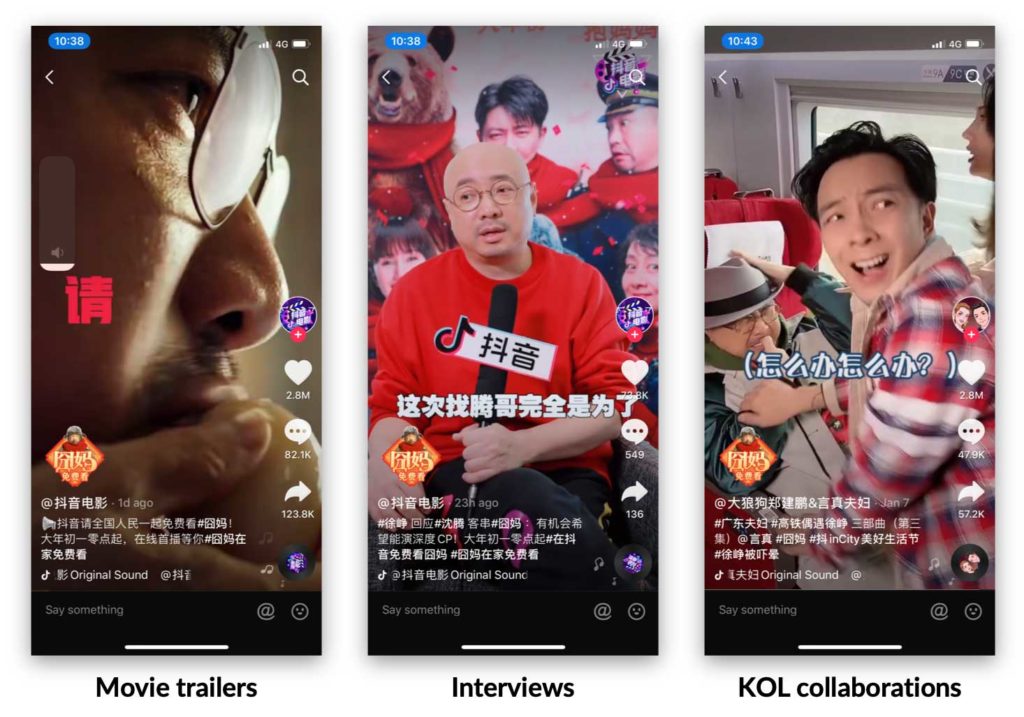

Douyin and Xigua promoted movie trailers and interviews of the movie. “Lost in Russia” also benefited from the ecosystem of Douyin influencers who pushed the film to their fan, sometimes with direct collaborations with star actor Xu Kun.

Videos related to the movie racked-up dozens of millions of views on Douyin even before its launch, ensuring a tremendous initial momentum.

A brilliant move as a user acquisition campaign

Chinese New Year is a perfect time for user acquisition: in 2014, WeChat acquired 4.8 million WeChat pay users via their first red envelope campaign, an event Jack Ma refers to as “a Pearl Harbor attack”; Alibaba later spent 268.8 million RMB and more each year to sponsor the Spring Festival Gala from 2016 to 2018 in order to acquire users from lower-tier cities.

In 2020 this year, Kuaishou was able to reach 25.24 million concurrent users as the sponsor of the Spring Festival Gala. Kuaishou distributed 1 billion RMB Red envelopes during the Spring Festival Gala and generated 63.9 billion campaign engagements.

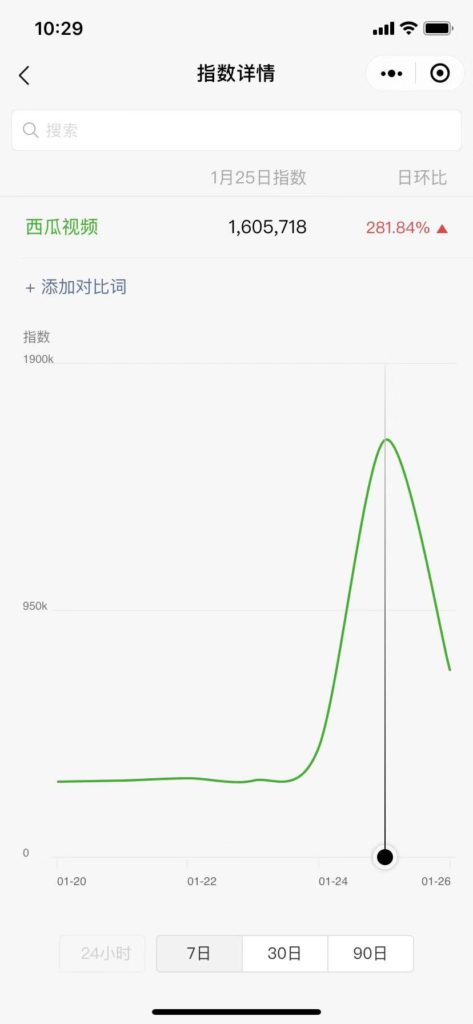

ByteCance decided to premiere this hit movie for free on its Douyin and Xigua platforms to acquire users. It’s a brilliant move to attract more users to download Douyin and Xigua Apps. The controversy of this premiere created viral discussions online and free press which ultimately benefits ByteDance.

A controversial decision

The decision from Huanxi Media to distribute the movie on Douyin was, however, not received without pushback.

More than 20,000 employees in the Zhejiang film industry signed a petition to boycott “Lost in Russia”.

According to them, Huanxi Media betrayed the film industry by unexpectedly canceling its deals to distribute the movie in cinemas. By doing so, it is threatening the livelihood of the broader movie industry, in particular of small cinemas that rely on revenues from the Chinese New Year to turn a profit.

A drop in the ocean

More importantly, this is the significant first move of ByteDance in the movie industry. The company managed to beat its competitors such as Youku or Tencent video in claiming the movie’s distribution rights.

These competitors are quite active:

- Alibaba acquired movie tickets App Taopiaopiao, created its own studio Alibaba pictures, and operates video App Youku Tudou

- Baidu runs video App iQiyi

- Tencent runs video App Tencent Video, supported by its broad social ecosystem

And although 630 million RMB can appear like a lot of money, it is not much compared to what other competitors are investing in this industry. iQiyi, on its own, vouched to spend more than 20 billion RMB in 2020 in Netflix-style original content production.

Tencent Video claimed 900 million mobile MAU’s as of March 2019, a distribution comparable to that of Douyin.

Conclusion

Douyin has made a significant move in the entertainment industry with the distribution of “Lost in Russia”.

However, the company still has to fight-off entrenched competitors. iQiyi, Youku, and Tencent Video have already developed significant expertise and invested enormous resources in producing original shows.

It will take many more steps for Douyin to become a full entertainment ecosystem rather than just a short-video platform.