Xiaohongshu / Red is the crucial platform during the awareness and consideration phases. Chinese consumers are used to searching on Red for feedback and reviews and then finalizing the purchase on Tmall or Taobao.

However, Red is no longer satisfied being only the UGC platform where people look for information. In August 2021, Red announced the “Account-Store Integration” to push for a closed-loop in-app conversion. More than half a year passed, so has Xiaohongshu made any progress on this?

Context about Xiaohongshu / Red Account and Store

Before 2021, Red had been operating its own store called “Welfare Community” (in Chinese: Fu li she, 福利社), mostly selling foreign brands and products via cross-border eCommerce. At that time, foreign brands didn’t need to operate a Red account. So you can collaborate with the platform to sell to China through a B2B approach. Red would buy the stock from foreign brands, keep it in bonded warehouses and ship it to end consumers when people place the order. (source: Sohu)

However, this approach didn’t work as well as expected. Chinese customers didn’t find this sales channel as attractive as the established ones like Taobao and Tmall. There are mainly two reasons:

- Tmall had more events, shopping festivals, discounts, and promotions that kept consumers’ attention;

- Since the brands didn’t invest in brand building, marketing and operation on Red, Chinese consumers didn’t feel connected with the brands selling through “Welfare Community.”

Over the years, most Chinese people still consider Red a content platform while doubting its eCommerce capacity.

What’s new about Xiaohongshu / Red Account-Store Integartion?

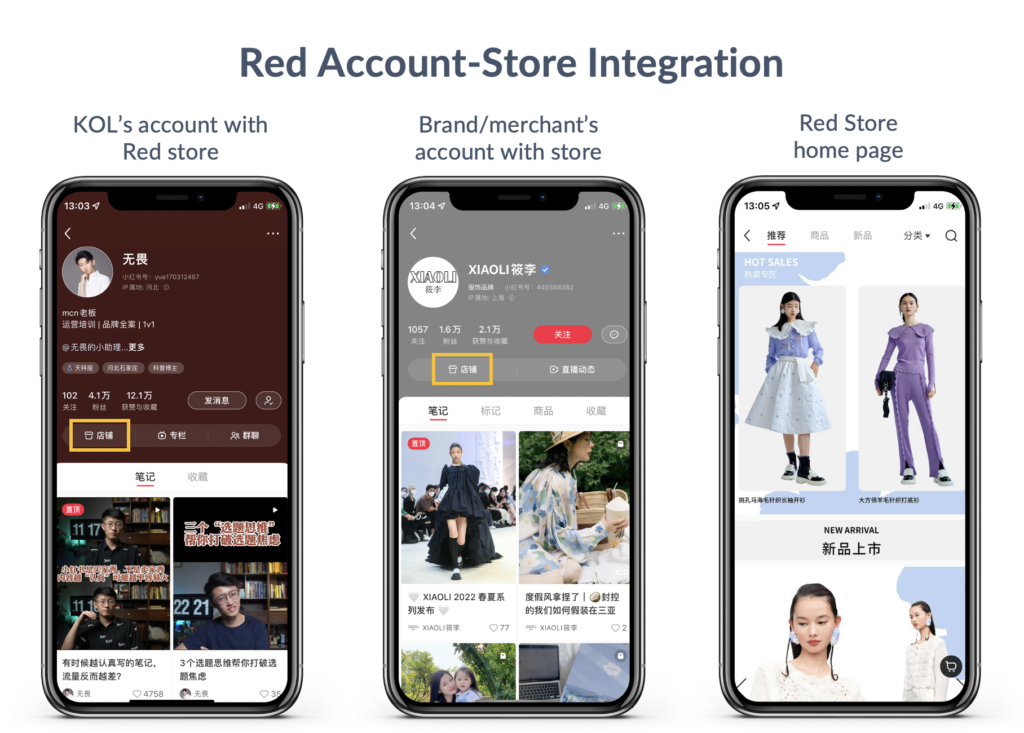

The Account-Store Integration means that:

1. Any Red account can apply for Red Store. Any brand or individual/KOL can create an account on Red and start selling with a store, which is integrated with the Red account and accesible through the account page.

2. There is no Red store if you don’t have Red account. For brands that look for a long-term strategy in China, you have to invest in content creation to build awareness and tell a brand story, and community management to engage with your followers and potential customers.

3. Red also offers a discounted platform commission for merchants. For store with less than 10,000 CNY (~1,470 USD) monthly revenue, there is no platform commission; for monthly revenue above 10,000 CNY, the commission will be 5% (Source: Mr. Milu Sky)

Need any help managing your Red account, or wondering if you should open a store on Red? Simply fill in this one-minute form and we will be in touch with you:

Why is Xiaohongshu / Red pursuing for Account-Store Integartion?

Nowadays, Chinese consumers heavily rely on social content to make their purchasing decision.

Over the years, Chinese consumers have been overwhelmed with choices from both domestic and international brands. When you are free to select products of similar appearance or functionality among 100 brands, the human connection becomes more important. That’s also why Chinese people rely more on recommendations from KOLs and KOCs, especially when they purchase a new brand for the first time.

New brands entering the Chinese market have to find a niche or a differentiating strategy to succeed. Social media content can help to amplify your differentiating strategy.

On social media such as Red and Douyin, the platform algorithm can efficiently deliver the right content to the right audience group, depending on their interactions and interests shown on the platform. The social content can come from KOL and the brand itself, but both channels are necessary and need to align with each other.

What can do you on Xiaohongshu / Red to drive sales?

Xiaohongshu / Red provides multiple marketing tools to help brands and influencers. For example, you can host live streaming, and use “Shutiao” (similar to boosted content on Instagram) to boost your potential viral posts. For merchants, you can also run paid KOL campaigns through Red’s official influencer collaboration platform Dandelion (in Chinese: 蒲公英/Pugongying), and run performance ads.

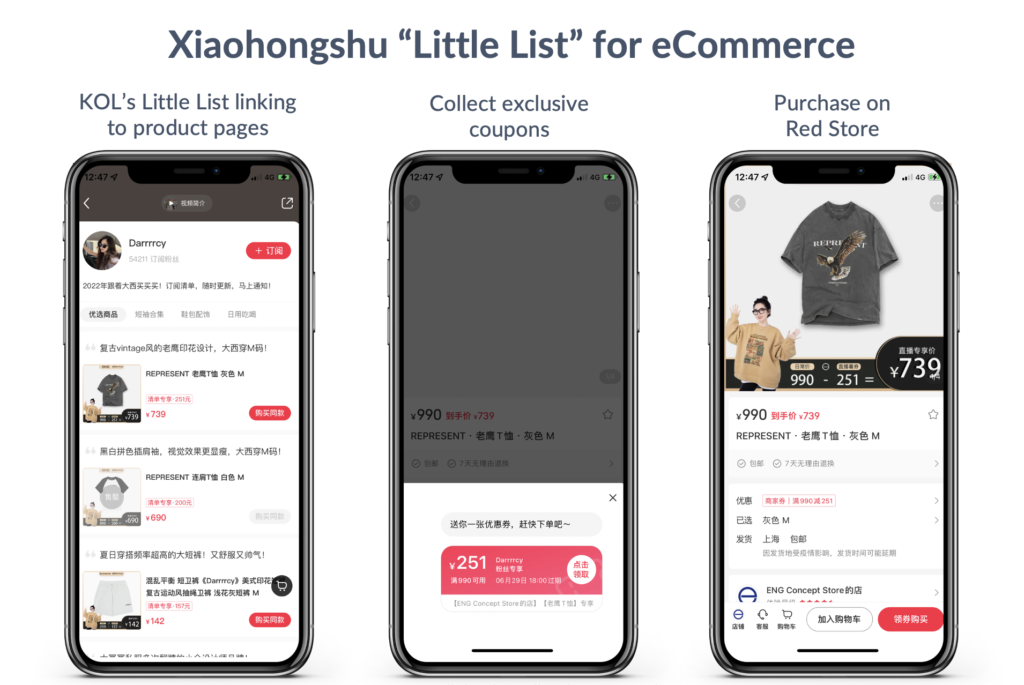

On the other side, KOLs can also activate the “Little List” (in Chinese: 小清单) function to help merchants drive sales. “Little List” is similar to KOL’s recommendation list or shopping list. KOLs can select products from different merchants available on Red Store and add them to “Little List.” Followers can subscribe to KOL’s “Little List” to receive updates; this KOL will also get a commission if users purchase through “Little List.”

Looking for more details about Red / Xiaohongshu marketing? You will find this guide very useful:

What do I need to invest in for a Red / Xiaohongshu Store?

The model of Red Store nowadays is similar to a marketplace, so brands also need to invest in operation. Some typical tasks will be product upload, store refresh, sign up for platform events, customer service, communication with KOLs, live streamings, and others. The workload will depend on the frequency of new-in, how popular is the brand, and the volume of daily sales.

Red plays an important role in consumers’ purchasing decisions, especially in the consideration and research phase. If Red manages to keep the users in the research phase and encourage them to purchase in-app, Red Store will be a promising social commerce channel.