Since the pandemic in 2020, Chinese consumers have been adapting to the ever-changing external environment and adjusting their preferences, lifestyles, and purchasing decisions. Today we will share updated insights from Red Content Trends Report, to help brands better understand their audience in post-covid China and discover new opportunities underlying the challenges.

In this article, we will explain:

- Red (Xiaohongshu) updated overview and user persona

- 5 new consumers trends on Red (Xiaohongshu) and opportunities for related brands

Red (Xiaohongshu) Platform Overview

- MAU (Monthly Active User): 200 million, which doubled the size in January 2020 (100 million).

- Geographic: over 50% are living in Tier-1 or Tier-2 cities, such as Shanghai, Beijing, Guangzhou, etc.

- Age: 72% of them are born in the 1990s (Millenials).

- Gender: Female / Male = 70% / 30%. Red used to have 90% of active users being female. However, as the platform grows and content diversifies, it’s attracting more male users and building a more balanced gender distribution.

Red (Xiaohongshu) Users Content Preference Trends

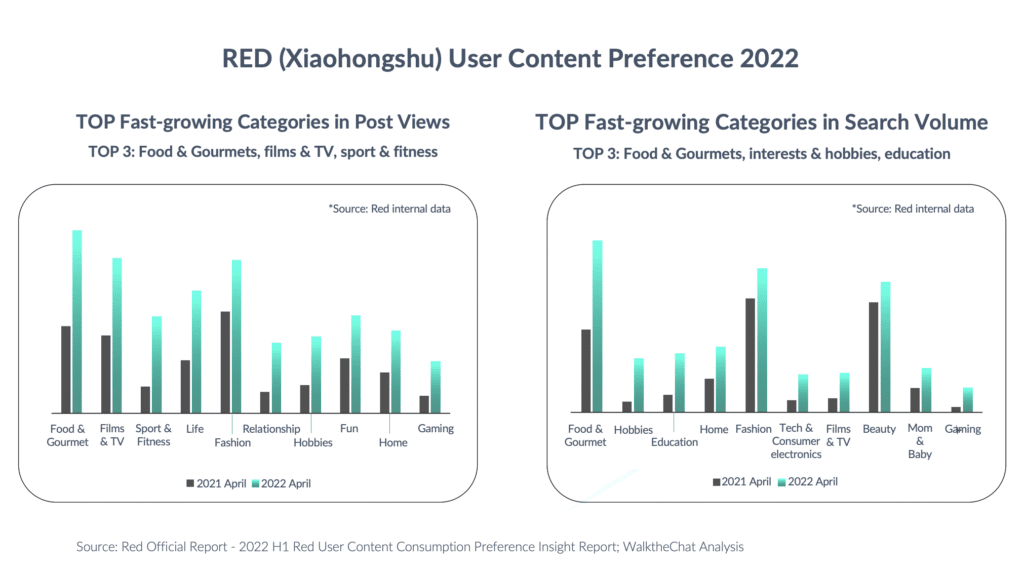

Over time, Red users are showing more diversified interests and behavior. Categories such as food & gourmets, hobbies, home decoration & renovation, and entertainment are the most fast-growing channels.

Here are the 5 types of content that users love to consume in 2022, in terms of post views and search volume:

- Cooking at home

- Fitness & workout

- Fashion & beauty

- Citytour nearby

- entertainment at home

Looking for help to define or improve your Red / Xiaohongshu strategy? Talk with us!

Now let’s look at two categories that are more relevant for foreign brands, and see how brands can leverage the uprising trend on Chinese social media.

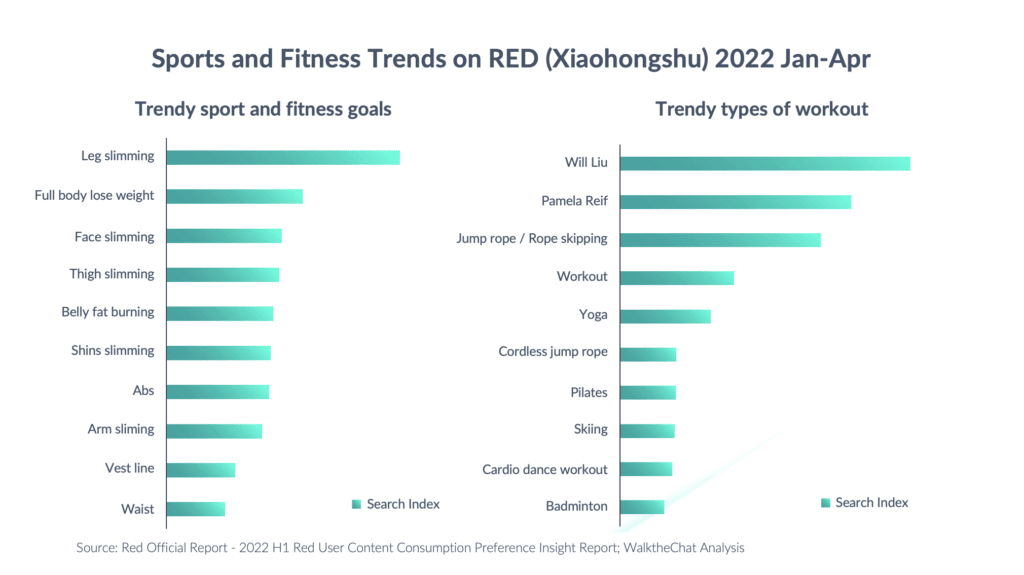

Fitness & Workout Trends on Xiaohongshu

Following the 2022 Beijing Winter Olympics and the impact of the pandemic, Chinese consumers have become enthusiastic about sport and fitness, especially home workouts. During the Shanghai lockdown, singer and composer Will Liu (Liu Genghong) started live-streaming his home workout training on Douyin and quickly became a social phenomenon.

Thanks to his professional training and positive vibes, Liu became viral all over the Chinese internet. His record is attracting nearly 10 million followers in one day. (source: Xinhua Daily) By June 2022, he has gained more than 72 million followers on Douyin, more than ten times the size before live-streaming fitness content.

Following the success of Will Liu, German fitness influencer Palema Reif also joined Douyin on April 12th. She has attracted more than 11 million followers in two months.

Both of them also have active accounts on Red.

Because of covid, Chinese people have realized the importance of health more than ever before. People actively search for specific sports and fitness training on social media, such as rope skipping, yoga, pilates, etc. Therefore, here’s an opportunity for related industries such as sports and fitness fashion, home workout equipment, etc.

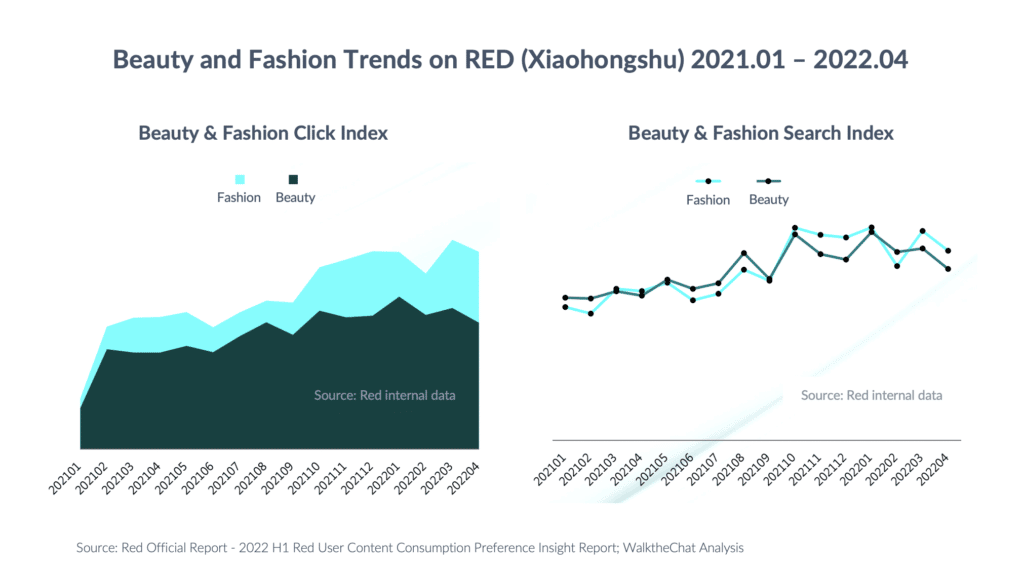

Fashion & Beauty Trends on Xiaohongshu

Fashion & Beauty continue to be trendy topics on Red. According to Red’s internal data of beauty & fashion content, having to wear a mask doesn’t affect Chinese consumers’ pursuit of looking better and more confident.

According to Red’s report on users’ content consuming preference, we can observe the first peak in the click index and search index in October 2021. Chinese consumers used Red as a Chinese “Google” to gather information, and decide what to buy during the 2021 Double 11 Shopping Festival. Both indexes dropped in February after several massive shopping festivals. It quickly picked up again in March 2022, thanks to the Women’s Day Shopping Festival.

According to Red’s Beauty Trends Report published in April, there are four TOP trends in 2022:

- efficient skincare

- Haute makeup

- stacking products

- gender neutrality

Red predicts a promising trend and desire in these verticals during this year because the search volume for these keywords soured in 2021. As the traditional beauty market saturates, new brands entering China have to focus on more segmented verticals. For example, efficient skincare or simplified skincare, functional skincare targeting oily/dry skin, and men’s beauty may see an opportunity here.

Looking for more information about Red / Xiaohongshu marketing? You will find the below articles very useful:

- Little Red Book (Xiaohongshu) Marketing – A Complete Guide

- Xiaohongshu/Red Pushes “Account-Store Integration” to drive In-app Conversion