JD (Jingdong, in Chinese: 京东) is the 2nd biggest eCommerce platform in China, famous for reliability and fast logistics. It is also the major competitor to Alibaba-run Tmall. JD just revealed its first-quarter financial report and achieved a growth rate higher than the market average.

Early this year, JD and Shopify formed a strategic partnership to help international merchants to sell cross-border to China more easily.

JD achieved an 18% increase in income, higher than the market average

In 2022 Q1, top-tier Chinese cities like Shanghai and Beijing have suffered from covid. The strict lockdown and logistics interruptions left visible impacts on both offline stores and eCommerce sales. As a result, National Online Retail Sales in Q1 have grown by 6.6%, lower than 14.1%, the YoY growth rate in 2021. (source: National Bureau of Statistics; 2022.04; 2022.01).

Meanwhile, JD Group achieved an income from operations of ~400 million USD, an increase of 17.95% from 2021 Q1 and much higher than the 6.6% market average (source: JD First Quater Results in 2022).

JD Marketplace: Partner with Shopify to support cross-border eCommerce merchants

JD.com and Shopify formed a strategic partnership, helping merchants to sell cross-border with a limited cost. The partnership consist in two parts:

- JD.com helps Chinese merchants sell to overseas markets with the help of Shopify via a DTC approach.

- Shopify allows western sellers easily list their products on JD’s cross-border eCommerce platform JD Worldwide, giving access to JD’s 550 million active users in China. (source: Shopify)

Chinese consumers are avid international shoppers. Especially for categories where people value the quality, such as formula milk, supplements, and luxury goods, 68% of Chinese customers considered foreign goods as having higher quality than the domestic ones (source: RetailX).

Up to 2022 May, JD Marketplace has been available for the US merchants, and will gradually expand this solution to European markets.

What are the benefits of selling on JD Worldwide with Shopify?

JD Marketplace will allow Shopify merchants in the US to get started as quickly as three to four weeks. To support merchants in their effort to begin selling into China, the channel will provide:

- Expedited onboarding to help merchants sell quickly

- Logistics: end-to-end fulfillment from JD’s US warehouses directly to consumers in China

- Pricing and taxes: smart price conversion to local currency based on foreign exchange rates, typical category pricing, as well as VAT and Consumption Tax

- Intelligent translation of product names and descriptions

(source: Shopify)

Apart from getting listed on JD.com, merchants can also actively drive traffic from social media to their products listed. The marketplace also provides in-site advertising platforms to help merchants capture their valuable audience searching for related products or categories.

Want to know more about this new sales channel on JD Worldwide? Please fill in this 1-minute form, and we will be in touch with you soon:

Solid logistics chain: JD’s competitive advantage

JD showed vitality despite the covid situation in China, mainly thanks to its self-built logistics network and fulfillment infrastructures. This eCommerce platform was one of few online channels that could still operate during the strict lockdown.

JD Group has built around 1,400 warehouses within China and overseas (Source: Sohu). It also operates its own logistics chains to guarantee quality service and speedy delivery to the end consumers.

At the height of the covid lockdown in Shanghai, JD sent 80,000 tons of daily necessities including medicines and mom&kids products. Around 4,000 JD delivery personnel also came to Shanghai to support day-to-day operations. This action has gained goodwill from Chinese consumers.

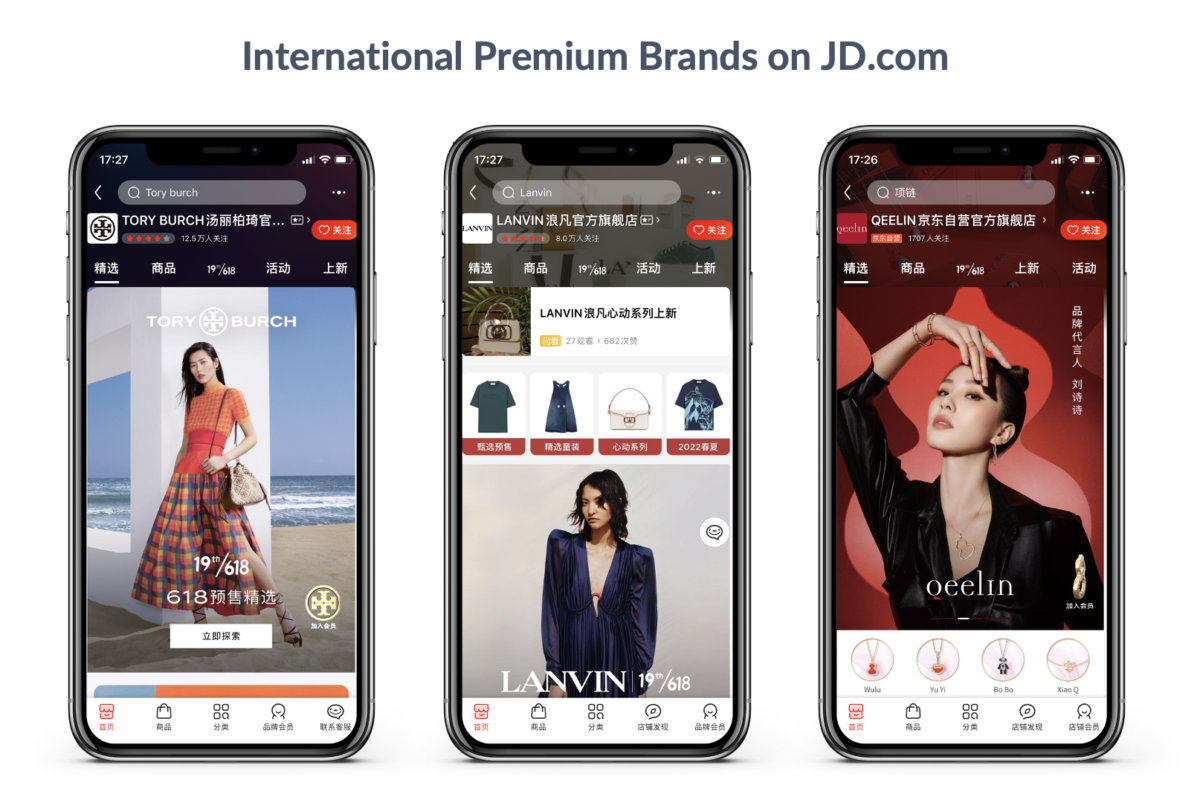

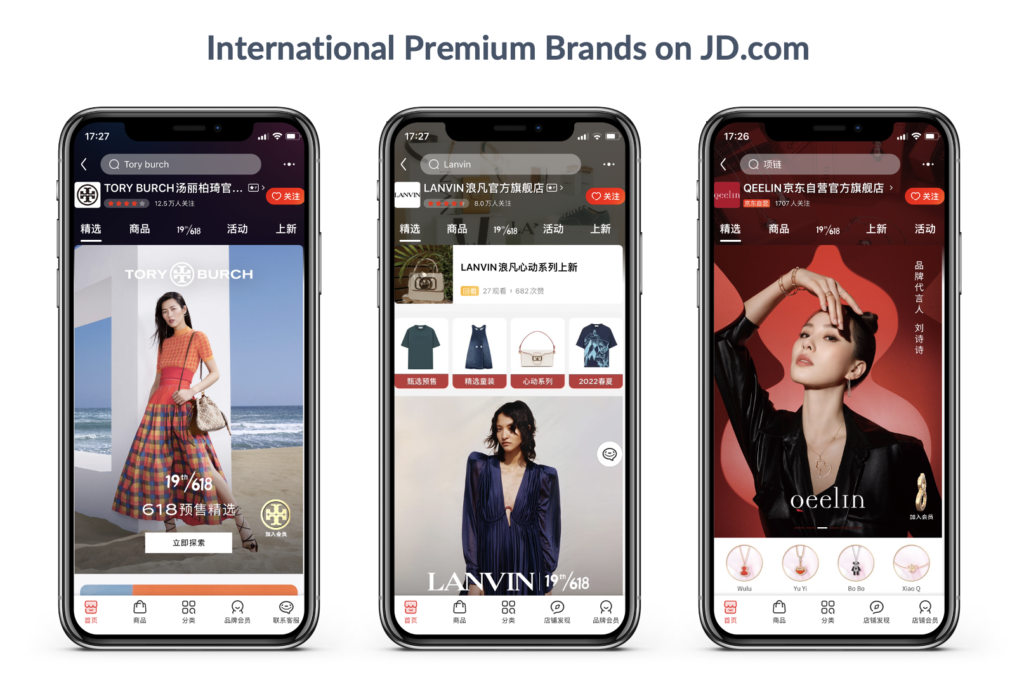

JD.com collaborate with premium brands to attract more female users

JD.com has been the strongest marketplace for consumer electronics. Therefore, it attracted more male than female users (62.91% male vs. 37.10% female, source: iimedia).

In recent years, JD tried to expand its categories to fashion and luxury to affiliate with more female consumers. In 2022 Q1, many premium brands joined forces with JD.com, including fine jewelry brand Qeelin (part of Kering Group), French high fashion brand Lanvin, and US premium lifestyle brand Tory Burch. Below are some examples of these flagship stores:

JD’s above-average performance during 2022 Q1 had given consumers more confidence in the platform. In collaboration with Shopify, the JD Marketplace aims to help solve cross-border commerce challenges. JD’s simplified procedure in the product listing, in-site marketing, and logistics solutions have helped US brands sell to China more quickly and will benefit more foreign brands in the future.

Want to know more about JD? Check out this article:

- JD, Alibaba and Pinduoduo’s Strong E-commerce performance Post-COVID

- JD.com 618 Revenues Grow 33% Amid COVID-19 Pandemic