The epidemic and macro environment affected China’s online advertising market, which fell slightly in the first half of 2022. Will it rebound in H2? Although brands continue betting on video and social media ads, top-tier media advertising revenue has also not increased, and competition has intensified.

China Online Advertising Market Decrease in 2022 H1

Due to regional COVID outbreaks in Chinese cities, consumer confidence has taken a hit. It’s also reflected in the advertising budget brands invest in the market.

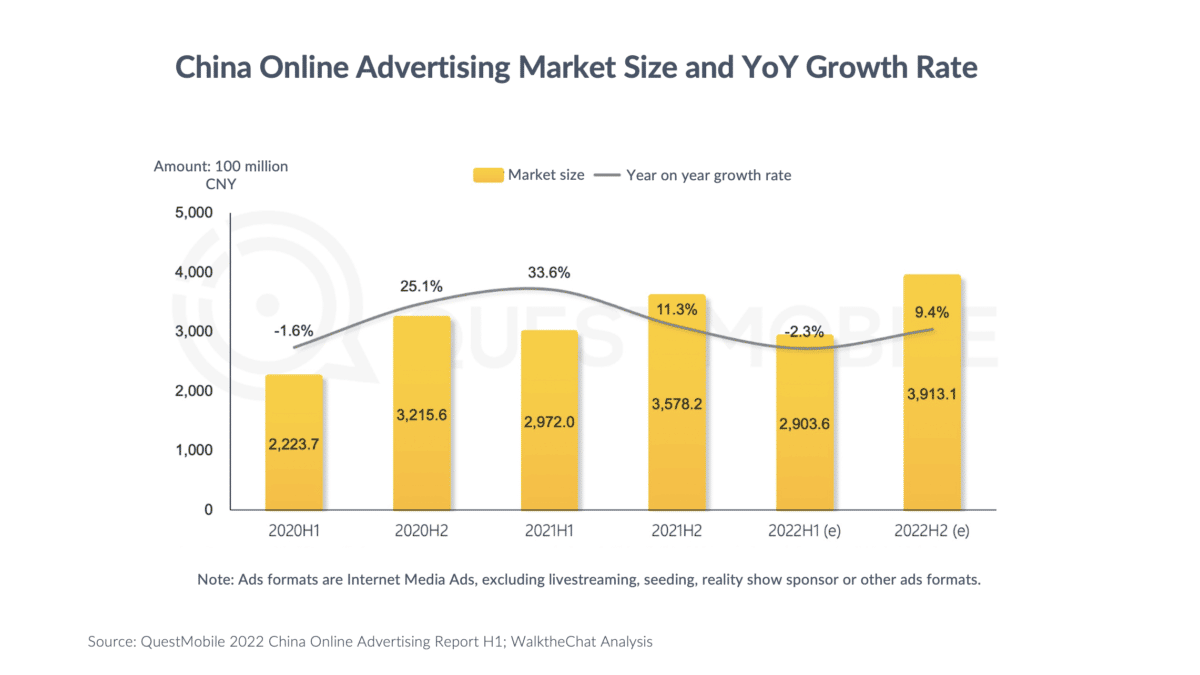

According to QuestMobile, media spend on Chinese internet platforms decreased by 2.3% in the first half of the year.

The advertising market size is estimated to increase again in H2 because of major sales festivals such as the 99 Festival in September, Double 11 in November, and Double 12 in December. To compensate for the lost sales target in H1, brands may move more advertising budget into H2, trying to leverage key sales moments and accomplish the year’s target.

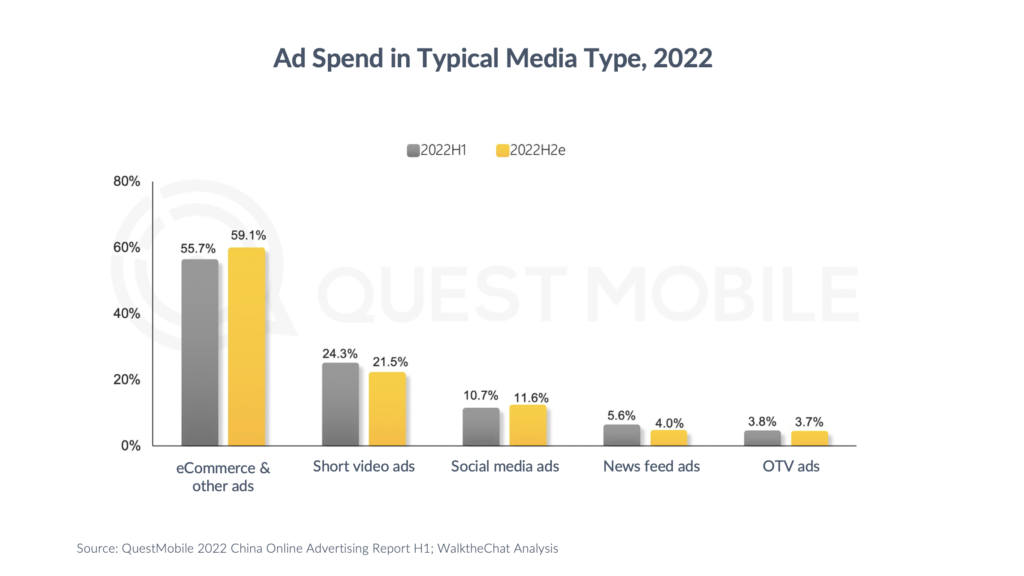

Video Ads and Social Media Ads Continue to Thrive in China

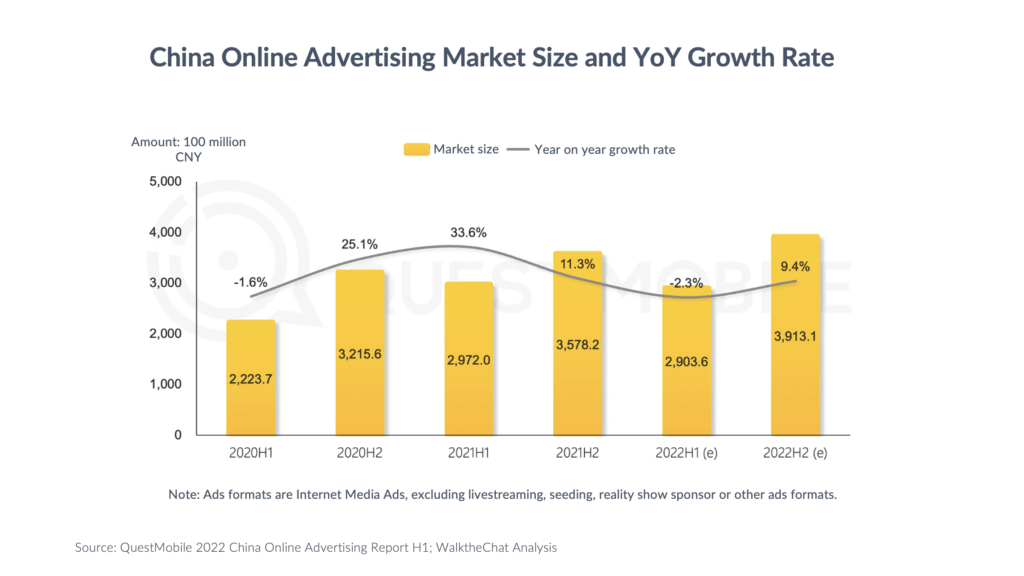

Video Ads and Social Media Ads are still the two biggest channels for online advertising. Short video ads now account for nearly 40% of advertisers’ total budgets in China. Typical short video platforms like Douyin and Kuaishou can quickly capture users’ attention and drive conversion. It’s an effective strategy for cheap products of less than 200 CNY.

Advertising on social media such as WeChat, Weibo, and Red accounts for 16% of the total ad budget.

We estimate that the domination of short video ads will stay, as, in the short term, there is no new format thWe estimate that the domination of short video ads will stay, as, in the short term, no new format can challenge Douyin’s capacity to capture users’ attention and maintain stickiness. Douyin has 670 million MAU (Monthly Active User) according to data in December 2021. Being the 2nd most prominent social platform after WeChat (1.2 billion MAU), Douyin still has room for improvement, while WeChat and Weibo have reached a growth bottleneck.

For advertisers seeking to reach Chinese audiences, we should first identify your target customers and then decide which platform to invest in.

Need any help with your advertising strategy in China? Let our ads expert help you!

Home appliances industry lead the advertising growth in 2022 H1

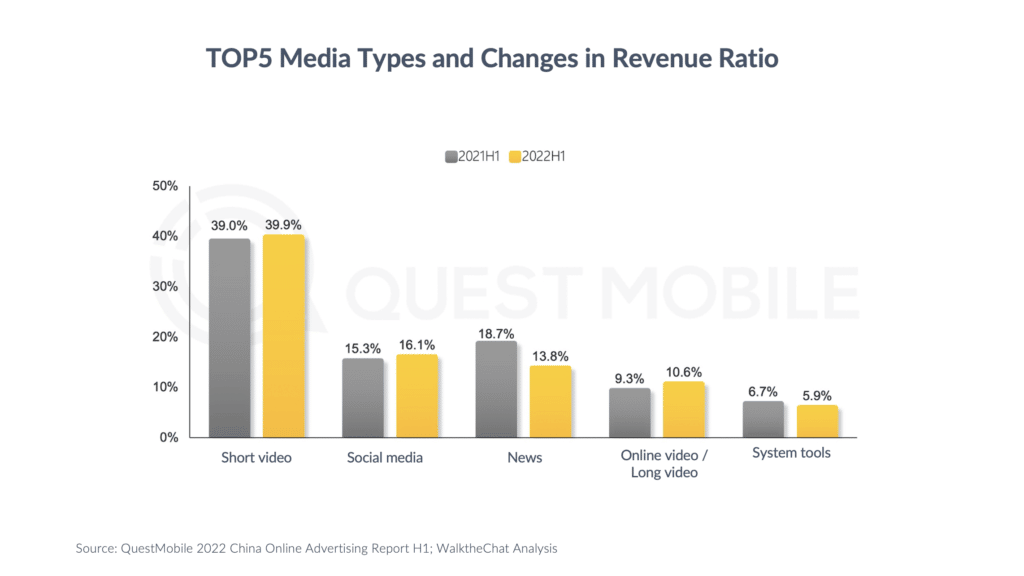

Beauty indThe beauty industry usually has the highest ad spend budget (> 5 billion CNY / 740 million USD), but the COVID outbreaks in H1 limited the industry’s consuming scenario and opportunities.

Due to the same reason, verticals such as domestic appliances and remote work equipment seized the increasing needs during H1 and invested more heavily in advertising.

For example, eating well at home is a riding demand. Therefore, consumers are more willing to spend on products such as rice cookers, high-speed blenders, air fryers, coffee machines, breakfast makers, etc, to enjoy better quality while staying home.

Beauty industry: international and domestic brands take different strategy

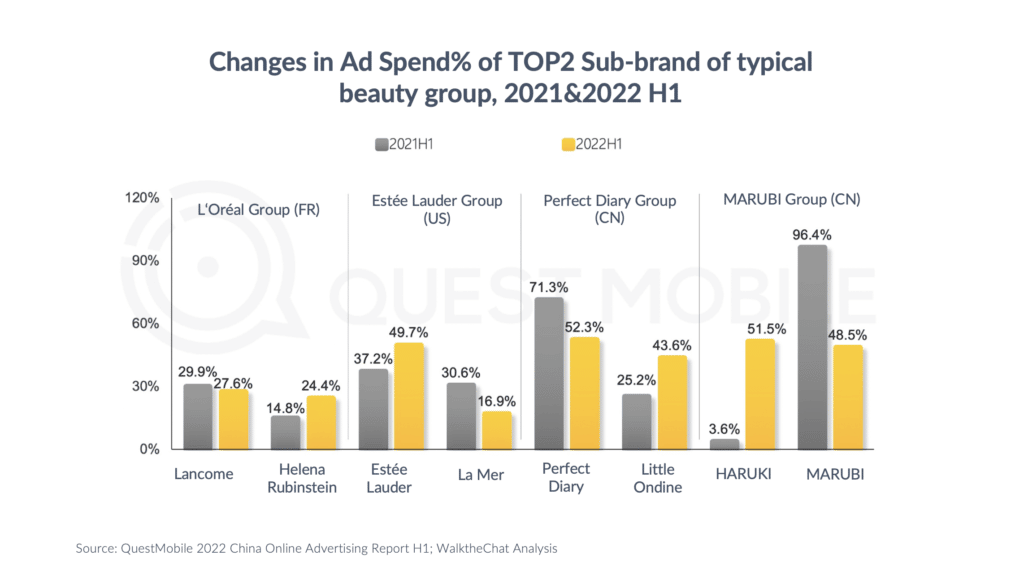

Due to fierced competition in the beauty industry, international brands and domestic brands have adopted different advertising strategy to strengthen their positioning.

International brands such as Loreal Group and Estee Lauder Group focus on pushing their high-end brands and products with higher price range. Their foreign identity and high R&D spending can justify a higher pricing and brand premium.

Domestic brands such as Perfect Diary and MARUBI are heading towards mass consumer positioning, focusing on more affordable products. Their experience and deep understanding of the Chinese market guarantee smooth navigation of the mass consumer market.

China Online Advertising Estimation in 2022 H2

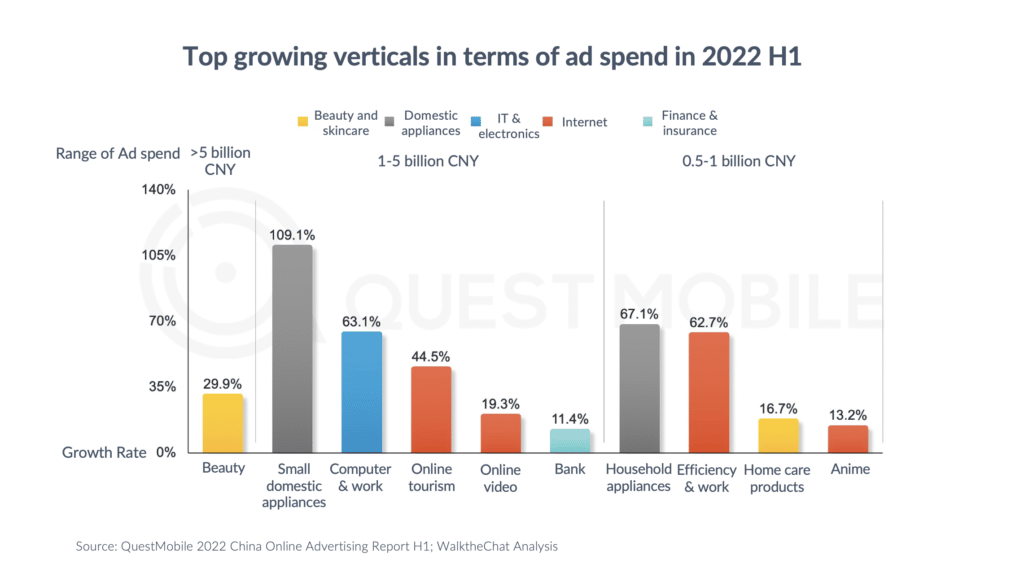

H2 is typically an essential moment for sales, thanks to multiple shopping festivals such as Double 11 and Double 12.

ECommerce Ads can better fulfill advertisers’ needs for conversion as it’s the closest placement to sales conversion. For example, leading eCommerce marketplaces like Tmall and JD offer effective in-site ads to drive sales.

Social Ads will also likely increase because advertisers need to attract more consumers to their private traffic pool. It’s also a pivotal moment to “activate” their loyal customers and push for cross-selling and up-sell opportunities. A typical example of a private traffic pool is to create a WeChat Group with your VIP customers and keep them engaged.

Nowadays, the cost of new consumer acquisition is rising on all platforms. So it’s crucial to take good care of your existing customers and improve the repurchase rate.

Looking for more information about online advertising? Have a look at these articles!