RED (Xiaohongshu) is the Chinese equivalent of “Instagram,” where consumers look for fashion trends, beauty tips, and authentic reviews before buying a product. More than 70% of active users on Red are females, and 50% live in tier 1 and 2 cities. Therefore, Red is a not-to-miss platform for fashion brands, including apparel, handbags, accessories, footwear, etc.

Chinese marketing data & analytics company Endata (艺恩) recently published a Red Marketing Manual for Fashion Brands. So in this article, we will go through:

- Overview of Fashion Trends and Keywords on Red

- Fashion KOLs and KOCs on Red and how to efficiently leverage influencers

- Our suggestions for fashion and handbag brands

Fashion Trends and Hot Keywords on Red (Xiaohongshu)

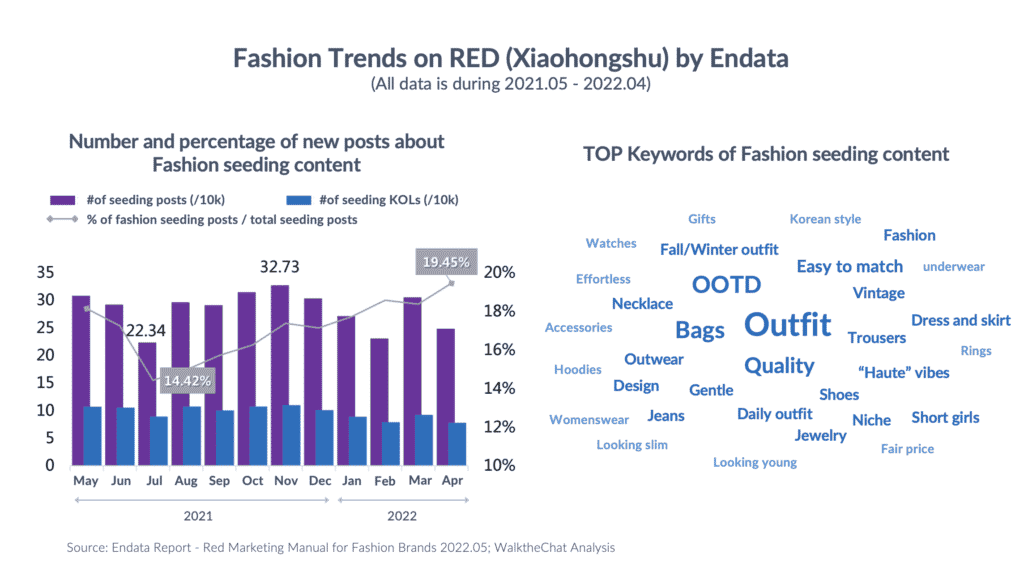

Red users pursue a trendy and quality lifestyle, so fashion is naturally one of the hot topics. We can observe that:

- There are more seeding posts about fashion style under two situations:

- 1. season change (for example, the number is high in March because Chinese consumers search for what to wear in spring)

- 2. before important sales events (for example, people start searching for what winter clothes to buy during Double 11 in October and November)

- Besides trendy keywords such as OOTD, outfit, fashion categories, etc., more niche and long-tail keywords deserve our attention. For example:

- Specific fashion style: elegant; gentle; vintage; “Haute” vibes; Korean style, etc.

- Address niche needs: for instance, fashion outfits, mix-and-match ideas focused on short girls, etc.

Need some help to understand if your brand will work well in China? Simply fill in this form, and we will be in touch with you.

Fashion KOLs and KOCs on Red (Xiaohongshu)

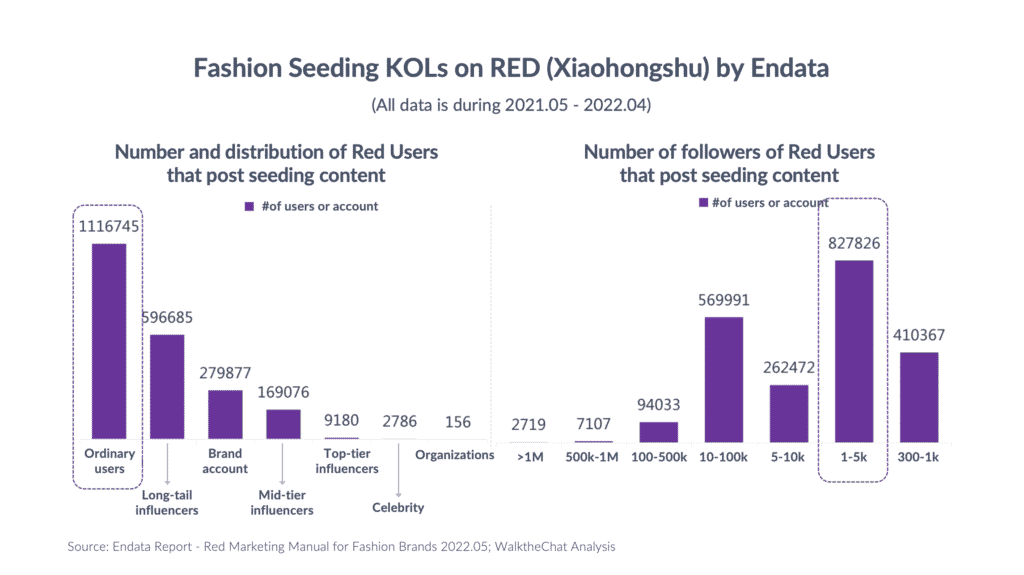

Red is a UGC (User Generated Content) platform, so ordinary users publish most of the fashion-seeding content, followed by long-tail influencers.

In terms of followers, there are abundant numbers of fashion influencers with 1-5k followers, whom we usually address as KOCs (Key Opinion Customers). KOLs (Key Opinion Leaders) with 10-100k followers also account for a large percentage of fashion influencers.

Successful Case: Urban Revivo

Urban Revivo is a leading Chinese premium fast fashion brand, also known as “UR.” Let’s look at what they did right.

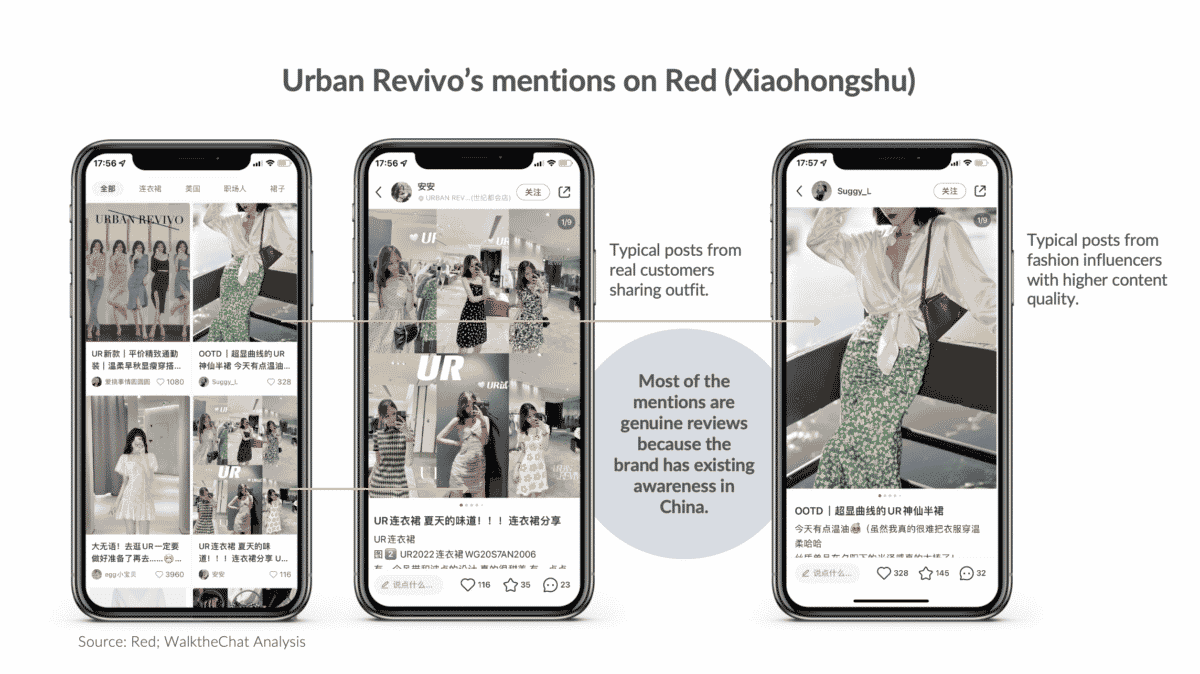

From 2021 May till 2011 April, Urban Revivo accumulated 43k new mentions on Red and has reached 340k+ in total. During the same period, around 21.5k Red users posted about Urban Revivo and generated more than 13 million new interactions.

Among the new content, only 0.12% is commercial content (paid collaboration). This low percentage means that most posts genuinely share their purchases and outfit ideas. (source: Endata)

Urban Revivo is a well-established Chinese brand founded in 2006, so the brand has accumulated high awareness over decades of operation.

For foreign brands entering the Chinese market, it takes time and patience to accumulate more mentions on Red. Ordinary consumers are more likely to purchase and share experiences when seeing more existing posts on Red. So we need to start with influencer seeding, and then the organic sales will follow.

Our Suggestions for fashion brands entering China

- Foreign brands should consider the seasonality of Chinese consumers’ needs and start creating some buzz by working with influencers months before an important sales event.

- We must be clear about our positioning and competitive advantage for any new brands entering China. We suggest brands consider your strong category that could address Chinese consumers’ specific pain points. It’s wise to identify potential hero products (best-selling styles) and focus your marketing efforts there.

- Brands need to build an influencer mix strategy containing different tiers of fashion influencers for various objectives. For example, you can leverage large numbers of KOCs to share OOTD (outfit of the day) and create a word-of-mouth affect. But working with a few larger KOLs who have real influence in their niche circle is also essential.

Want to know more about Red/Xiaohongshu marketing? You will find the below articles useful:

- RED (Xiaohongshu) Trends 2022: emerging trends in Fitness, Fashion & Beauty

- Little Red Book (Xiaohongshu) Marketing – A Complete Guide

- Xiaohongshu/Red Pushes “Account-Store Integration” to drive In-app Conversion